Spot Bitcoin Exchange-Traded Funds (ETFs) saw yet another record-breaking day yesterday, with inflows reaching a new daily all-time high (ATH). This surge in investment comes at a time when Coinbase, the leading US crypto exchange and custodian for eight of the ten spot ETFs, reports its BTC reserves at their lowest since 2015, signaling a potential supply shock in the near future.

Bitcoin ETFs Continue To Smash Records

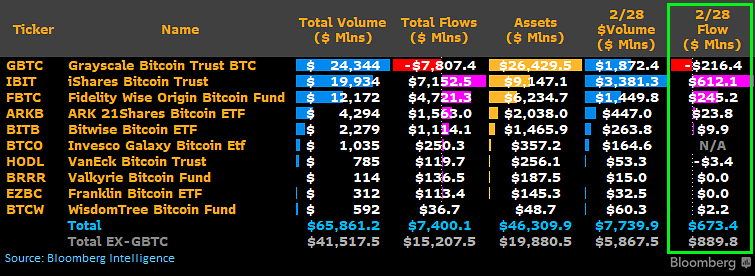

James Seyffart, a Bloomberg ETF analyst, provided a detailed update on the record day, February 28, stating, “UPDATE: We have a new record inflow for the Cointucky Derby Bitcoin ETFs! [BlackRock’s] IBIT took in a record $612 million on its own. On a net basis, the group took in $673 million. This beats the day 1 record of $655 million. (still waiting on BTCO) Also, IBIT crossed $9 billion in assets.”

The data shared by Seyffart further illustrates the competitive dynamics within the Bitcoin ETF space. While BlackRock’s IBIT led the charge with substantial inflows, Grayscale faced re-accelerating outflows, totaling $216 million yesterday. In contrast, Fidelity’s FBTC ETF recorded an impressive inflow of $245 million.

WhalePanda, a noted figure in the crypto community, provided insight into the day’s events, emphasizing the scale of BlackRock’s inflows and the expected volatility in the market. “We had an insane $676.8 million of inflows […]. Fidelity is going to hit $5 billion inflows either today or tomorrow, with Blackrock well on its way to $10 billion.”

He added, “The supply is super thin up here, so expect more violent moves to both sides from here on. Once we hit ATH it wouldn’t surprise me to see $10k moves to either side in a day,” cautioning investors against complacency in the bullish market.

Eric Balchunas, another Bloomberg analyst, highlighted the trading volume associated with these inflows, noting, “RIDIC: the New Nine doubled their volume record (set Monday) with just about $6b traded […] IBIT led with $3.3b of it, Fidelity did $1.4b (both double their previous records).”

Balchunas’s comments shed light on the sheer market activity driven by these ETFs, surpassing previous benchmarks and indicating a massive demand for Bitcoin investment vehicles. Notably, this is organic, as per Balchunas. “I asked around to some mkt makers and most say this volume is largely a function of natural demand vs algo/arb type volume. Word is wirehouse platforms are seriously looking at adding them soon. I’m sure pressure is mounting for them.”

Bitcoin Supply Shock Incoming

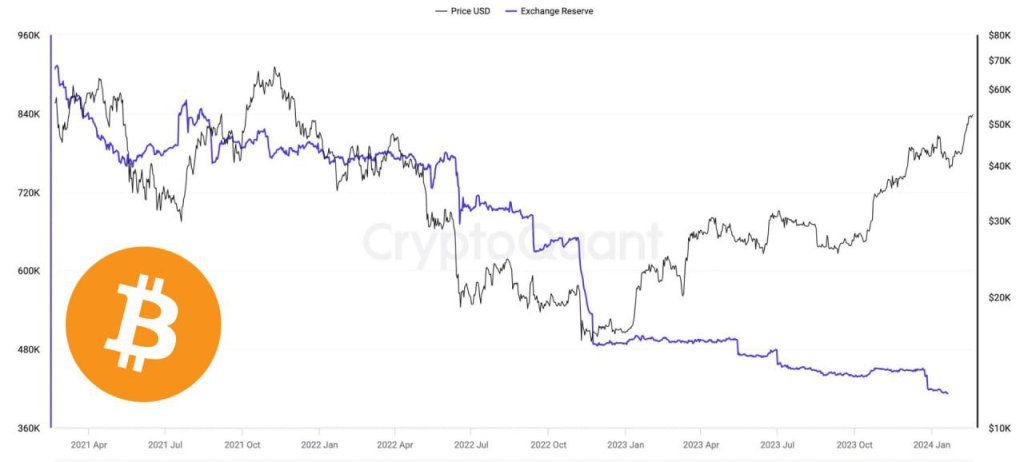

Mason Jappa, CEO and founder of Blockware, contextualized the inflows within the broader market dynamics, particularly focusing on the decreasing BTC supply on exchanges like Coinbase.

“Coinbase’s current Bitcoin supply continues to trend downwards (this is the lowest their BTC supply has been since 2015). This paired with the halving coming up paints a very interesting supply shock being realized as we speak,” Jappa noted. This trend is critical, as reduced supply on exchanges, coupled with increasing demand, could precipitate significant price movements.

Coinbase’s role as the custodian for major Bitcoin ETFs, including BlackRock‘s iShares Bitcoin Trust (IBIT), ARK 21Shares Bitcoin ETF (ARKB), Bitwise Bitcoin ETF (BITB), as well as Grayscale (GBTC), adds a layer of strategic importance to the exchange’s reserve levels.

The recent correlation between Coinbase’s spot premium and Bitcoin’s price movements suggests that as ETFs continue to draw on the exchange’s reserves, the market may witness tighter supply and heightened price volatility. Remarkably, with the halving on the horizon and exchange reserves dwindling, the market is potentially on the cusp of a significant supply shock.

At press time, BTC traded at $62,487.