Readings from the daily chart show that Bitcoin (BTC) has been stuck in a narrow trading range since August 29. It faces stiff resistance at $111,961 while holding support at $107,557.

Despite this muted performance, some BTC traders remain unfazed, steadily increasing their exposure to the king coin.

Bitcoin Futures Traders Double Down as Price Stalls

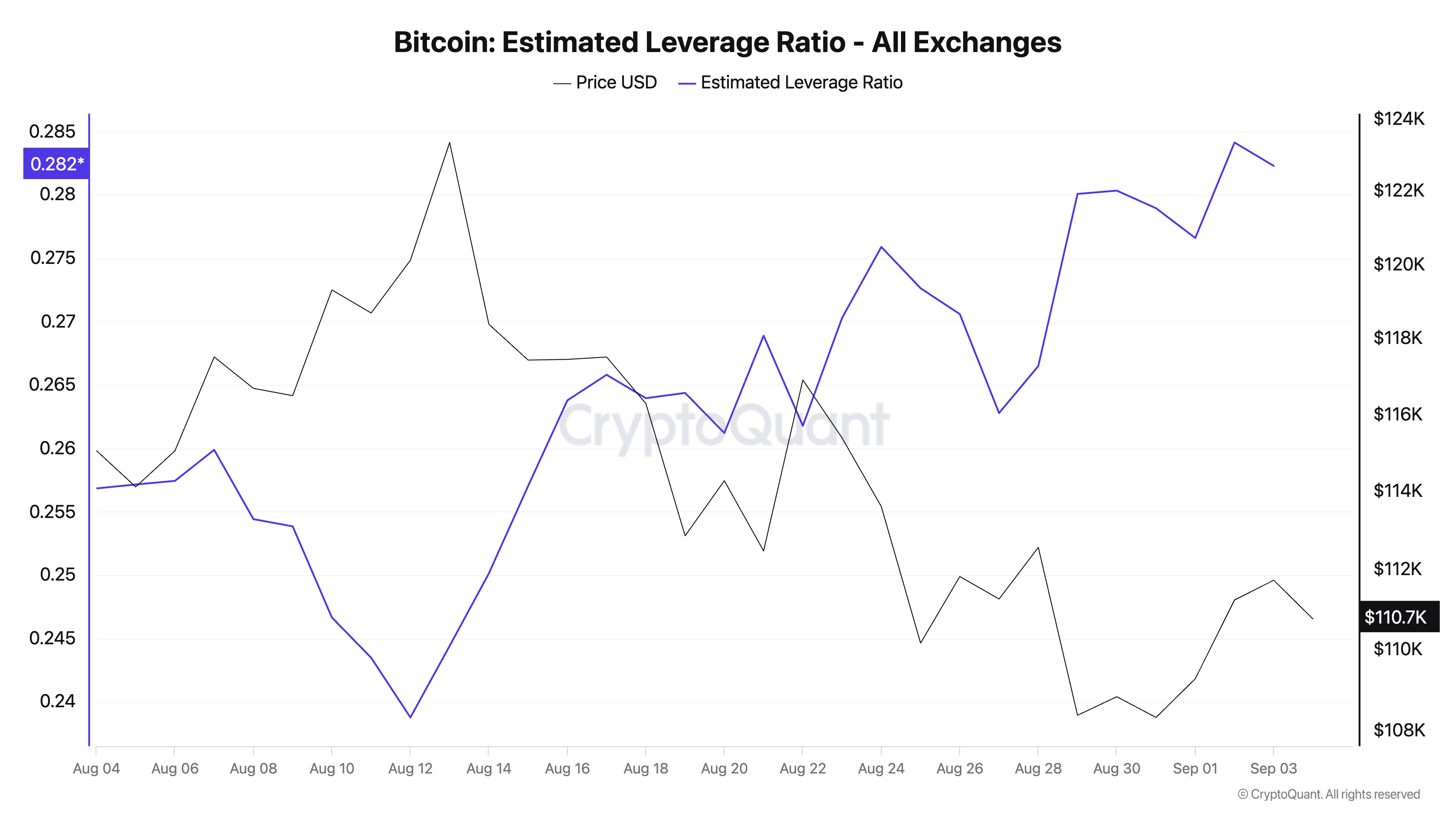

Bitcoin’s climbing Estimated Leverage Ratio (ELR) across crypto exchanges reflects the growing investor confidence and an increased appetite for risk, even amid the coin’s lackluster performance.

According to data from CryptoQuant, BTC’s ELR has risen steadily since August 12. Soon after BTC surged to its all-time high of $123,731 before entering a downward trajectory that has persisted ever since.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Interestingly, while the price has struggled to regain upward momentum, leverage in the derivatives market has continued to climb. This signals that traders remain undeterred by short-term corrections and are instead doubling down on their exposure to the coin.

An asset’s ELR measures the average amount of leverage its traders use to execute trades on a cryptocurrency exchange. It is calculated by dividing the asset’s open interest by the exchange’s reserve for that currency. When it falls, investors grow cautious about the token’s short-term prospects and avoid high-leverage positions.

Conversely, as with BTC, a climbing ELR, especially during a period of muted price performance like this, indicates that traders are not retreating from the market but are instead increasing their risk exposure.

Rather than scaling back amid stagnation, BTC traders are taking on more leveraged positions, signaling confidence that the current consolidation is temporary.

Why Bitcoin’s Bull Cycle May Just Be Getting Started

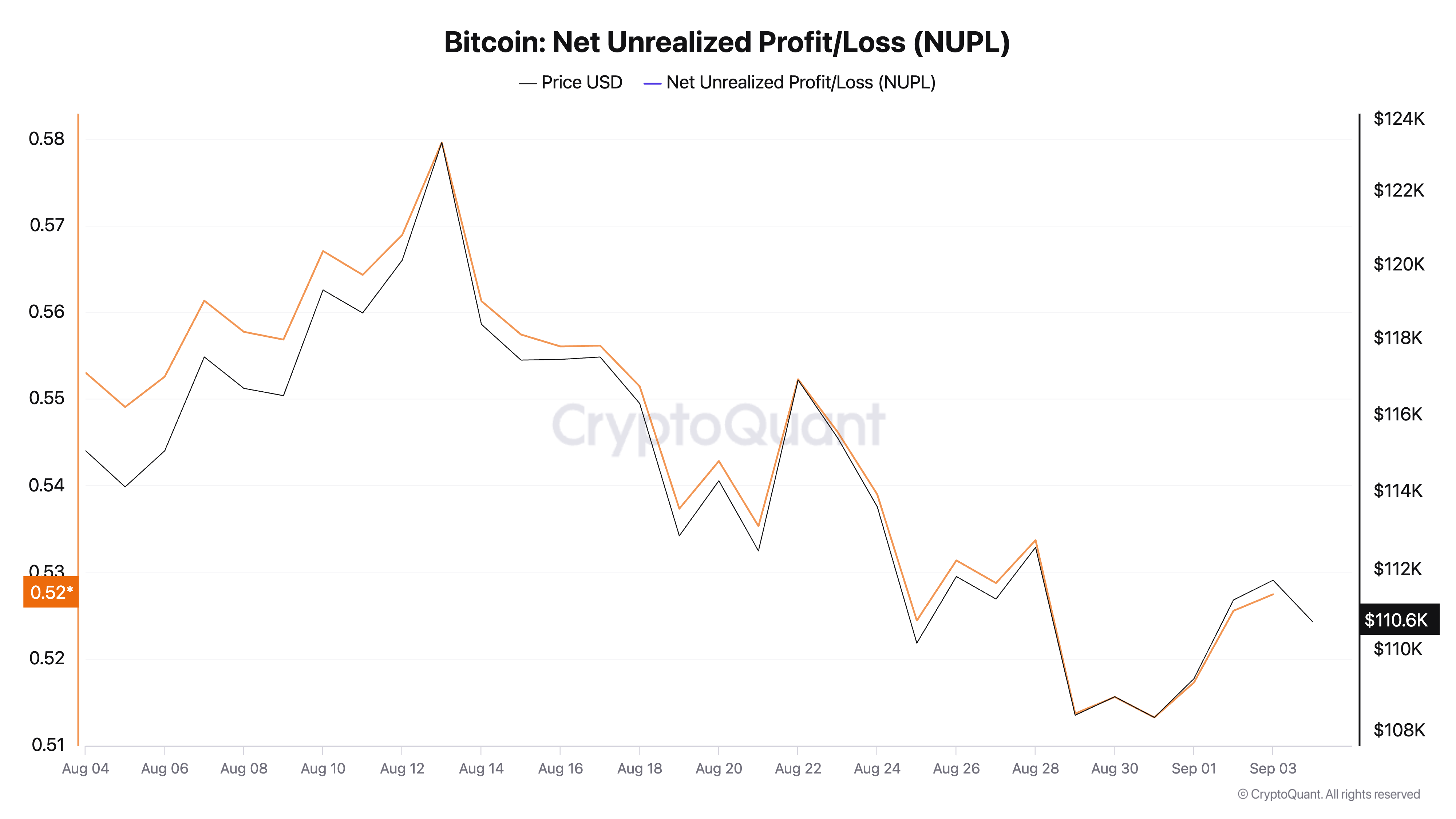

In a new report, pseudonymous CryptoQuant analyst PelinayPA noted that the market may be in a “mid-bull” phase, where price movements tend to accelerate.

This is based on assessing the coin’s Net Unrealized Profit/Loss (NUPL) metric, which, according to PelinayPA, is at 0.52. The NUPL measures whether the market is predominantly in profit or loss, helping to identify market cycle phases.

A historical assessment of this metric reveals that NUPL values between 0.7 and 0.8 have coincided with BTC market peaks in 2013, 2017, and 2021.

“At present, the market is in a ‘faith & optimism’ phase, which typically reflects the mid-stage of a bull cycle. Based on historical patterns, Bitcoin has a strong chance of moving toward the $120K – $150K range in the coming phases,” PelinayPA said.

This suggests that while BTC has yet to approach its historical peak zones, it is already entering a phase in which momentum is beginning to build again.

Will It Be Bulls or Bears Who Break First?

With the leading crypto positioning for a near-term rebound, a break above the resistance at $111,961 is possible. If this happens, the BTC could extend its gains to $115,892.

On the other hand, if buy-side pressure weakens, BTC could remain rangebound or fall below the $107,557 support level.

The post Bitcoin Futures Traders Double Down as Market Sits in “Mid-Bull” Zone appeared first on BeInCrypto.