Bitcoin has been navigating a turbulent environment over the past few days, as escalating geopolitical tensions continue to drive market uncertainty. On Friday at dawn, Israel launched a military strike against Iran, triggering immediate retaliations that have since kept global financial markets on edge. The conflict, coupled with broader macroeconomic instability, has intensified volatility and stalled bullish momentum across major risk assets.

Despite the pressure, Bitcoin remains resilient. After briefly tagging the $112,000 all-time high last week, BTC has since retraced but is still trading above a crucial support zone. According to a recent technical analysis shared by top analyst Jelle, Bitcoin’s previous all-time high level is still holding as support, offering a key psychological and structural anchor for bulls. This price zone is critical to maintain in order to preserve the larger uptrend structure and potentially prepare for another attempt at price discovery.

Investors now turn their attention to macro catalysts such as oil prices, bond yields, and central bank policy expectations, which continue to influence liquidity flows across markets. For Bitcoin, holding current levels may serve as a foundation for a stronger move once external pressures ease and market conditions stabilize.

Bitcoin Consolidates Near Highs Amid Global, Macroeconomic Headwinds

Bitcoin has entered a consolidation phase following a powerful move from the $74,000 level to its all-time high of $112,000. This sharp rally, which unfolded over a matter of weeks, has now paused as traders and institutional investors assess the growing complexity of the macro environment. From surging US Treasury yields and sticky inflation to escalating geopolitical tensions—most notably the Israel-Iran conflict—the current backdrop presents significant headwinds for risk assets like Bitcoin.

Yet, despite this turbulence, Bitcoin has shown notable strength by holding above critical support levels. According to Jelle, Bitcoin’s previous all-time high is still acting as strong support, which could serve as a launchpad for further upside. Jelle noted that BTC closed the previous daily candle solidly, even as global markets were rattled by fresh waves of uncertainty. His conclusion was clear: “Bitcoin wants higher.”

Indeed, while the short-term picture is clouded by caution, many remain optimistic about Bitcoin’s next move. Some forecasts suggest BTC could break above its $112K high within the coming weeks, especially if macro conditions—like easing yields or diplomatic progress in the Middle East—offer relief to investors.

The next few weeks will be pivotal. A clean break above the ATH could ignite a new phase of price discovery, while a failure to hold current support may trigger deeper pullbacks. For now, consolidation above $100K keeps the bullish structure intact.

BTC Price Analysis: Weekly Structure Shows Strength

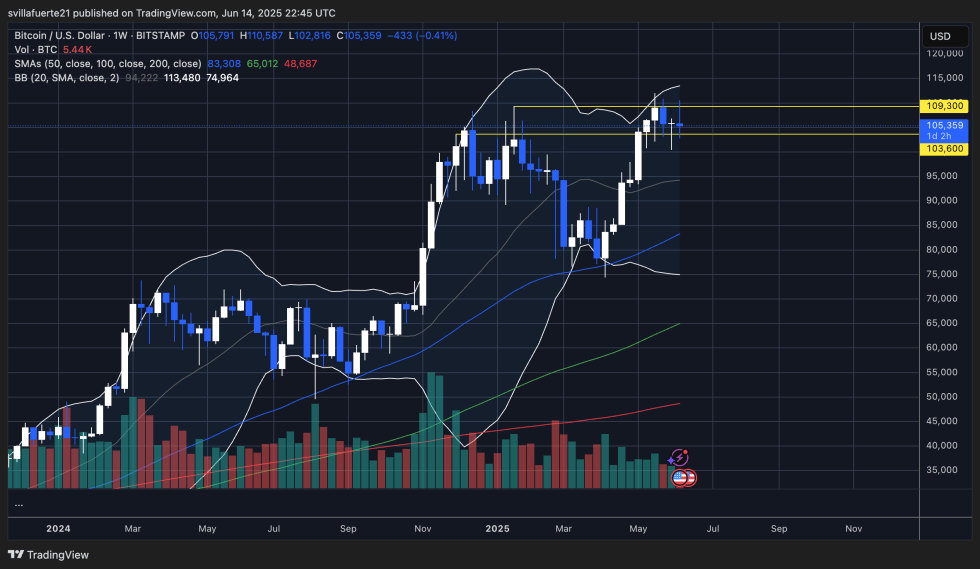

Bitcoin’s weekly chart reflects a phase of consolidation just below the $112,000 all-time high, following a sharp rally from sub-$75K levels. After multiple tests of the $109,300 resistance zone, BTC continues to hold above the previous ATH range, with current support around $103,600 holding firm for now. This behavior signals that bulls remain in control despite recent geopolitical and macroeconomic stress.

The Bollinger Bands are tightening after a period of expansion, often a signal of upcoming volatility. The price action remains comfortably above the midline of the bands and all key moving averages (50, 100, and 200-week SMA), indicating sustained bullish momentum over the medium term.

What stands out is the resilience of BTC in the face of global headwinds. Even with increased volatility due to the Israel-Iran conflict and sticky US inflation fears, Bitcoin’s weekly closes remain constructive. As long as BTC continues to print higher lows and defend the $103,600–$105,000 support zone, the path toward a breakout into price discovery remains valid.

A clean weekly close above $109,300 would be a significant bullish trigger, potentially targeting the $120K–$125K zone in the near term. Until then, consolidation within this range remains the dominant structure.

Featured image from Dall-E, chart from TradingView