Bitcoin faced a wave of intense selling pressure earlier today after reports confirmed a direct military strike by Israel on Iranian targets, escalating tensions in the Middle East. The news triggered widespread volatility across global markets, sending oil and gold higher while equities and crypto assets reeled under risk-off sentiment. Despite the shockwave, BTC is holding relatively strong above the $104,000 mark, suggesting resilience from market participants even as caution dominates the landscape.

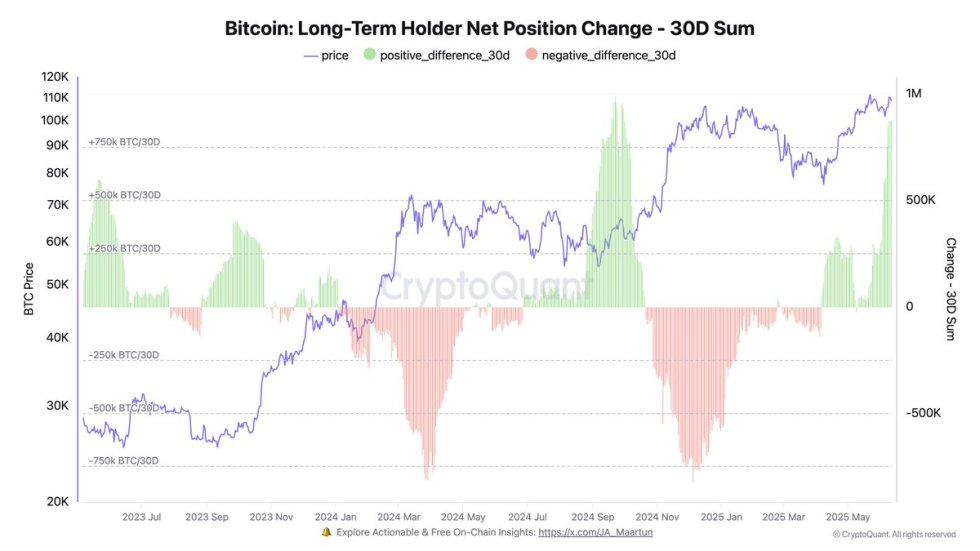

As fear spreads, investors are now questioning whether Bitcoin can maintain key support levels or if more downside is imminent. However, on-chain data paints a different picture. According to insights from CryptoQuant, Bitcoin long-term holders (LTHs) added 881,578 BTC over the past 30 days — a significant accumulation streak. This behavior reflects strong conviction among seasoned participants, reinforcing the view that long-term demand remains intact despite short-term turmoil.

With volatility expected to persist as geopolitical risk unfolds, Bitcoin’s next move will be critical. For now, the combination of macroeconomic uncertainty and sustained long-term accumulation sets the stage for a pivotal moment in the broader market cycle. All eyes are on whether BTC can turn this turbulence into a base for future strength.

Bitcoin Long-Term Accumulation Surge Amid Global Tensions

Bitcoin surged to $110,000 just two days ago, coming within striking distance of its $112,000 all-time high. However, heightened geopolitical tensions—especially following the Israel-Iran conflict—have sent markets into a state of risk-off volatility. BTC has since retraced to $104,000, a 7% drop from its local high, but the price action remains notably resilient. Bitcoin continues to trade above critical support levels, and the broader trend suggests that bulls may still have momentum on their side.

The $112,000 zone remains the key level to flip, as a decisive breakout there would push BTC into price discovery and signal the start of a new explosive phase for the entire crypto market. For now, the market waits for confirmation, as Bitcoin consolidates below resistance in a high-stakes environment.

Despite the volatility, strong on-chain fundamentals are keeping investor sentiment intact. According to CryptoQuant CEO Ki Young Ju, long-term holders have added 881,578 BTC to their wallets over the past 30 days—a massive wave of accumulation. This cohort is typically composed of more experienced investors, signaling confidence in Bitcoin’s medium-to-long-term trajectory.

While global uncertainty continues to dominate headlines, Bitcoin’s ability to hold the $104K level, combined with this aggressive long-term accumulation, suggests that any pullback may be short-lived. If bulls regain momentum and reclaim $110K, the next stop could be uncharted territory beyond the all-time high. The next few days will likely define the tempo for the rest of the quarter.

BTC Finds Support After Sharp Rejection From $110K Resistance

The 4-hour Bitcoin chart reveals a sharp rejection from the $110K zone earlier this week, followed by a swift decline to $104K. The price is currently holding just above a critical support level around $103,600—a zone that previously served as a launchpad in early June. The $109,300 resistance remains the key level to break for continuation toward all-time highs, but until then, the trend remains vulnerable to downside volatility.

Price action shows increased volume on the recent sell-off, signaling heightened investor reaction to the geopolitical tensions triggered by the Israel-Iran conflict. However, the bounce off the $103,600 level suggests that bulls are defending this area, and it continues to serve as a key structural support.

The 50, 100, and 200-period SMAs are now converging between $106,000 and $106,500, adding confluence as a short-term resistance cluster. A clean break above that region could open the door for a retest of $109,300. If BTC fails to hold the $103,600 level, however, the market could revisit the $100K psychological mark.

Featured image from Dall-E, chart from TradingView