The world’s largest Bitcoin mining firm, Marathon, has just revealed the state of its operations in its latest quarterly report. Moreover, the company has been aggressively expanding its hash power and is pivoting to an international joint venture model for future growth.

On Nov. 14, Bitcoin mining expert Jaran Mellerud shared Marathon’s operations report, noting how the mining giant is preparing for the BTC halving in less than six months’ time.

Marathon Seeking Growth Overseas

Marathon is the largest public miner by hash rate, with 19.2 EH/s (exahashes per second) online. Moreover, the firm is also the largest public miner by Bitcoin held, owning a stack of 13,396 BTC worth an estimated $474 million at current prices.

According to the report, Marathon has grown its Bitcoin production by 467% in one year, expanding its hash rate from 7 EH/s one year ago.

This has enabled the firm to go from a meager 416 Bitcoin produced in Q3 2022 to a massive 3,490 BTC in Q3 2023.

The report noted that Marathon will likely soon reach its 23 EH/s goal. This is due to the powering up of its facility in Garden City, Texas, in November. Furthermore, it is expected to be fully operational later in the month with 4.1 EH/s, but energization of the site has been delayed since July.

Read more: Bitcoin Halving Cycles and Investment Strategies: What To Know

However, the firm mentioned that it would be pivoting to international joint ventures. These could make it the most geographically diversified miner and gradually reduce production costs over time.

“As Marathon is getting its final US-based hosted facilities online, it focuses more on scaling internationally through joint ventures with local partners.”

The firm has grown weary of high costs and energization delays at its US-hosted facilities. It expects to expand 30% in 2024 with the addition of new facilities in Abu Dhabi and Paraguay.

Marathon’s cost structure has improved but remains relatively high compared to peers. Moreover, its margins could get squeezed after the halving if Bitcoin prices fall below $30,000.

Bitcoin Mining Ecosystem Outlook

Bitcoin network’s daily average hash rate is currently 428 EH/s, which is close to its all-time high. This puts further pressure on miners competing for the next block.

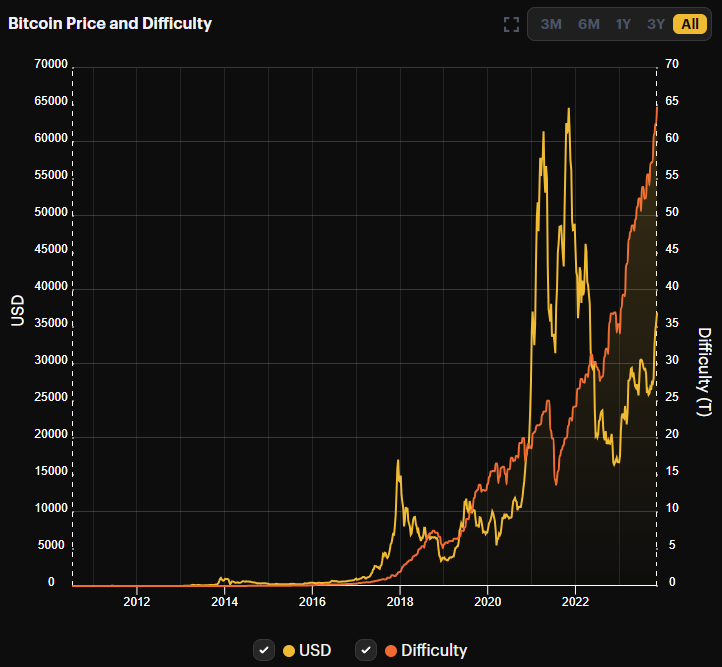

Speaking of competition, difficulty, which essentially measures the levels of ‘work’ needed to mine on the network, is currently at peak levels of 64.6T.

Mining profitability, or hash price, remains low despite the price increases. It is currently $0.079 per TH/s per day, according to Hashrate Index.

With high hash rates and low profitability, BTC mining remains a struggle for all but the biggest players.

Top crypto platforms in the US | November 2023

Paybis

Paybis” target=”_blank”>No fees for 1st swap →

iTrustCapital

iTrustCapital” target=”_blank”>Crypto IRA →

Coinbase

Coinbase” target=”_blank”>$200 for sign up →

Uphold

Uphold” target=”_blank”>No withdrawal fee →

eToro

eToro” target=”_blank”>$10 for first deposit →

BYDFi

BYDFi” target=”_blank”>No KYC trading →

The post Bitcoin Mining Giant Marathon Pivots to International Ventures Ahead of Halving appeared first on BeInCrypto.