In a recent series of posts on X (formerly Twitter), Charles Edwards, the founder and CEO of Capriole Investments, has declared the end of the “deep value era” for Bitcoin, introducing what he refers to as the beginning of the “Bitcoin Momentum era.” Edwards’ detailed analysis involves ten on-chain metrics he developed, which collectively suggest a significant shift in the cryptocurrency’s valuation and market dynamics.

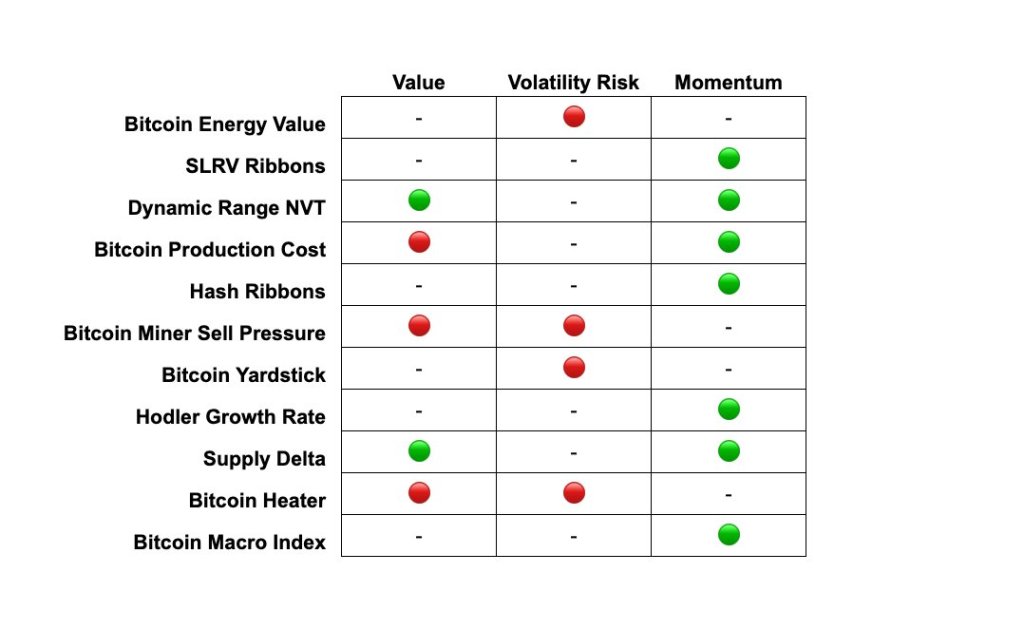

What Bitcoin On-Chain Data Says

One of the core metrics, Bitcoin’s Energy Value, now places BTC’s value at $70,000. Edwards explains, “Bitcoin’s intrinsic value priced from the pure Joules of energy into the network only. Currently at $70K, making Bitcoin fairly valued for the first time in 2 yrs.”

The SLRV Ribbons, another metric presented by Edwards, tracks the ratio of short-term to long-term holders, with current trends indicating strong potential for high-return periods in BTC investments. “SLRV Ribbon uptrends usually isolate the best returning Bitcoin risk-on periods. The trend still looks very strong today, Edwards noted.

Dynamic Range NVT Signal adds value bands to BTC’s “PE Ratio” (NVT), which compares on-chain volume to market cap. According to Edwards, this metric has recently returned to a state of relative value after being overvalued. This suggests a normalization in valuation metrics after a period of overvaluation.

In the context of Production Cost, the cryptocurrency has surpassed its production costs, buoyed by the Ordinals fee boost, indicating that mining is again highly profitable and potentially leading to higher repricing. Edwards noted that “Bitcoin broke out of the cost of production in recent months… But the era of value Bitcoin is over.”

The Hash Ribbons indicator, which Edwards described as his first on-chain metric, shows “widening growth in Hash Rate locally,” an indicator of miners’ confidence and network health.

A significant observation came from the Miner Sell Pressure metric. Edwards pointed out, “It’s VERY high right now, comparable to 2017. This highlights a few things: miners are v. profitable and locking that in, and ETF demand is draining supply.”

The BTC Yardstick and Hodler Growth Rate metrics indicate that BTC might be in the early stages of a bull run, with a growing number of holders beginning to sell into profits. However, Edwards suggests, “Based on prior durations to cycle peaks, we should have some time to go.”

Supply Delta and Bitcoin Heater, respectively, provide insights into the ratio of short-term to long-term holders and the aggregated market leverage. Both metrics suggest conditions that historically precede significant market movements.

Early Innings, But Deep Value Is Gone

Lastly, Edwards favors the BTC Macro Index, a machine learning model aggregating over 60 on-chain and macro metrics, which currently signals strong market expansion. “We are in strong expansion, in the very early innings of a typical Bitcoin cycle,” Edwards noted.

Summarizing, Edwards’ analysis foresees a multi-month uptrend for BTC, albeit with potential for volatility and pullbacks due to the accelerated pace of market developments in 2024 and the approach of the next Halving. Edwards boldly states, “All metrics generally agree that a very large multi-month uptrend will likely emerge from here.”

Edwards concludes, “Bitcoin’s deep value is gone. That ship has sailed. You had 2 years to pick up undervalued BTC. Instead an exciting new chapter has begun… Welcome to the Bitcoin Momentum era.”

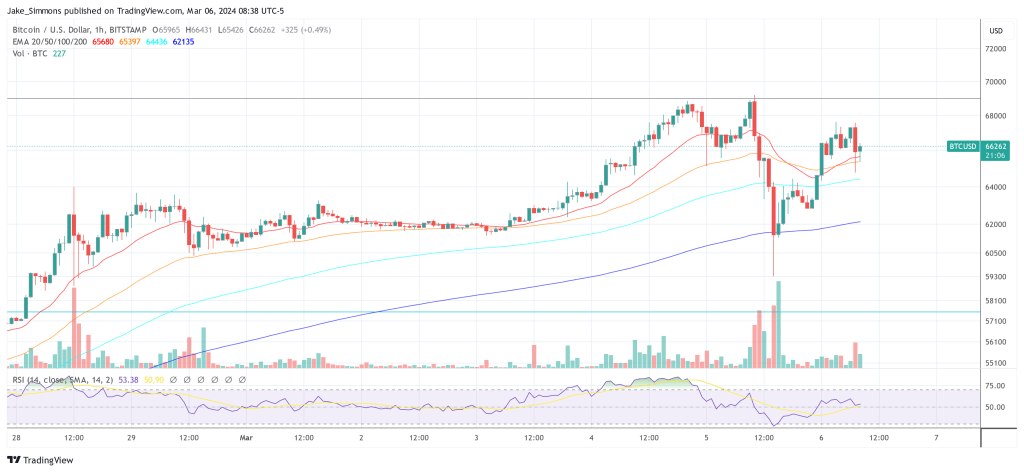

At press time, BTC traded at $66,262.