The Bitcoin market experienced another eventful trading week marked by multiple failed breakouts from the $115,000 resistance zone despite the announcement of another interest rate cut by the US Federal Reserve. As price action presently consolidates around $110,000, data from the Bitcoin Options market has provided insights into traders’ behavior and general sentiment.

Bitcoin Options Traders Bet On Stable Market

On Friday, prominent blockchain analytics firm Glassnode shared its weekly update of the Bitcoin options market, analyzing traders’ beliefs on future price movement. As earlier stated, the Fed announced its second rate cut for 2025 on Wednesday. While this is a popular bullish move, the hawkish tone indicating fewer cuts ahead reduced traders’ optimism, resulting in a brief rally for risk assets such as Bitcoin.

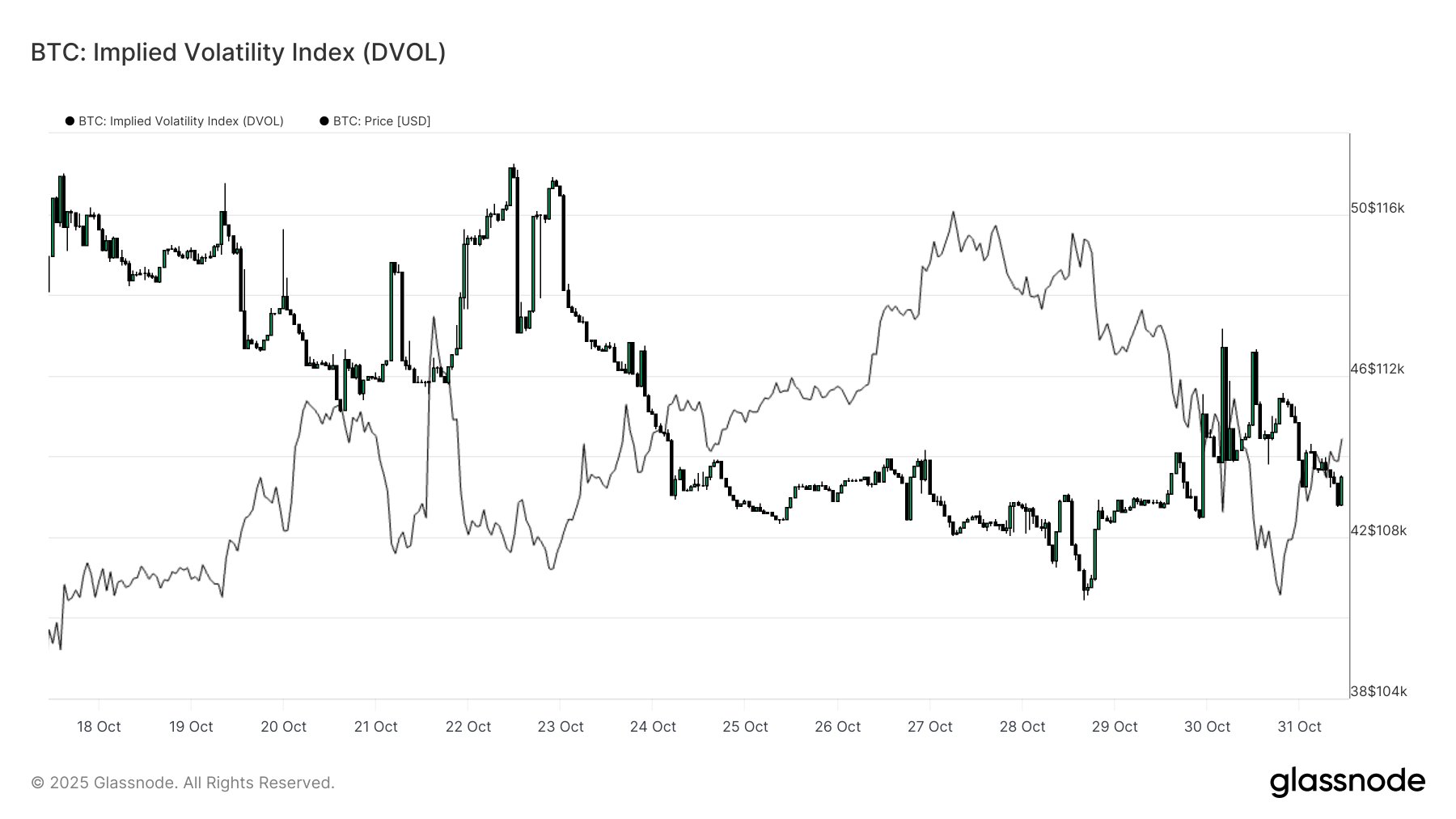

Amid this development, the BTC Implied Volatility Index, which measures how much volatility traders expect in the future, is grinding lower. This data suggests that traders are pricing a calmer BTC with no expectations of a major price move despite the present macro noise. Meanwhile, the 1M Volatility Risk Premium also turned negative as realized volatility moved faster than implied volatility. Glassnode expects this development to mean-revert, meaning the short-term volatility is overpriced and traders are likely to sell, thereby backing the narrative of an expected calm market.

Furthermore, the Put/Call volume also showed another side to this narrative, producing a full retest to its lowest value in October. Notably, traders initially showed bullish action with a wave of calls but soon changed sentiment in line with the general market. However, amid the domination of calls, Glassnode notes neutral directional conviction, i.e, equal buying and selling pressure, backing the market’s lack of confidence in an immediate bullish or bearish move.

Little Hope On Price Upswing?

The 25-delta skew chart has provided another narrative that shows a growing sense of caution. Notably, this metric measures the implied volatility between calls and puts. When the 25-delta skew is neutral, it means traders see a balanced risk as put and calls are equally priced. Following a brief stint in this neutral zone, this metric is now rising again, indicating that traders are valuing puts higher and are actively hedging against a price downswing.

Therefore, while there is no expectation of any significant price move in the short-term, Bitcoin Option traders appear significantly wary of any price fall. At press time, Bitcoin is valued at $109, 304 reflecting a minor 1.94% gain in the past day. Meanwhile, the daily trading volume is down by 11.62% and valued at $65.18 billion.

Featured image from iStock, chart from Tradingview