As Bitcoin continues its impressive trajectory, bulls are ardently pushing the cryptocurrency ever closer to the significant $30,000 resistance mark.

Currently, Bitcoin stands at a commendable price of $29,615, marking a nearly 1.5% increase on Saturday alone.

However, as enthusiasm mounts, critics raise alarms about potential vulnerabilities, drawing parallels with historic precious metal manipulations, especially amidst the soaring hopes for Bitcoin ETFs.

Compounding the scene, recent events such as Binance’s decision to discontinue its Visa Debit Card stand in stark contrast to Bitcoin’s resilient ascent.

Furthermore, the Federal Reserve’s upcoming proposal on rate hikes could potentially amplify interest in the crypto realm, further fueling Bitcoin’s momentum.

Fed’s Rate Hike: A Potential Boost for Crypto Interest

After his recent comments, Federal Reserve Chair Jerome Powell has sparked discussions among investors regarding the potential effects of pausing the ongoing interest rate hikes on both conventional and cryptocurrency markets.

For mainstream investors, Bitcoin could emerge as a more attractive store of value, considering the potential for diminished returns on traditional financial instruments.

Moreover, with the stability of traditional markets, institutional investors might be drawn to incorporate cryptocurrencies as noncorrelated assets in their portfolios.

Given the Decentralized Finance (DeFi) sector’s reputation for yield farming and staking opportunities, this shift could be part of a broader diversification strategy.

Should the interest rate remain stable, the yield gap between traditional products and DeFi platforms might widen.

As monetary policies fluctuate amidst global economic uncertainties, cryptocurrencies associated with long-term Treasury rates are gaining traction for portfolio diversification, highlighting their escalating significance in financial markets.

With potential changes in traditional financial instruments on the horizon, investors seeking alternative assets might find Bitcoin (BTC) increasingly appealing.

Critics Raise Concerns: Bitcoin ETFs & Metal Manipulation Echoes

Skeptics are concerned that the growing anticipation for a Bitcoin exchange-traded fund (ETF) could render the cryptocurrency susceptible to manipulation, echoing the scenarios witnessed in the gold and silver markets.

There’s a prevalent fear that a physically settled Bitcoin ETF could employ futures to introduce illusory BTC supplies, potentially offsetting pronounced price surges.

Unlike purchasing actual Bitcoin, acquiring Bitcoin ETFs wouldn’t reduce the genuine supply. This could enable ETF managers to oversee holdings surpassing their tangible assets, potentially influencing prices.

Critics argue that an ETF might undermine Bitcoin’s long-term potential and view it as a threat to its inherent value and self-custody.

They draw parallels with exchange-traded funds (ETFs) in the precious metals sector, which have faced price manipulation and fixing allegations.

Opinions on the impact of a Bitcoin ETF are divided. Despite the above concerns, some remain optimistic, believing that Bitcoin’s decentralized nature will prevail.

While Bitcoin (BTC) is currently on the rise, there’s ongoing debate about how this news might influence its valuation in the future.

Binance Visa Card Halts; Bitcoin’s Steady Ascent Continues

Recently, Binance, a major cryptocurrency exchange, has announced that it will cease its Visa debit card services in the European Economic Area (EEA) from December 20, 2023.

This decision will affect 1% of its global users. These Visa cards facilitated crypto-to-fiat transactions across 40 European countries.

Additionally, this change may affect the Ukrainian Refugee Crypto Cards program.

Binance has promised that European users’ main accounts won’t be impacted. They’ve also said that transactions can still be made using the Binance Pay app, although some merchants might accept it less than before.

This decision was made in response to several challenges that Binance has encountered, which include the suspension of euro transactions and ongoing regulatory restrictions.

Despite these difficulties, recent developments have aimed to address concerns for users in the United States. This includes purchasing Tether and facilitating dollar withdrawals through stablecoin conversion.

However, Binance has faced increased regulatory scrutiny and lost partnerships in certain regions. Nevertheless, Bitcoin (BTC) continues to experience significant value appreciation today.

Bitcoin Price Prediction

Bitcoin’s technical analysis highlights a pivot at $29,188 and immediate resistance at $30,282, with further resistances at $31,078 and $31,820.

Immediate support is at $28,195, followed by $27,287 and $26,554. The RSI, a momentum measure, stands at 74, indicating overbought conditions, though anything over 50 signifies bullish sentiment.

The 50-day EMA, a key technical marker, is also at $29,188, underlining bullish tendencies. The “Three White Soldiers” pattern on a 4-hour chart reinforces this bullish outlook.

While Bitcoin’s direction appears mainly bullish, the high RSI suggests caution. Minor pullbacks might occur before a significant upward move. Given crypto’s unpredictable nature, investors should remain vigilant and adaptable.

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023.

Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

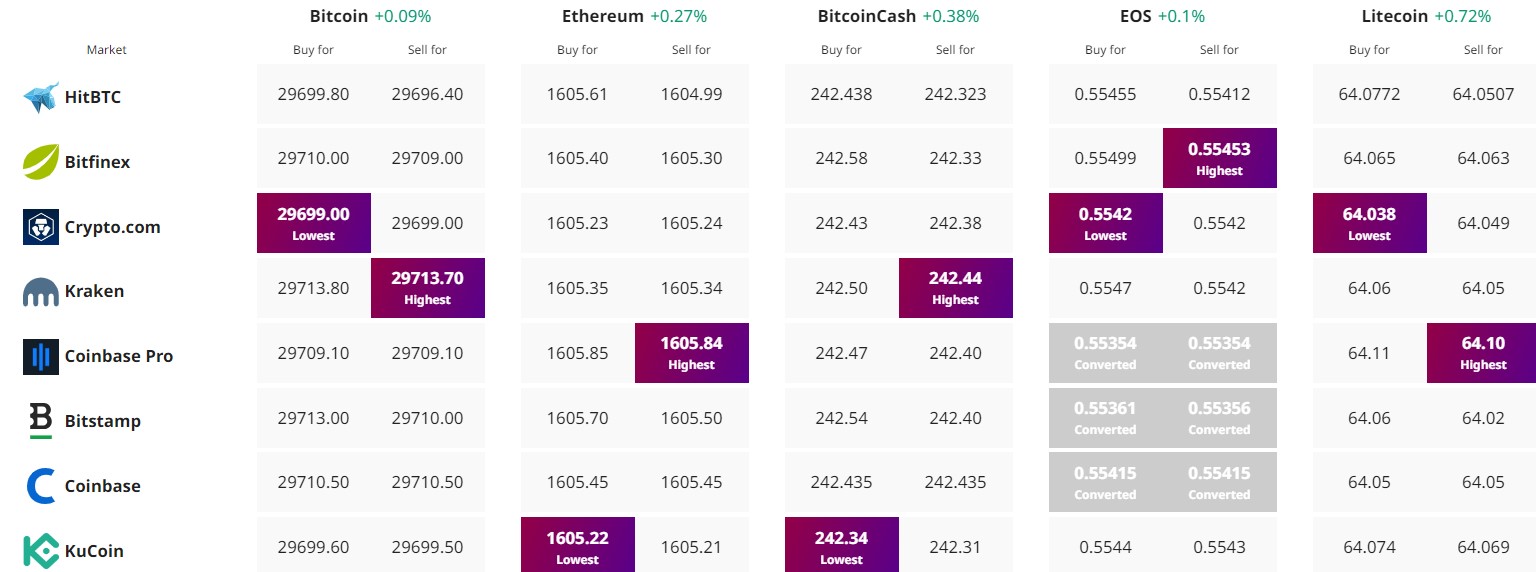

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.