The dynamic world of Bitcoin has been in the spotlight once again, experiencing both tumult and triumph. As of Friday, Bitcoin’s price ascends to $26,289, marking a 1.5% hike.

However, it’s not just the price that’s making headlines. A recent study from the International Monetary Fund warns of the potential risks cryptocurrencies pose to global financial stability.

On the other hand, Ark Investment shares concerns about persisting macroeconomic challenges potentially impeding Bitcoin’s bullish momentum. Meanwhile, industry giants Jay-Z and Jack Dorsey are venturing deeper into Africa, bolstering Bitcoin talents on the continent.

Amidst these developments, the cryptocurrency community remains abuzz with news of Ryan Salame, a former FTX executive, who is on the verge of relinquishing a staggering $1.5 billion as part of a legal settlement.

IMF Study Highlights Risks of Using Cryptocurrencies for Financial Stability

In a report dated September 7th, global regulators, including the International Monetary Fund (IMF), have collectively addressed the potential risks associated with the widespread adoption of cryptocurrencies.

These regulatory bodies argue that while digital assets offer advantages like faster and cheaper cross-border payments, many of these benefits have not been fully realized.

Their concerns revolve around the possibility that widespread crypto adoption could undermine the effectiveness of monetary policy, bypass capital flow management measures, worsen fiscal risks, and divert resources away from the real economy, ultimately posing a threat to global financial stability.

Furthermore, the report highlights the lack of clear tax treatment for crypto-assets within existing legal frameworks.

To address these concerns, the report advocates for the development of a roadmap to mitigate these risks and outlines timelines for implementing recommendations from the Financial Stability Board and IOSCO. Despite this report, the BTC/USD kept on rising on Friday.

Bitcoin’s Bull Run at Risk: Ark Investment’s Insight on Macroeconomic Headwinds

In a recent report, ARK Invest, managing $13.9 billion in assets, highlighted concerns regarding macroeconomic headwinds that could impact the cryptocurrency market throughout the remainder of 2023. Despite being a strong advocate for cryptocurrencies, ARK sees potential challenges in the short term.

The reasons for their cautious stance include factors like interest rates, GDP estimates, unemployment, and inflation. They note that the Federal Reserve’s restrictive monetary policy, as indicated by the “natural rate of interest,” may pressure lending and borrowing rates.

Additionally, ARK anticipates a slowdown in inflation, which could lead to a bearish macroeconomic outlook.

The divergence between real GDP and GDI, along with downward revisions in U.S. employment data, adds to their concerns. They also highlight the emergence of “stagflation,” with increasing consumer spending potentially driving inflation.

This news may contribute to increased uncertainty in the cryptocurrency market today, potentially prompting some investors to exercise caution, given the concerns raised by a prominent investment firm like ARK.

Jay-Z and Jack Dorsey’s Business Expands to Foster Bitcoin Talent in Africa

In a recent move, Btrust, the Bitcoin non-profit co-founded by Jay-Z and Block CEO Jack Dorsey, has acquired Qala, a company dedicated to training African Bitcoin and Lightning engineers. This acquisition transforms Qala into the Btrust Builders Program, aiming to propel Bitcoin development in Africa.

Btrust, equipped with financial resources, identified the need for a structured talent pipeline, while Qala possessed the infrastructure but lacked sustainable funding. Notably, Qala relied on grants, including a $100,000 contribution from the Human Rights Foundation.

The new program, led by Qala’s CEO Femi Longe and program manager Stephanie Titcombe, will focus on open-source training, involving senior African software developers in Bitcoin and Lightning development.

This development might be behind the positive movement of BTC/USD prices as it signals increased support for cryptocurrency in Africa.

Former FTX Executive Ryan Salame Faces Potential $1.5 Billion Forfeiture After Guilty Plea

In recent developments, former FTX executive Ryan Salame, deeply involved in the exchange’s political fundraising activities, has pleaded guilty to federal criminal charges related to FTX. Salame admitted to being a “straw donor,” funneling millions to Republican candidates, while FTX founder Sam Bankman-Fried supported Democrats.

Salame’s guilty plea includes charges of making unlawful contributions and operating an unlicensed money transferring business, leading to a forfeiture of over $1.5 billion. He must forfeit $6 million initially, along with assets such as properties and a Porsche. If these conditions are met, he could avoid the full forfeiture.

Investors are keeping a close eye on the FTX case and its developments, which might not be directly related to BTC/USD price movement but still contribute to the overall market sentiment.

Bitcoin Price Prediction

Bitcoin is exhibiting a cautious rise, currently hovering above $26,000. While it showcases potential recovery patterns, resistance at $26,500 remains a challenge.

BTC’s trajectory recently surpassed a vital bearish trend and is now navigating the resistance zones, with pivotal markers at $26,400 and $26,500.

A consistent hold above the latter could usher in a substantial upward movement, targeting levels as high as $28,000.

Conversely, if the coin struggles at $26,500, a downward correction is possible, with immediate supports poised at $26,100 and $26,000. A breach below these could intensify selling pressures, pushing Bitcoin towards $25,500 or even $25,350.

Top 15 Cryptocurrencies to Watch in 2023

Get ahead of the game in the world of digital assets by checking out our carefully curated selection of the top 15 alternative cryptocurrencies and ICO projects to watch for in 2023.

Our list is compiled by industry experts from Industry Talk and Cryptonews, so you can expect professional recommendations and valuable insights for your cryptocurrency investments.

Stay updated and discover the potential of these digital assets.

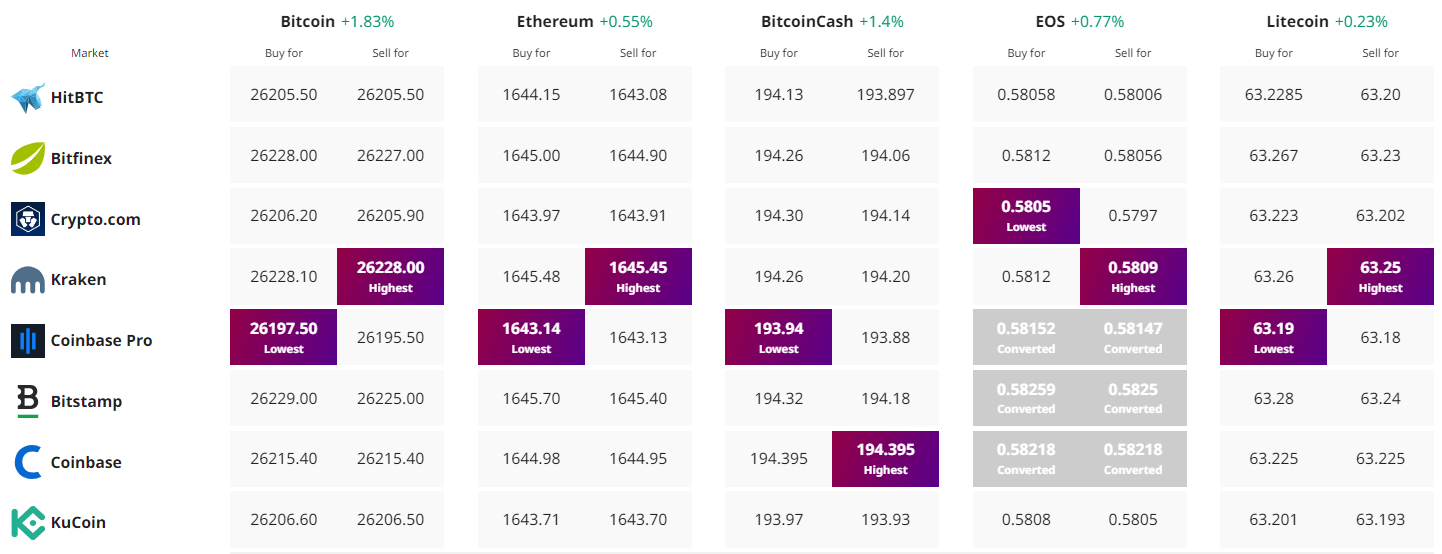

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.