On-chain data shows Bitcoin sharks and whales have observed their population grow during the recent market downturn, while retail has capitulated.

Bitcoin Sharks & Whales Have Been Growing In Number Recently

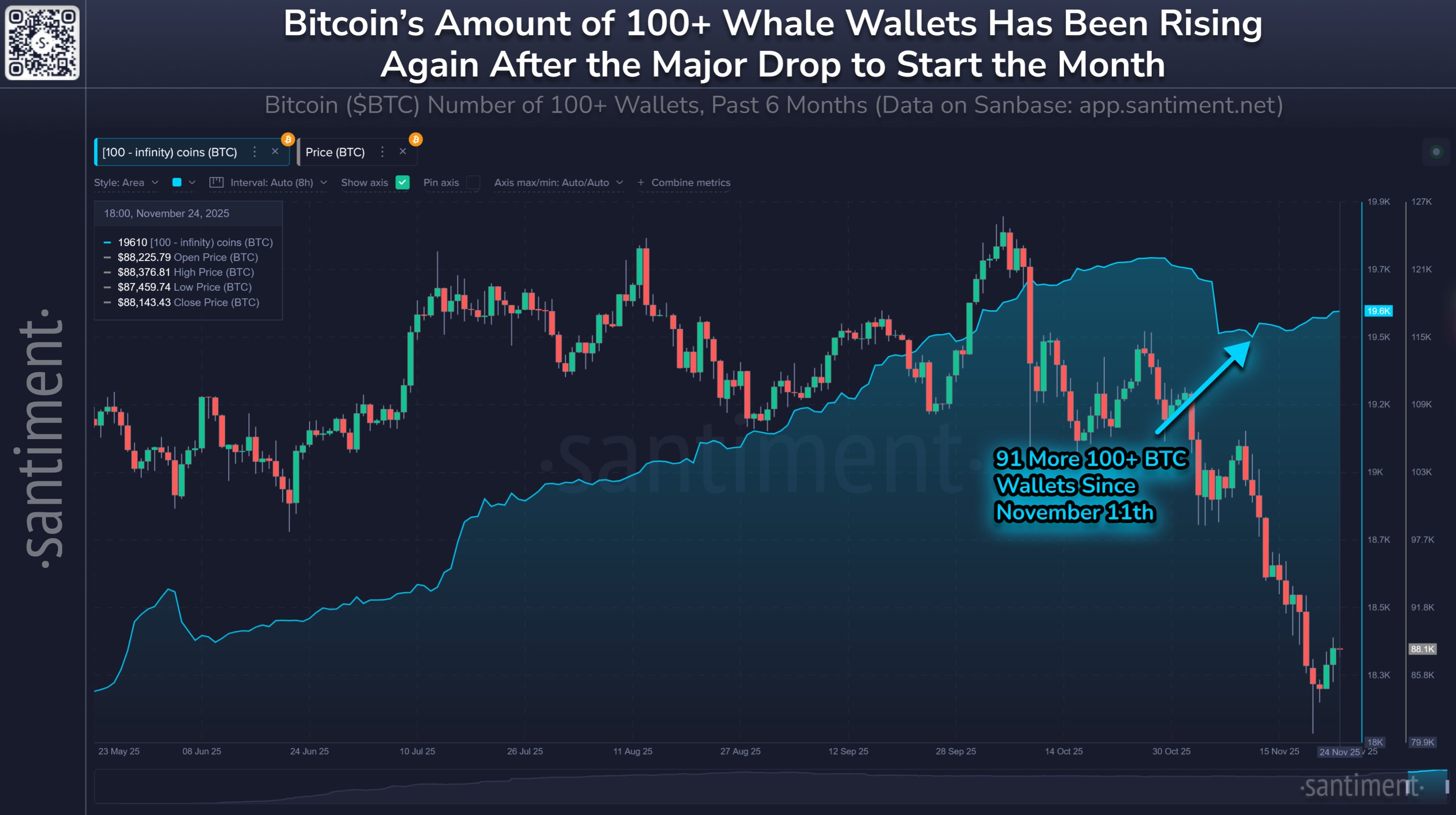

In a new post on X, on-chain analytics firm Santiment has talked about the latest trend in the Supply Distribution of the key Bitcoin investors. The “Supply Distribution” is an indicator that tells us, among other things, the number of addresses that belong to a particular cohort.

Investors are divided into these groups based on the amount of the asset that they are carrying in their balance. For example, the 1 to 10 coins cohort includes all wallets with at least 1 and at most 10 BTC. The Supply Distribution for this group would determine the total number of addresses on the network that fall inside the range.

In the context of the current topic, the range of interest is the 100+ BTC one, equivalent to about $8.6 million at the current exchange rate. It includes two key investor cohorts known as the sharks and whales. The sharks and whales are entities that can carry some degree of influence on the blockchain due to their large holdings (with whales naturally being the more important of the two), so their behavior can often be worth keeping an eye on.

Since the all-time high (ATH) in October, Bitcoin has been following a downtrend, and as the chart below shows, the sharks and whales initially reacted by exiting as their Supply Distribution registered a sharp drop.

How the population of sharks and whales has changed on the BTC network over the last few months | Source: Santiment on X

Interestingly, however, as Bitcoin’s decline has accelerated since November 11th, the Supply Distribution of the sharks and whales has witnessed a reversal. Today, there are 91 more investors of this size on the network compared to the low earlier in the month. This represents an increase of 0.47% for the metric, which, while not that high, is a sign that big money holders have been slowly coming back in to buy the crash.

Santiment has also revealed that the smallest of investors on the network (holding less than 0.1 BTC or $8,700) have seen their population shrink at the same time as this growth in the sharks and whales.

This trend could be a potential indication that the small hands have been capitulating after the bearish momentum, and large entities have been buying coins off them. “Retail capitulation will generally play out well for crypto prices in the long run,” explained the analytics firm.

BTC Price

Bitcoin displayed a brief recovery above $89,000 on Monday, but the coin has since retraced back to $87,000.

The price of the coin seems to have overall moved sideways in the last five days | Source: BTCUSDT on TradingView

Featured image from Dall-E, Santiment.net, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.