Bitcoin and Ether ETFs recorded sharp midweek outflows, though long-term inflows and total assets remain strong.

U.S.-listed crypto exchange-traded funds (ETFs) faced a sudden pullback last week as investors cut exposure across major products. Among these investment products, Bitcoin and Ethereum recorded heavy redemptions during a shortened trading period. Onchain data points to a change in market mood after the sector posted strong inflows earlier in the month.

BlackRock’s IBIT Leads Bitcoin ETF Outflows During Weak Trading Week

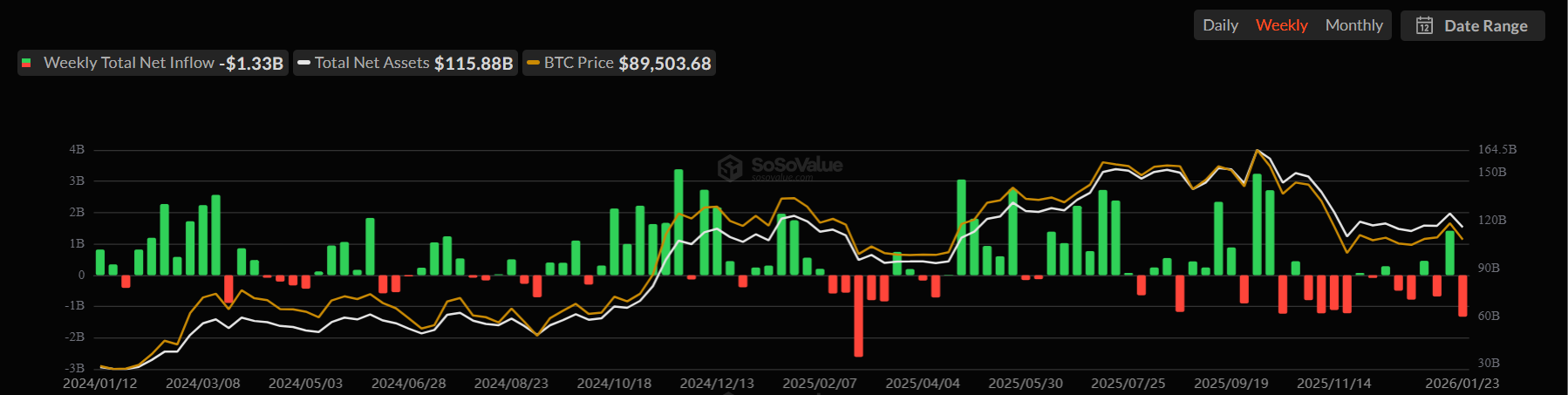

According to data captured by SoSoValue, Bitcoin-focused funds posted their weakest week in almost a year, with about $1.33 billion leaving the sector. This figure covered a four-day trading week as markets closed on Monday for the Martin Luther King Jr. Day holiday.

Interestingly, this trend marks a sharp flip from the week prior, when the vehicles pulled in $1.42 billion in net inflows.

Image Source: SoSoValue

Selling pressure peaked midweek, as BTC funds posted $709 million in exits on Wednesday. Tuesday followed with $483 million in outflows.

However, redemptions eased toward the end of the week, with $32 million leaving on Thursday. And on Friday, the funds closed the week with $104 million in investment losses.

BlackRock’s IBIT led the weekly outflows, with the heaviest investment losses coming on Tuesday and Wednesday. IBIT holds about $69.75 billion in net assets and accounts for roughly 3.9% of total BTC supply.

Weekly Bitcoin ETF Losses Reach Highest Point Since February 2025

Market observers date back to February last year as the last time Bitcoin ETFs recorded such a heavy weekly drawdown. During that stretch, funds lost $2.61 billion as the OG coin fell from $109K to below $80K.

Analysts later labeled that episode the “February Freeze,” driven by sharp price swings and risk reduction.

Several factors have shaped trading patterns during the week:

- Market schedule was shortened, which in turn reduced liquidity and amplified daily moves.

- Losses peaked in the middle of the week, particularly on Tuesday and Wednesday.

- Large funds absorbed the majority of redemptions.

- Even though pressure reduced late in the week, withdrawals remained steady.

Despite recent losses, the investment vehicles still have a positive long-term flow record. In the past two years, spot Bitcoin ETFs have attracted $56.5 billion in net inflows. And with that, total net assets across products stand at $115.9 billion.

Ether ETF Flows Turn Negative as Midweek Selling Intensifies

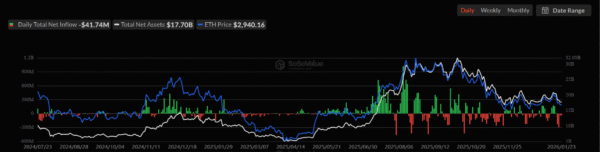

Ether ETFs moved in the same direction as their BTC peers, posting $611 million in net outflows. Wednesday marked the worst session, with $298 million redeemed. Tuesday followed closely with $230 million in outflows, based on SoSoValue figures.

Image Source: SoSoValue

Grayscale’s ETHE lost another $10.8 million during the period. However, smaller inflows helped soften the impact of the losses. Grayscale’s ETH trust added $9.16 million, while Fidelity’s FETH gained $4.4 million. Other ether ETFs from Bitwise, VanEck, Franklin, 21Shares, and Invesco recorded flat flows.

Similar to Bitcoin, Ether ETF performance reversed sharply from the prior week. Earlier sessions had brought $479 million in net inflows, driven by strong demand for BlackRock and Grayscale products.

When viewed over the past two years, total Ethereum ETF assets now stand near $17.7 billion. Cumulative net inflows since launch in July 2024 reached $12.3 billion.

Not all crypto ETFs followed the downward trend in the past week. For instance, spot Solana ETFs posted $9.6 million in net inflows over four days. Products have now logged gains for several consecutive weeks, led by Bitwise’s BSOL.

In a week where the big market players saw large losses, spot XRP ETFs showed mixed results. Funds recorded $40.6 million in net outflows for the week. Heavy selling on Tuesday drove most losses, though modest inflows returned later. Outflows followed the first daily net redemption since the products launched in mid-November.