Bitcoin is consolidating around the $115,000 level as markets brace for tomorrow’s highly anticipated Federal Reserve meeting. After weeks of volatility, the market has entered a cautious holding phase, with traders and institutions alike waiting for clarity on the Fed’s next steps. The decision to cut interest rates will set the tone for risk assets, but investors are equally focused on whether quantitative easing policies will return to the discussion. Both outcomes could significantly reshape the macroeconomic outlook and dictate Bitcoin’s next move.

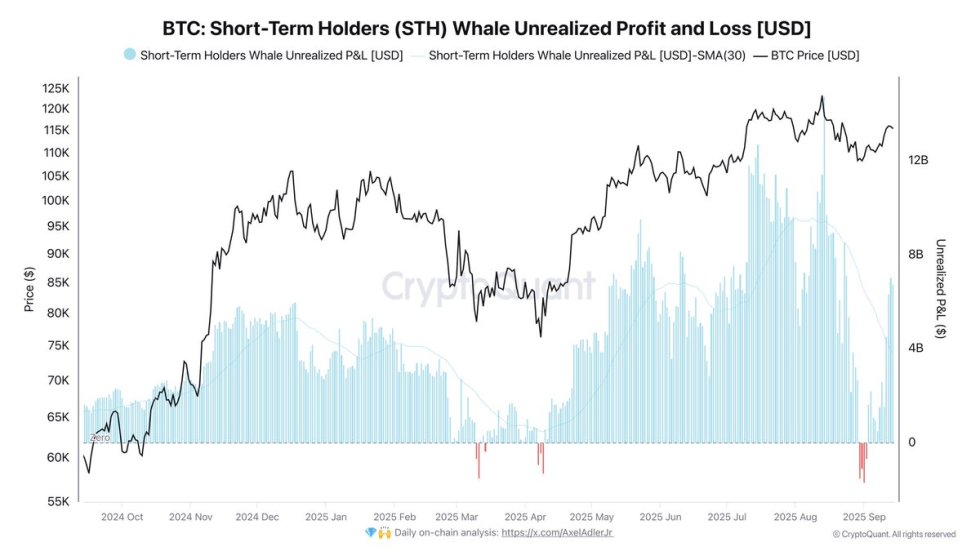

Top analyst Darkfost highlighted an important on-chain development that adds further context to the current consolidation. According to his data, Short-Term Holder (STH) whales, who came under pressure during the small correction at the beginning of September, are now back in unrealized profit. That correction temporarily pushed STH whales into loss territory, testing their conviction. However, history shows that similar pullbacks have been short-lived and well-defended, often paving the way for Bitcoin to resume its upward trajectory.

The convergence of macroeconomic decisions and improving onchain health sets the stage for a decisive week. With the $115K range acting as a pivot, the Fed’s announcement could be the catalyst that determines Bitcoin’s breakout direction.

Short-Term Holders Defend Critical Levels

According to Darkfost, the small correction at the beginning of September placed Short-Term Holders (STH) under notable pressure, as it directly challenged their unrealized profit zone. This critical area, which fluctuates around $108,000–$109,000, has become an important battleground for bulls and bears. For now, STH whales continue to defend this zone successfully, preventing losses from widening and providing stability to the broader market structure.

Historical precedent supports this resilience. Previous corrections of similar nature, which briefly pushed STH whales into unrealized losses, were short-lived and well-defended. Each time, Bitcoin managed to stabilize and then resume its bullish trajectory shortly after. This pattern suggests that the current defense could again act as a springboard, reinforcing confidence among traders who view the $108K–$109K range as a structural line of defense.

However, the broader context cannot be ignored. This week is shaping up to be pivotal for Bitcoin and risk assets, with the Federal Reserve set to announce its interest rate decision tomorrow. While technical and on-chain signals suggest underlying strength, macroeconomic forces could introduce sharp volatility. Darkfost notes that tomorrow’s decision will provide much-needed clarity, potentially setting the tone for whether Bitcoin extends its rally or faces a deeper consolidation phase.

Bitcoin Consolidates Around Key Level

Bitcoin (BTC) is holding steady around $115,482, showing resilience as the market braces for tomorrow’s Federal Reserve decision. On the daily chart, BTC is consolidating near a critical level after recovering from its early-September lows. Price is hovering just above the 50-day moving average ($114,355), which now acts as immediate support, while the 100-day average ($112,782) provides an additional safety net. The 200-day average at $102,810 remains far below, reinforcing the broader bullish structure despite short-term uncertainty.

Resistance lies in the $116,000–$117,000 zone, where BTC has faced repeated rejections in recent weeks. A breakout above this range would likely open the door for a retest of the $123,217 resistance, a level that capped the last major rally. On the downside, failure to defend the 50-day moving average could invite a pullback toward $113,000 or even $112,000.

BTC is consolidating within a tightening range, awaiting macroeconomic clarity. If the Fed delivers the anticipated rate cut without shocking the market, Bitcoin could gain momentum for another push higher. Until then, sideways action and increased volatility remain the base case.

Featured image from Dall-E, chart from TradingView