The broader cryptocurrency market has shifted into a heightened bearish phase, causing Bitcoin to drop from its current all-time high of $124,000 to the $117,000 threshold. While bearish pressure is building, indicators such as Bitcoin’s supply dynamics are providing insights about the current state of the market and investors’ sentiment.

What Bitcoin Supply Data Says About The Market

Bitcoin’s price has fallen sharply after reaching a new all-time high on Thursday, which has sparked speculation about the current state of the market. Amidst the growing speculations, Boris, a crypto trader and on-chain expert, has provided a detailed analysis of the current state of BTC’s market, using the supply dynamics.

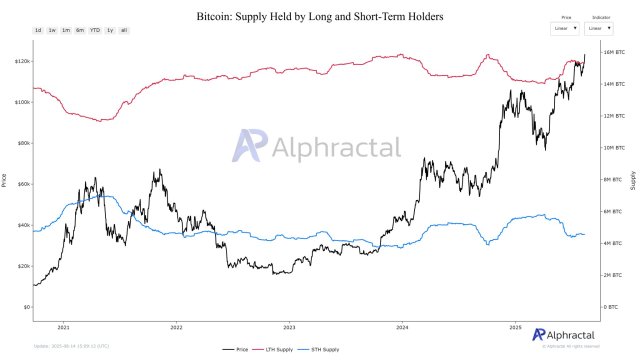

Bitcoin supply patterns are currently painting a vivid picture of investor behavior, accumulation tendencies, and possible price direction, as well as the market’s health. Boris’ examination of the supply dynamics hinges on the behavior of long-term holders and short-term holders.

As Bitcoin rose to its all-time high, supply dynamics revealed a stark divergence between these different groups of investors. Presently, long-term BTC holders are steadily offloading their holdings while short-term BTC holders are persistently accumulating the asset at a rapid rate.

This divergence in sentiment between the groups indicates that the market is currently in a post-all-time high stress test. A post-all-time high stress test reflects a phase where the boundaries of market resiliency and investor belief are being tested.

With short-term holders holding strong and long-term traders responding aggressively to price fluctuations, the present phase is determining whether BTC can maintain its value and momentum following the recent high.

Data shows that long-term holders’ supply saw a drop from 15.50 million BTC to 15.28 million BTC, which is an indication of profit-taking. Meanwhile, the supply of short-term holders rose from 4.38 million BTC to 4.61 million BTC, suggesting that the cohort is capitalizing on recent rallies.

According to the on-chain expert, this change demonstrates that STHs followed the trend and increased risk, while LTHs responded to the rally with sales. After a short period, Bitcoin’s price quickly fell back from about $124,000, putting late buyers through a stress test.

Furthermore, Boris noted that the final wave exhibits a classic market pattern where experienced holders limit their exposure and short-term holders accumulate close to the top. Such a development typically signals a loss of momentum.

Short-Term BTC Holders Are Showing Strength

A recent research from Glassnode, a leading on-chain data analytics firm, has also revealed an underlying strength among short-term BTC holders. The platform’s research is solely focused on the Bitcoin Short-Term Holder SOPR Indicator.

Specifically, this key metric tracks whether new investors are selling at a profit or loss. As BTC’s price surges, the metric temporarily dipped below neutral levels, but quickly recovered and rose above neutral. This move, according to Glassnode, shows limited realized losses and indicates that new Bitcoin investors are prepared to protect their cost basis, which is currently close to $112,000.