Prioritize Environmental, Social, and Governance (ESG) goals. Do so by applying a near-infinite number of ad-hoc tools which vary from country to country and region to region. Do it with a fractured financial infrastructure, and of course, try to achieve economic growth throughout.

There’s another possibility. Pursue ESG goals within a unified framework with clearly identifiable goals. Do it all under the advantage of a financial instrument that allows for various applications but can contribute towards the overarching goals.

Could Bitcoin be that tool? A new report from the Bitcoin-Bundesverband shows just how it could happen.

Here’s how Bitcoin could reshape global finance and improve sustainability, allowing innovation from the ground up.

Making ESG Goals Possible and Profitable

ESG goals have become a dominant theme in national and corporate economics. The EU, for example, has many ESG-related rules on the books:

- Sustainable Finance Disclosure Regulation (SFDR) – Requires financial market participants – including asset managers, insurance companies, and pension funds – to disclose how they integrate sustainability risks and adverse impacts in their investment decisions and products.

Corporate Sustainability Reporting Directive (CSRD) – Expands ESG reporting obligations beyond the Non-Financial Reporting Directive (NFRD), requiring large and listed companies to publish detailed climate and social impact disclosures

EU Taxonomy Regulation – A classification framework (Regulation 2020/852) defining which economic activities are ‘environmentally sustainable’ to prevent greenwashing. Covers six environmental goals and requires a ‘Do No Significant Harm’ test, plus governance and social safeguards

Corporate Sustainability Due Diligence Directive (CSDDD) – Adopted June 13, 2024, obliges large companies to identify, prevent, and mitigate human rights and environmental harms throughout their value chains

Those rules are all part of a broader framework based on the UN’s agreed SDG goals. The Bitcoin report identifies several specific goals that Bitcoin adoption could achieve:

- SDG 1: No Poverty, helped by Bitcoin’s financial inclusion

- SDG 7: Affordable and Clean Energy, by encouraging sustainable energy use

- SDG 9: Industry, Innovation and Infrastructure, by potentially reducing emissions

All told, the report concludes that there are significant chances for Bitcoin to actually support ESG initiatives and the UN’s own SDGs, contrary to the common perception of Bitcoin being in opposition to such goals.

Of course, there is one particularly thorny environmental issue with Bitcoin that’s well-known: energy consumption. There may be a path forward for Bitcoin there as well.

Corporate Bitcoin Adoption Is Still Environmentally Friendly

One of the primary arguments against Bitcoin has been that it is fundamentally environmentally unfriendly, consuming far too much energy that could otherwise go towards supplying business and infrastructure.

But there’s growing evidence that energy-intensive Bitcoin mining could turn out to be a feature of the emerging crypto economy, rather than a bug.

Understanding how Bitcoin energy consumption could be helpful to starts with understanding that not all energy is created equal. Energy from renewable sources impacts the environment in a radically different way than gas or coal-fired electricity.

Understanding the differentiated nature of energy consumption, the Bitcoin Bundesverband report highlighted several potential uses for Bitcoin’s energy appetites.

Decarbonisation: Bitcoin mining already uses well over 50% renewable energy, per the Bitcoin Mining Council.

Efficiency and Integration: Riot Blockchain in Texas, USA, is building a mining facility integrated directly with the energy networks. This allows the company to use excess energy and stabilize energy grid performance.

Waste Heat: Data centers – essentially what a Bitcoin mining facility is – generate significant amounts of excess heat. Rather than lose that heat, there are efforts underway to capitalize on and recycle it for use in greenhouses and small-scale heating networks.

These ideas fit into a broader trend of reconsidering Bitcoin mining in the light of expanding renewable energy production.

Renewable energy sources, such as wind and solar, can be unpredictable. Energy grids based on those sources tend to suffer from periodic underproduction (often offset by battery storage) and overproduction, during which excess energy may simply be lost.

Research by the European Bitcoin Energy Association concluded that:

‘Renewable-based mining could potentially drive a net-decarbonizing effect on energy grids…’

By scaling up Bitcoin mining operations during overproduction and scaling them down in scarcity, Bitcoin’s proof-of-work model could actually contribute to stabilizing renewable energy networks and promoting decarbonization.

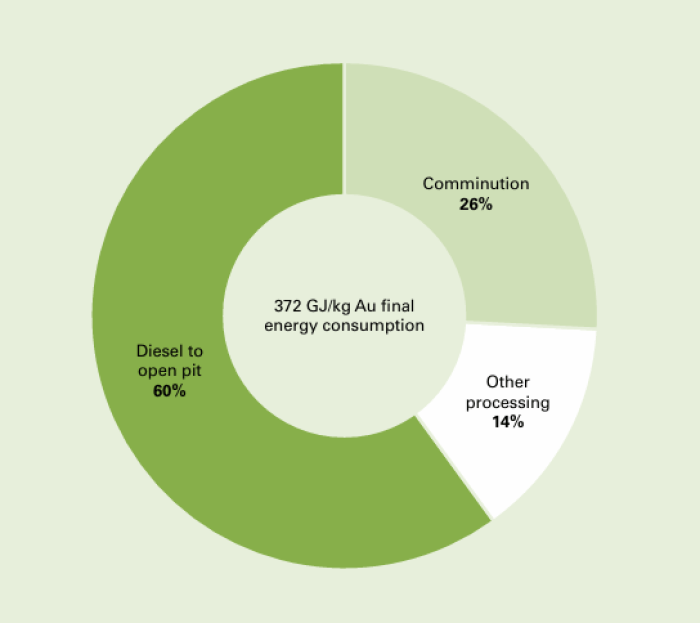

At the same time, it’s worth noting as the Bitcoin Bundesverband Report does, that the actual energy consumption of the Bitcoin network – approx. 146 TWh/year – is significantly less compared to traditional financial systems and gold mining.

A look at all of the energy sources required in the full process of gold mining illustrates just how energy-intensive the entire process is.

A Unified Financial Framework with Social Impact

The development of Bitcoin has completely changed over the past 5 years, most notably since Michael Saylor launched (Micro)Strategy’s famous pivot.

Bitcoin isn’t just a store of value anymore. It’s money, gold, and an investment tool, all in one.

The combination is on the verge of completely transforming the financial framework to streamline ESG implementation.

Companies and governments are increasingly using Bitcoin as a strategic financial tool. It serves as:

A hedge against inflation

A long-term store of value

A means of securing Bitcoin-backed loans

A way to streamline global payments while reducing dependence on traditional banking systems

Notable adopters include firms like MicroStrategy, Tesla, Deutsche Börse, and state-backed entities in Abu Dhabi, Bhutan, and Texas.

On the social side, Bitcoin is also transforming how projects raise funds. Instead of issuing new tokens, some initiatives use Bitcoin directly for crowdfunding, supported by fast, low-cost second-layer solutions like the Lightning Network.

This approach not only lowers costs compared to traditional platforms but also offers censorship resistance; look at the Canadian trucker protests in 2022.

Public administrations in countries like Estonia, Georgia, and Guatemala are using the Bitcoin blockchain to anchor official documents, securing them against tampering and enhancing trust in regions with fragile institutions.

This ‘digital notary’ function provides global verifiability for everything from land registries to election records.

Social and financial, corporate and individual – the Bitcoin Bundesverband Report highlights how transformative Bitcoin’s impact has become.

And now there’s a meme coin poised to take it one step further.

BTC Bull Token ($BTCBULL) – Bitcoin Comes to Meme Coins for More Ways to Earn

BTC Bull Token ($BTCBULL) harnesses all of Bitcoin’s incredible 230% AAR with the nearly limitless potential of a meme coin.

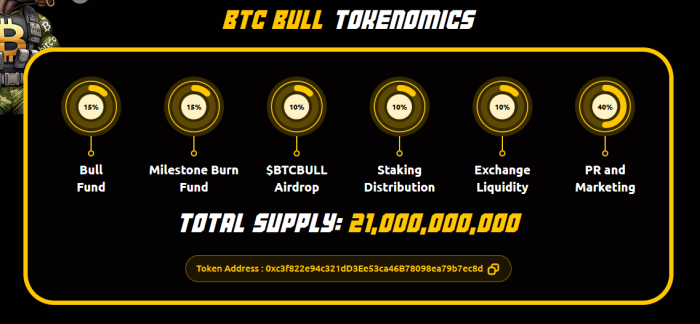

The result? An innovative project roadmap that rewards key Bitcoin milestones with either deflationary token burns or free crypto airdrops.

Bitcoin at $125K, $175K, even $225K? Each milestone triggers a $BTCBULL token burn, fueling serious price momentum.

Bitcoin smashes $150K or $200K? $BTCBULL holders in the Best Wallet app unlock free Bitcoin airdrops. Hold tight, rewards are coming.

And if $BTC hits $250K? Then a truly massive $BTCBULL airdrop awaits.

This isn’t an independent project; it’s a meme coin fully integrated into the ever-more-integrated Bitcoin ecosystem. The tokenomics reflect that, with an even distribution between short-term and long-term goals.

The Bitcoin Bundesverband Report evidences how intricate the Bitcoin ecosystem is, supporting our analysis of predicted $BTCBULL token prices. We think the token, currently at $0.002575, could hit $0.0187 by the end of 2026 – an impressive 626% increase.

What is BTC Bull Token? It’s a critical part of Bitcoin’s continued evolution. Learn how to find the best crypto presales and discover how to buy $BTCBULL by visiting the presale page today.

A Brave New Bitcoin World

ESG initiatives can be complex to evaluate. But the Bitcoin Bundesverband Report shows that Bitcoin doesn’t haven’t to be an obstacle to ESG; it can play a key role in advancing ESG goals.

And BTC Bull Token is right there with it.

As always, be sure to do your own research – this isn’t financial advice.

Decarbonisation: Bitcoin mining already uses well over 50% renewable energy, per the Bitcoin Mining Council.

Decarbonisation: Bitcoin mining already uses well over 50% renewable energy, per the Bitcoin Mining Council. Efficiency and Integration: Riot Blockchain in Texas, USA, is building a mining facility integrated directly with the energy networks. This allows the company to use excess energy and stabilize energy grid performance.

Efficiency and Integration: Riot Blockchain in Texas, USA, is building a mining facility integrated directly with the energy networks. This allows the company to use excess energy and stabilize energy grid performance. Waste Heat: Data centers – essentially what a Bitcoin mining facility is – generate significant amounts of excess heat. Rather than lose that heat, there are efforts underway to capitalize on and recycle it for use in greenhouses and small-scale heating networks.

Waste Heat: Data centers – essentially what a Bitcoin mining facility is – generate significant amounts of excess heat. Rather than lose that heat, there are efforts underway to capitalize on and recycle it for use in greenhouses and small-scale heating networks.

A hedge against inflation

A hedge against inflation Bitcoin at $125K, $175K, even $225K? Each milestone triggers a $BTCBULL token burn, fueling serious price momentum.

Bitcoin at $125K, $175K, even $225K? Each milestone triggers a $BTCBULL token burn, fueling serious price momentum.