Bitcoin vs Traditional Banking — Pros and Cons

In this blog, I will explore the clash of the financial titans: Bitcoin vs. traditional banking — focusing on various aspects such as payments, store of value, financial inclusion, digital bearer instruments, and ordinal NFTs.

So how do those two systems differ from each other?

Bitcoin excels in payments with reduced fees and global access, while traditional banking ensures regulatory protection and a robust infrastructure. As a store of value, Bitcoin offers limited supply and decentralization, whereas traditional banking guarantees stability and regulatory support. For financial inclusion, Bitcoin’s global accessibility competes with traditional banking’s diverse financial products and regulatory safeguards.

In digital bearer instruments, Bitcoin emphasizes direct ownership and security, contrasting with traditional banking’s stability and system integration. Ordinal NFTs on Bitcoin provide unique ownership and transparency, while traditional banking maintains familiarity, regulatory oversight, and a wider array of financial services.

Ultimately, the choice between Bitcoin and traditional banking depends on specific needs, risk tolerance, and the evolving landscape of financial technology. Bitcoin’s innovations bring advantages such as reduced transaction fees, faster cross-border transactions, and increased financial sovereignty, but traditional banking offers familiarity, regulatory support, and a broader array of financial services.

Let’s explore it in more detail…

PAYMENTS

Both Bitcoin technology and traditional banking have their advantages and limitations. Bitcoin’s innovation lies in its decentralized and borderless nature, reduced fees, and potential for financial inclusion.

However, traditional banking offers regulatory protections, established infrastructure, and support mechanisms that some individuals and businesses may find essential. The choice between the two depends on specific use cases, risk tolerance, and the evolving landscape of financial technology.

Bitcoin is an innovative payment network and a new kind of money. https://bitcoin.org/en/

Let’s compare the added value of Bitcoin technology to traditional banking solutions in the context of payments:

Bitcoin Technology

1. Decentralization and Trustless Transactions:

Bitcoin: Operates on a decentralized network without the need for a central authority. Transactions are verified by a network of nodes, reducing reliance on intermediaries.

Traditional Banking: Centralized banks act as intermediaries for transactions, requiring trust in their operations and security measures.

2. Global Accessibility and Inclusion

Bitcoin: Accessible to anyone with an internet connection, enabling financial participation for the unbanked and underbanked globally.

Traditional Banking: Excludes individuals without access to banking services or those residing in remote areas with limited bank infrastructure.

3. Reduced Transaction Fees:

Bitcoin: Often offers lower transaction fees, especially for cross-border transfers, reducing the cost of sending money internationally.

Traditional Banking: Can involve high fees for cross-border transactions, including intermediary and currency conversion charges.

4. Fast Cross-Border Transactions:

Bitcoin: Transactions can be settled relatively quickly, potentially within minutes, across borders without the delays associated with traditional international transfers.

Traditional Banking: International transactions can take days to clear due to intermediary banks, time zone differences, and processing delays.

5. Privacy and Anonymity:

Bitcoin: Provides a degree of privacy through cryptographic addresses, offering pseudonymity in transactions.

Traditional Banking: Transactions are often tied to personal identities, compromising privacy and potentially exposing sensitive financial information.

6. Security and Fraud Prevention:

Bitcoin: Transactions are secure and tamper-resistant due to blockchain technology, reducing the risk of fraud and unauthorized access.

Traditional Banking: Banks employ security measures, but centralized systems can be susceptible to data breaches and fraud.

7. Financial Sovereignty:

Bitcoin: Users have direct control over their funds, reducing dependence on banks and eliminating the risk of frozen accounts.

Traditional Banking: Accounts can be subject to freezes, restrictions, or seizures by authorities or banks.

8. Reduced Dependence on Intermediaries:

Bitcoin: Transactions can be conducted directly between peers, reducing the need for intermediaries in the payment process.

Traditional Banking: Transactions often involve multiple intermediaries, leading to longer processing times and increased costs.

9. Micropayments and Fractional Ownership:

Bitcoin: Highly divisible, enabling micropayments and fractional ownership of assets that were previously impractical.

Traditional Banking: Limited divisibility can hinder micropayments and small-scale investments.

10. Programmable Money and Smart Contracts:

Bitcoin: Supports basic smart contract functionality, allowing for automated transactions based on predefined conditions.

Traditional Banking: Lacks built-in programmability and smart contract capabilities.

11. Immutable Record and Transparency:

Bitcoin: Transactions are recorded on an immutable blockchain, ensuring transparency and preventing alteration.

Traditional Banking: Transaction history can be altered or manipulated by centralized institutions.

Traditional Banking Solutions

1. Familiarity and Regulation:

Traditional Banking: Established and regulated by governmental authorities, providing a familiar framework for financial activities.

Bitcoin: Regulatory uncertainty and the evolving landscape can create challenges and apprehension.

2. Customer Support and Dispute Resolution:

Traditional Banking: Offers customer support, dispute resolution, and the possibility of recovering funds in case of errors or fraud.

Bitcoin: Limited recourse for recovering lost funds or addressing disputes due to the irreversible nature of transactions.

3. Currency Stability:

Traditional Banking: Provides stability through government-backed fiat currencies.

Bitcoin: Exhibits price volatility, making it potentially unsuitable for risk-averse individuals or merchants.

4. Government Backing and Deposit Insurance:

Traditional Banking: Often backed by government guarantees and deposit insurance, providing a safety net for customers’ funds.

Bitcoin: Lacks government backing and deposit insurance, potentially leading to concerns about fund safety.

STORE OF VALUE

Bitcoin technology offers distinct advantages as a store of value compared to traditional banking, primarily due to its limited supply, decentralized nature, global accessibility, and potential as a hedge against economic instability. However, traditional banking provides stability, familiarity, and regulatory protections that some individuals may prioritize. So let’s explore how Bitcoin’s technology compares to traditional banking as a store of value.

Bitcoin Technology

1. Limited Supply and Scarcity:

Bitcoin: Bitcoin’s supply is capped at 21 million coins, creating a deflationary model that inherently limits its issuance. This scarcity can potentially protect against the erosion of value due to excessive inflation.

Traditional Banking: Fiat currencies issued by governments can be subject to inflation due to central bank policies, potentially leading to a decrease in purchasing power over time.

2. Decentralization and Ownership:

Bitcoin: Ownership of Bitcoin is self-custodial, giving individuals full control over their assets without reliance on third-party intermediaries. This reduces the risk of government intervention or bank-related issues affecting ownership.

Traditional Banking: Funds held in banks are subject to the bank’s policies and regulations, with potential risks of account freezes, confiscations, or loss of access due to regulatory actions.

3. Global Accessibility and Portability:

Bitcoin: Being digital and borderless, Bitcoin can be accessed and transferred globally with ease, enabling individuals to preserve value across geographic boundaries.

Traditional Banking: Traditional banking often involves currency conversion fees and limitations when transferring funds internationally.

4. Diversification and Hedge Against Traditional Assets:

Bitcoin: Bitcoin’s relatively low correlation with traditional financial markets makes it an appealing asset for diversification and as a potential hedge against economic downturns.

Traditional Banking: Traditional assets like stocks and bonds can be influenced by broader market trends and economic conditions, potentially leading to correlated losses.

5. Resistance to Inflation and Currency Devaluation:

Bitcoin: Bitcoin’s scarcity and decentralized nature make it resistant to government-driven inflation and currency devaluation.

Traditional Banking: Fiat currencies can be subject to inflationary policies by central banks, leading to a reduction in purchasing power over time.

6. Store of Value Across Political and Economic Instability:

Bitcoin: In regions with political or economic instability, Bitcoin can provide a way to store wealth that is less susceptible to government manipulation or local economic crises.

Traditional Banking: In uncertain economic or political environments, traditional banks and financial systems can be exposed to government controls, capital controls, and economic shocks.

Traditional Banking

1. Government Backing and Stability:

Traditional Banking: Government-backed fiat currencies benefit from stability and the legal framework provided by the issuing country’s government.

Bitcoin: Lacks direct government backing, which can lead to concerns about stability and acceptance in mainstream commerce.

2. Familiarity and Regulation:

Traditional Banking: Well-established and regulated by government authorities, providing a familiar and trusted environment for storing wealth.

Bitcoin: Regulatory uncertainty and evolving landscape can create challenges and limit mainstream adoption.

3. Deposit Insurance and Guarantees:

Traditional Banking: Many countries offer deposit insurance, protecting a portion of account balances in case of bank failures.

Bitcoin: Lacks deposit insurance, which could raise concerns about the security of stored funds.

4. Ease of Use and Accessibility:

Traditional Banking: Accessible to a broad range of individuals, often with physical branch locations and customer support.

Bitcoin: Requires a degree of technical knowledge and reliance on digital platforms, which might exclude some individuals from participating.

FINANCIAL INCLUSION

Bitcoin’s technology can play a significant role in financial inclusion by providing access to a global, decentralized financial network. It can empower the unbanked and underbanked populations to participate in the economy and access financial services. However, traditional banking still offers advantages such as regulatory protections, physical support, and a broader range of financial products, especially for individuals who may require additional assistance and financial services beyond basic transactions.

Bitcoin Technology

1. Direct Ownership and Control:

Bitcoin: Bitcoin provides direct ownership and control over digital assets, allowing individuals to hold and transfer value without relying on intermediaries.

Traditional Banking: Traditional banking involves holding digital money in accounts that are controlled and managed by the bank, requiring trust in the bank’s operations.

2. Decentralized Verification:

Bitcoin: Transactions are verified by a decentralized network of nodes, ensuring the authenticity of ownership and preventing double-spending without relying on a central authority.

Traditional Banking: Traditional banking relies on centralized systems for transaction verification, potentially leading to delays and security vulnerabilities.

3. Global Accessibility:

Bitcoin: Bitcoin’s borderless nature enables global accessibility to digital assets, allowing individuals to send and receive value across geographic boundaries.

Traditional Banking: Traditional banking services can be limited to specific regions and require currency conversion for international transactions.

4. Censorship Resistance:

Bitcoin: Bitcoin transactions are resistant to censorship, as no central authority can control or block transactions.

Traditional Banking: Traditional banking transactions can be subject to censorship or restrictions based on government policies or regulatory decisions.

5. Privacy and Pseudonymity:

Bitcoin: Bitcoin transactions offer a degree of privacy through cryptographic addresses, allowing users to conduct transactions without revealing personal information.

Traditional Banking: Traditional banking transactions often involve sharing personal information, reducing privacy.

6. Immutable Record and Security:

Bitcoin: Transactions recorded on the blockchain are tamper-resistant and secure, providing an immutable record of ownership.

Traditional Banking: Traditional banking records can be altered or manipulated, potentially leading to discrepancies or disputes.

Traditional Banking

1. Government Backing and Regulation:

Traditional Banking: Government-backed fiat currencies provide a level of stability and recognition, backed by legal tender laws.

Bitcoin: Lacks government backing and can face regulatory challenges that might limit its acceptance as a widely recognized digital instrument.

2. Depository Services:

Traditional Banking: Traditional banks offer secure depository services for digital money, ensuring funds are protected and accessible.

Bitcoin: Users must take responsibility for securing their private keys and digital wallets, which can be challenging for individuals unfamiliar with cryptographic concepts.

3. Customer Support and Dispute Resolution:

Traditional Banking: Traditional banks offer customer support and dispute resolution services in case of errors or issues with transactions.

Bitcoin: Bitcoin transactions are irreversible, and there is limited recourse for recovering lost funds or addressing transaction disputes.

4. Integration with Traditional Financial Systems:

Traditional Banking: Traditional banks seamlessly integrate with existing financial systems, allowing easy access to a wide range of financial services.

Bitcoin: Integration with traditional financial systems can be limited due to regulatory and technological challenges.

DIGITAL BEARER INSTRUMENT

First, we need to understand what is a bearer instrument.

Imagine you have a special ticket to a concert. This ticket is valuable because it lets you attend the concert. Now, let’s say that this ticket is like a “bearer instrument.” That means if you have the ticket in your hand, you’re allowed to go to the concert. It doesn’t matter whose name is on the ticket; what matters is having the physical ticket.

In the world of money and finance, there are things like this ticket called “bearer instruments.” These could be special papers or documents that represent money or ownership. Whoever holds these papers is considered the owner and can use them to get things or do certain things, just like with the concert ticket.

For example, there used to be pieces of paper called “bearer bonds.” If you had one, you could get money back from the government or a company on a certain date. It didn’t matter whose name was on the paper; whoever had it could get the money.

But these kinds of papers can also be a bit risky. If you lose them or someone takes them, they can use them instead of you. That’s why many places now use electronic records to keep track of who owns what, to make things safer and more secure.

So, a bearer instrument is like a special paper that gives you certain rights or money just by having it in your hands, similar to how a concert ticket lets you attend a concert.

Some common examples of bearer instruments include:

-Bearer Bonds: These are debt securities issued by a government or corporation. The holder of the physical bond certificate is entitled to receive interest payments and the principal amount upon maturity. Bearer bonds are not registered in any name and can be freely transferred by delivery.

-Bearer Shares: In some jurisdictions, companies issue bearer shares, which are physical stock certificates representing ownership in the company. The person holding the share certificate is considered the owner of the shares and is entitled to dividends and voting rights.

-Cash Bearer: Cash banknotes and coins are also considered bearer instruments. Whoever holds the physical currency is the legal owner and can use it for transactions.

Promissory Notes: These are written promises to pay a certain amount of money to the bearer on a specified date. They can be freely transferred by delivery, and the person who holds the note at maturity can claim the payment.

So how does Bitcoin’s technology compare to traditional banking in the context of digital bearer instruments?

In summary, Bitcoin’s technology offers a digital bearer instrument that provides direct ownership, global accessibility, and security. It enables individuals to hold and transfer value without intermediaries and offers censorship resistance. However, traditional banking provides stability, government backing, and integration with existing financial systems.

Bitcoin Technology

1. Direct Ownership and Control:

Bitcoin: Bitcoin provides direct ownership and control over digital assets, allowing individuals to hold and transfer value without relying on intermediaries.

Traditional Banking: Traditional banking involves holding digital money in accounts that are controlled and managed by the bank, requiring trust in the bank’s operations.

2. Decentralized Verification:

Bitcoin: Transactions are verified by a decentralized network of nodes, ensuring the authenticity of ownership and preventing double-spending without relying on a central authority.

Traditional Banking: Traditional banking relies on centralized systems for transaction verification, potentially leading to delays and security vulnerabilities.

3. Global Accessibility:

Bitcoin: Bitcoin’s borderless nature enables global accessibility to digital assets, allowing individuals to send and receive value across geographic boundaries.

Traditional Banking: Traditional banking services can be limited to specific regions and require currency conversion for international transactions.

4. Censorship Resistance:

Bitcoin: Bitcoin transactions are resistant to censorship, as no central authority can control or block transactions.

Traditional Banking: Traditional banking transactions can be subject to censorship or restrictions based on government policies or regulatory decisions.

5. Privacy and Pseudonymity:

Bitcoin: Bitcoin transactions offer a degree of privacy through cryptographic addresses, allowing users to conduct transactions without revealing personal information.

Traditional Banking: Traditional banking transactions often involve sharing personal information, reducing privacy.

6. Immutable Record and Security:

Bitcoin: Transactions recorded on the blockchain are tamper-resistant and secure, providing an immutable record of ownership.

Traditional Banking: Traditional banking records can be altered or manipulated, potentially leading to discrepancies or disputes.

Traditional Banking

1. Government Backing and Regulation:

Traditional Banking: Government-backed fiat currencies provide a level of stability and recognition, backed by legal tender laws.

Bitcoin: Lacks government backing and can face regulatory challenges that might limit its acceptance as a widely recognized digital instrument.

2. Depository Services:

Traditional Banking: Traditional banks offer secure depository services for digital money, ensuring funds are protected and accessible.

Bitcoin: Users must take responsibility for securing their private keys and digital wallets, which can be challenging for individuals unfamiliar with cryptographic concepts.

3. Customer Support and Dispute Resolution:

Traditional Banking: Traditional banks offer customer support and dispute resolution services in case of errors or issues with transactions.

Bitcoin: Bitcoin transactions are irreversible, and there is limited recourse for recovering lost funds or addressing transaction disputes.

4. Integration with Traditional Financial Systems:

Traditional Banking: Traditional banks seamlessly integrate with existing financial systems, allowing easy access to a wide range of financial services.

Bitcoin: Integration with traditional financial systems can be limited due to regulatory and technological challenges.

ORDINAL NFT’S

Ordinal NFTs built on Bitcoin technology offer unique advantages in terms of digital ownership, decentralization, and transparency for representing achievements and progress. They can empower users to directly control and showcase their virtual accomplishments. However, traditional banking provides established financial services, regulatory oversight, and stability that ordinal NFTs might lack.

To understand ordinal NFTs, let’s break down the concept in simpler terms:

Imagine you’re collecting digital stickers that show your achievements in a video game. These stickers are special because they represent different levels you’ve reached. The first sticker might say “Level 1,” the next one “Level 2,” and so on. These stickers are like “ordinal NFTs.”

NFT stands for “Non-Fungible Token.” It’s like a digital certificate that says you own something unique, just like owning a rare trading card in real life. What makes “ordinal” NFTs special is that they represent a sequence or order, like the levels you’ve achieved in the game.

So, when you earn an ordinal NFT, you’re basically getting a digital badge that says you’ve reached a specific level. And since it’s an NFT, no one else can have the exact same badge. It’s like a virtual trophy that shows off your progress in the game!

Now, let’s compare the added value of ordinal NFTs built on Bitcoin technology to traditional banking:

Bitcoin Technology

1. Digital Ownership and Provenance:

Ordinal NFTs: Built on the Bitcoin blockchain, ordinal NFTs represent unique achievements or levels. Each NFT is linked to a specific order or sequence, providing a clear record of progression.

Traditional Banking: Traditional banks do not offer a similar system for representing and proving the order or sequence of achievements.

2. Decentralization and Transparency:

Ordinal NFTs: Bitcoin’s blockchain ensures that the ownership and order of NFTs are transparent and tamper-proof, as they are recorded on a decentralized public ledger.

Traditional Banking: Traditional banking lacks the transparency and immutability of a blockchain, which could potentially lead to disputes or uncertainties about achievements.

3. Self-Custody and Control:

Ordinal NFTs: Users directly own and control their ordinal NFTs through private keys, reducing the need for intermediaries and offering greater control over virtual achievements.

Traditional Banking: Traditional banking typically involves reliance on centralized platforms, limiting user control over digital assets.

4. Global Accessibility and Portability:

Ordinal NFTs: NFTs can be accessed and transferred globally, allowing users to showcase their achievements to a wider audience and potentially monetize their progress.

Traditional Banking: Traditional banking services can be restricted by geographic location and might not easily allow the showcasing of achievements.

Traditional Banking:

1. Familiarity and Regulation:

Traditional Banking: Offers familiarity and regulatory oversight, which can provide a sense of trust and accountability when dealing with financial matters.

Ordinal NFTs: NFTs and blockchain technology might be less familiar to many individuals and lack the same level of established regulation.

2. Customer Support and Dispute Resolution:

Traditional Banking: Traditional banks provide customer support and mechanisms for addressing disputes related to financial matters.

Ordinal NFTs: Dispute resolution for blockchain-based assets like NFTs can be complex and might not offer the same level of consumer protection.

3. Financial Services and Transactions:

Traditional Banking: Traditional banks offer a wide range of financial services beyond digital ownership, such as savings, loans, and payments.

Ordinal NFTs: NFTs primarily represent achievements and ownership in a specific context, lacking the broader financial services of traditional banking.

4. Government Backing and Stability:

Traditional Banking: Government-backed fiat currencies provide stability and legal recognition.

Ordinal NFTs: Lack government backing and can be subject to market volatility, limiting their acceptance as a stable store of value.

In this blog, I’ve ventured into the fascinating clash of giants — Bitcoin versus traditional banking. From dissecting payment systems to exploring the concept of digital bearer instruments, I walked you through the most important concepts. My motivation? To untangle the complexities, offering you a glimpse into the transformative power of Bitcoin.

Personally, I’m fascinated by the evolving landscape of finance and I see the future of finance evolving in ways we couldn’t have imagined.

I think Bitcoin’s potential to reshape the game is undeniable. In this blog, we’ve reviewed payments, value storage, and even touched on the future with ordinal NFTs. Want to add your voice to the mix? What’s your take on Bitcoin’s role in the financial future? How can traditional banking keep up?

Drop your thoughts in the comments below and follow me for more insights.

Let’s navigate this financial frontier together! 🚀

Reference links and additional reading

Bitcoin.org This official Bitcoin website outlines the advantages of using Bitcoin, especially in terms of payments and decentralization.

Investopedia Investopedia is a reliable source, and this article discusses both the advantages and disadvantages of Bitcoin.

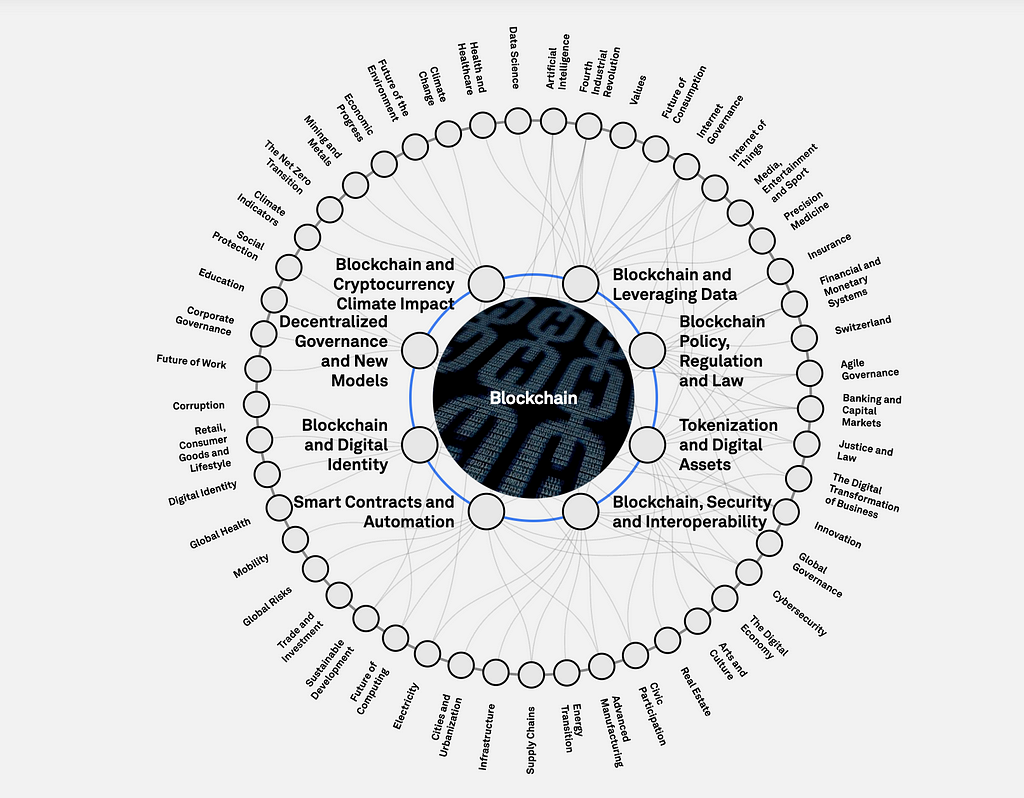

World Economic Forum The World Economic Forum often provides insights into the future of finance, including digital currencies like Bitcoin.

Bank for International Settlements (BIS) BIS offers information on central bank digital currencies (CBDCs), providing a perspective from the traditional banking side.

Forbes -The real problem with centralized banks and why crypto is inevitable. Forbes is a reputable source, and this article might offer a balanced view on the comparison.

Harvard Business Review Harvard Business Review often provides in-depth analyses. This article explores challenges and potential solutions related to blockchain technology.

CoinDesk — How Bitcoin Works. CoinDesk is a well-known crypto news source. This article explains the basics of how Bitcoin works, providing a technical perspective.

MIT Technology Review MIT Technology Review often explores the broader impact of technologies. This article delves into how Bitcoin’s technology is influencing various sectors.

Financial Times — CryptocurrenciesThe Financial Times is a reputable financial news source. This link will take you to their section on cryptocurrencies, where you can find various articles discussing Bitcoin in relation to traditional banking.

Bitcoin vs Traditional Banking — Pros and Cons was originally published in The Dark Side on Medium, where people are continuing the conversation by highlighting and responding to this story.