BlackRock has reportedly filed to amend its Ethereum ETF to include staking, according to new SEC documents. If approved, BlackRock’s fund would become the first US Ethereum ETF to offer staking rewards.

Shortly after the filing, NASDAQ submitted a corresponding rule change proposal to allow ETHA to stake a portion of its holdings. This regulatory coordination signals a serious intent to launch the first US spot Ethereum ETF with staking rewards.

BlackRock’s Ethereum ETF Already Dominates Inflows

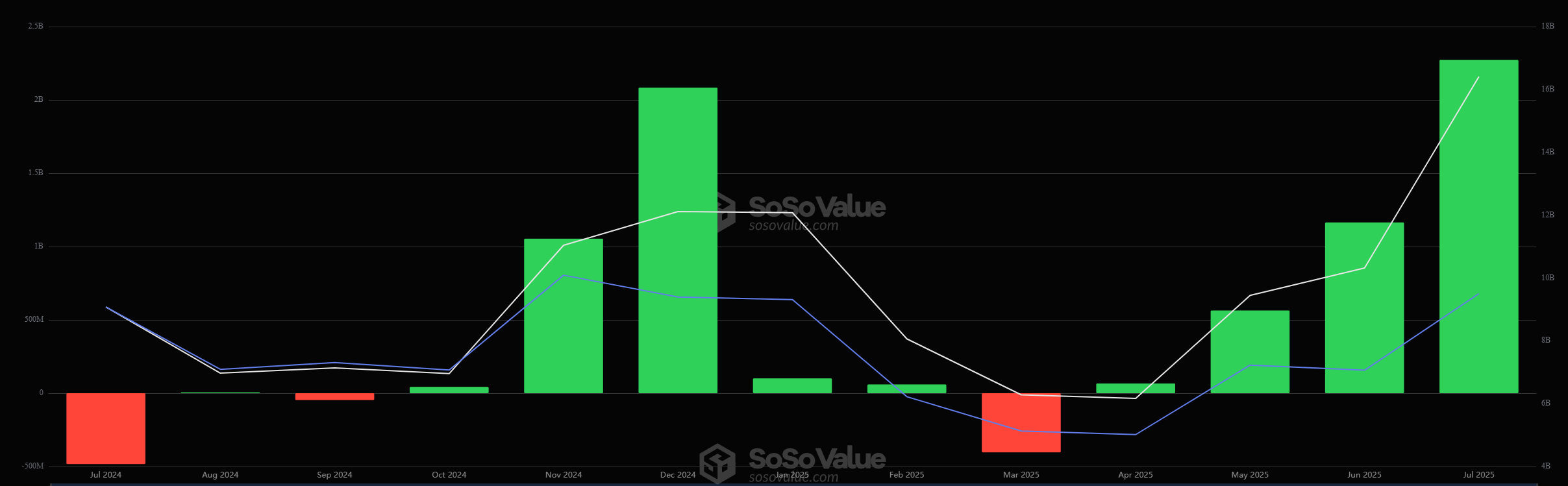

The move comes as BlackRock’s ETHA leads all US spot Ethereum ETFs in performance. On July 16, ETHA recorded $499 million in net inflows, the largest daily total across all issuers.

Since its debut, ETHA’s assets under management have swelled to $7.9 billion, holding over 2.02 million ETH.

BlackRock has added nearly $656 million worth of Ethereum to its treasury this month alone. It’s currently the largest institutional ETH holder outside of the Ethereum Foundation.

What Staking Would Add to ETH ETFs

If approved, staking would allow ETHA to earn Ethereum’s native yield—typically around 3–5% annually—by participating in network validation.

This would transform ETHA from a pure price-tracking vehicle into a yield-generating digital asset fund, aligning it more closely with dividend-paying stocks or bonds.

It could also reduce Ethereum’s circulating supply, as staked ETH is locked, intensifying Ethereum’s deflationary mechanics. Analysts suggest this structural shift may strengthen ETH’s long-term value proposition.

The SEC has yet to approve any staking-enabled ETF, but BlackRock’s filing and NASDAQ’s proposal could set a precedent. Other issuers, including Grayscale and Franklin Templeton, have similar applications under review.

A Defining Moment for Institutional Ethereum

BlackRock’s staking ambitions mark a turning point in crypto asset management.

By combining price exposure with yield, ETHA could unlock a wave of new institutional inflows—particularly from pension funds and sovereign investors seeking regulated income-generating crypto products.

With Ethereum hovering around $3,400, rising ETF inflows, and shrinking exchange reserves, the introduction of staking could be the catalyst for Ethereum’s next institutional growth phase.

The industry now awaits the SEC’s response. A green light could reshape the US crypto ETF space.

The post BlackRock Files to Add Staking to Its Ethereum ETF appeared first on BeInCrypto.