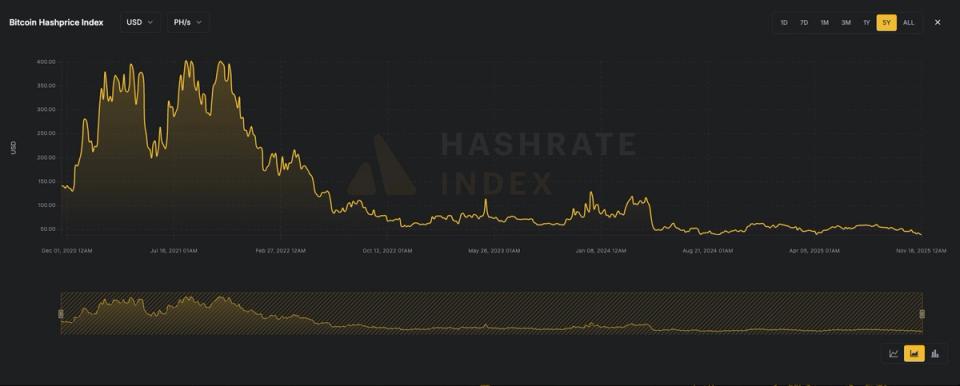

Bitcoin’s hashprice has fallen to its lowest level in five years, according to Luxor, now sitting at $38.2 PH/s. Hashprice, a term introduced by Luxor, measures the expected daily value of one terahash per second of computing power. The metric reflects how much revenue a miner can expect from a specific amount of hashrate. It can be denominated in any currency or asset, although it is typically shown in USD or BTC.

Hashprice depends on four key variables: network difficulty, the price of bitcoin, the block subsidy, and transaction fees. Hashprice rises with bitcoin’s price and fee volume, and falls as mining difficulty increases.

Bitcoin’s hashrate remains near record levels at more than 1.1 ZH/s on a seven day moving average. Meanwhile, the bitcoin price is at $91,000, down roughly 30% from its October all time high of more than $126,000, and network difficulty remains near all-time highs at 152 trillion (t). Transaction fees remain extremely low, with mempool.space quoting a high priority transaction at 25 cents or 2 sat/vB.

This decline in hashprice is occurring alongside a broader pullback in publicly traded bitcoin mining stocks, even as many in the sector have pivoted business plans away from BTC mining and to AI infrastructure.

The CoinShares mining ETF, WGMI, has fallen 43% from its peak and is trading just below $41.