Bitcoin options expiry day has come around again, and a huge tranche of them is about to go as the week draws to a close. Meanwhile, crypto markets have found a new support zone, but will the derivatives deluge make a difference?

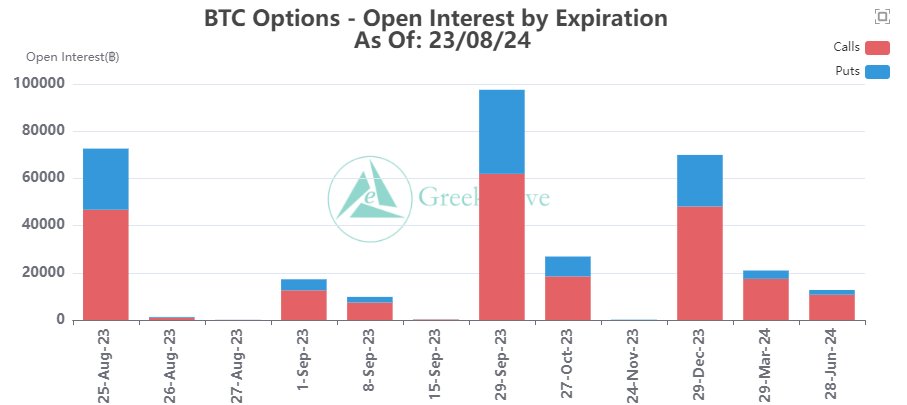

On August 25, around 72,000 Bitcoin options contracts will expire with a notional value of $1.91 billion. Moreover, the number of contracts that have yet to expire (open interest) is much larger than the previous week’s options expiry events.

Bitcoin Options Expiry Day

This week’s big batch of Bitcoin contracts have a max pain point of $28,000, which is still considerably higher than current spot prices.

Max pain is the price point with the most open contracts and the level at which most losses will be made when those contracts expire.

Moreover, the options contracts have a put/call ratio of 0.55, meaning almost twice as many calls (longs) are expiring than puts (shorts).

Derivatives analysis feed Greeks Live commented:

“After the biggest drop of the year, there is a huge probability that BTC and ETH will deliver this month away from the max pain point and will get back close after this month’s delivery.”

It added that the market has held relatively high IV (implied volatility) levels despite this week’s lower volatility. We derive the measure of expected future volatility, known as implied volatility, from the expiring derivatives contracts.

“Sellers now more cautious and buyers relatively strong,” it said before adding, “$26,000 has really become a strong support.”

If you’re interested in trading Bitcoin derivatives, check out BeInCrypto’s guide here.

Ethereum Options Outlook

Moreover, there are also around 536,000 Ethereum options contracts expiring this Friday. These have a notional value of $890 million and a max pain point of $1,800.

There is a put/call ratio of 0.39, which means many more calls are being sold than puts.

Market momentum is currently bearish following the 11% slump over the past fortnight. BTC is teetering on the $26,000 level and may fall below it again over the weekend if selling pressure continues.

Moreover, the brief visit to $26,600 on Thursday could not be sustained, and it appears that the path of least resistance is trending downwards again.

The fear and greed market sentiment index has now slipped to ‘Fear’ at 39, suggesting that confidence remains low.

The post Can $1.9 Billion in Expiring Bitcoin Options Shake Markets? appeared first on BeInCrypto.