Cardano (ADA) is under pressure, down 4% in the last 24 hours and nearly 10% over the past week, with daily trading volume falling 15% to $869 million. The decline in price and activity comes as several key metrics point to weakening momentum and growing uncertainty.

From a bearish BBTrend shift to volatile whale activity and the threat of a looming death cross on its EMA lines, ADA faces a critical period. Whether it can hold support and regain strength or continue slipping will likely depend on near-term market sentiment and broader crypto conditions.

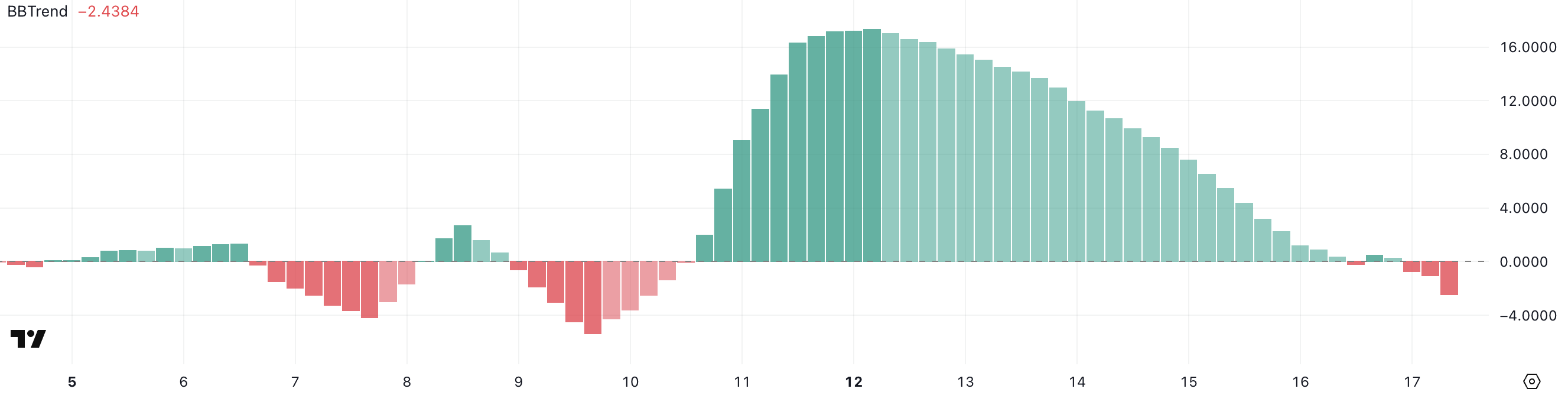

ADA Signals Weakness With BBTrend Falling Below Zero

Cardano’s BBTrend has turned negative, currently sitting at -2.43 after spending nearly five days in positive territory.

Between May 11 and May 16, the indicator remained above zero, even hitting a recent high of 17.34 on May 12.

This shift suggests that the recent upward momentum has faded, and the asset may be entering a new phase of weakness or consolidation.

The BBTrend (Bollinger Band Trend) measures how strongly price moves away from its average relative to volatility, offering insights into the strength and direction of trends.

Values above zero typically indicate bullish momentum, while values below zero suggest bearish pressure is increasing. With ADA now showing a BBTrend of -2.43, it signals a potential shift toward downside bias.

If this negative trend persists, it could lead to further price weakness or a period of stagnation until new buying interest returns.

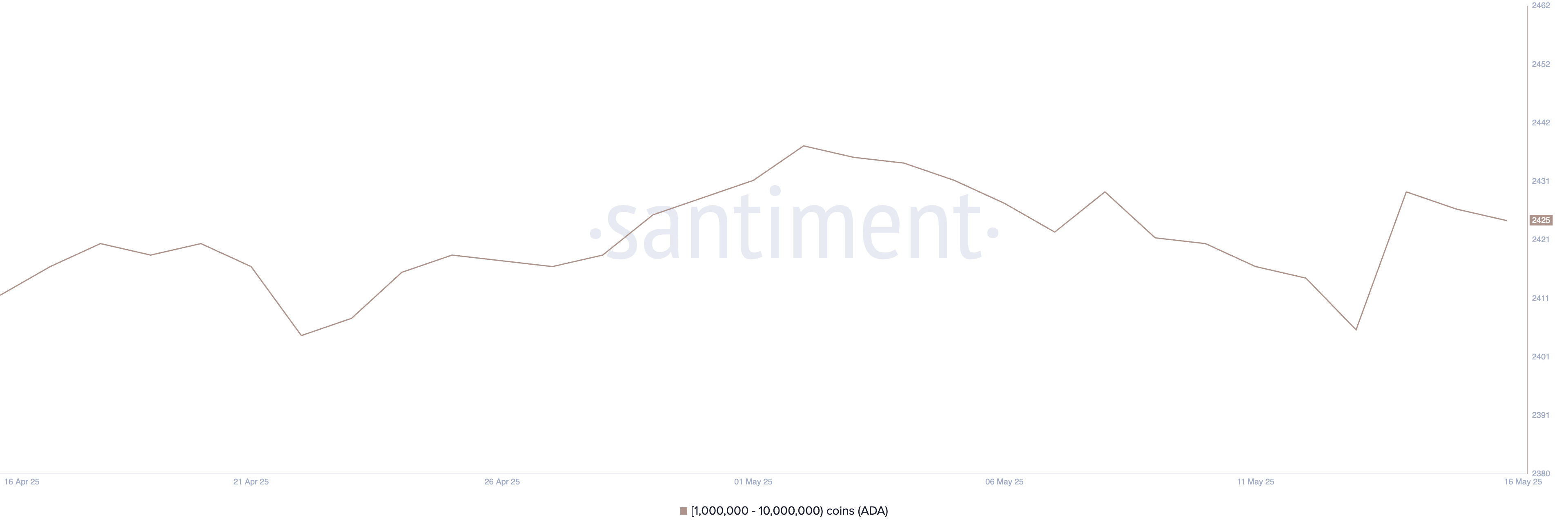

Cardano Whale Activity Cools After Short-Lived Spike

The number of Cardano whale addresses—wallets holding between 1 million and 10 million ADA—has experienced noticeable volatility over the past few days. On May 13, this number dropped to 2,406, marking one of the lowest points in the past month.

A sharp rebound followed on May 14, with whale wallets jumping to 2,430, suggesting brief renewed interest among large holders.

However, this uptick did not hold, as the count declined again over the next two days, now settling at 2,425. The fluctuations highlight a lack of conviction among major players, with neither sustained accumulation nor consistent distribution taking hold.

Monitoring whale activity is important because these large investors can drive major price moves due to the size of their holdings.

A rising whale count generally points to accumulation, signaling long-term confidence and potentially supporting upward price movement. In contrast, a decline or stagnation in whale numbers often suggests hesitation or selling pressure, which can weigh on price momentum.

With the current count still below peak levels and showing instability, Cardano may struggle to build strong bullish momentum in the short term unless accumulation resumes more decisively.

Cardano at Risk of Death Cross as Bears Eye Key Support Levels

Cardano’s EMA structure is showing early signs of weakness, with short-term moving averages beginning to dip toward the longer-term ones—a setup that could soon trigger a death cross.

This bearish crossover often signals the start of a deeper downtrend. If it confirms, Cardano price may test the support level at $0.729.

A break below that could open the door to further losses toward $0.68, and in a more aggressive sell-off, prices could fall as low as $0.642.

However, if the current momentum shifts and bulls regain control, ADA has a chance to reverse course.

The first key target is breaking above the $0.781 resistance. If that level is cleared, Cardano could rally toward $0.841 and, in a stronger bullish move, reach $0.86.

The post Cardano Whales Slide as ADA Price Faces Potential Death Cross appeared first on BeInCrypto.