In an interesting development, China has now injected RMB 161.2 billion ($22.4 billion) into its economy in a move that could have global financial ripple effects. This event comes amidst an ongoing extensive correction in the crypto market that has sparked speculations on the viability of the current bull market run.

Crypto Market Set For Rebound As China Restarts Money Supply Growth

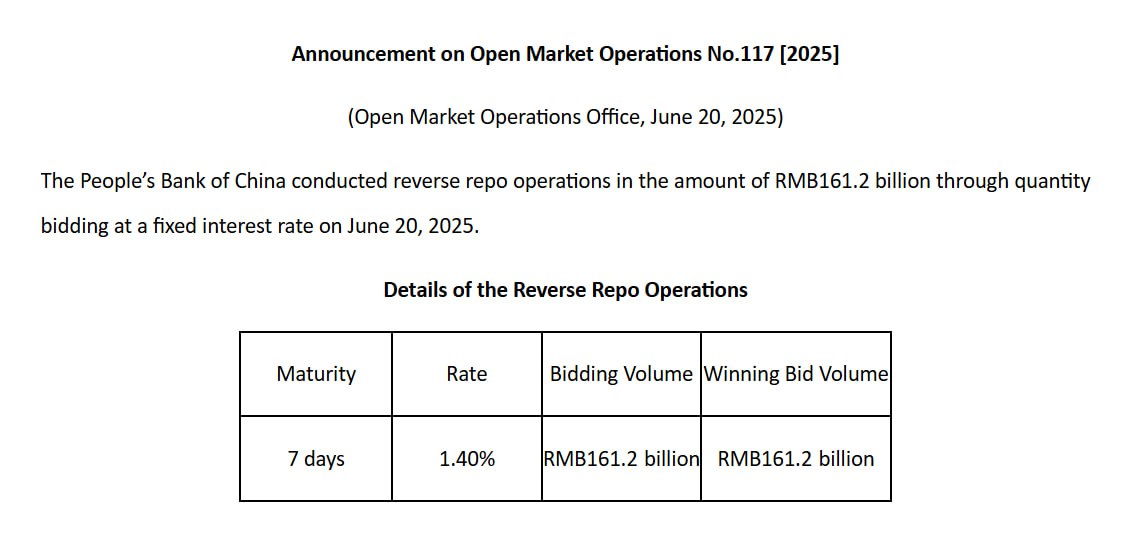

In an Open Market Operations announcement on June 20, the People’s Bank of China (PBOC) stated intentions to inject RMB 161.2 billion into the economy through a seven-day reverse repo operations at a 1.40% interest rate. For context, reverse repos are short-term liquidity tools in which the central bank purchases securities from commercial banks with an agreement to sell them back at a later date, thereby temporarily boosting liquidity in the banking system.

Interestingly, this latest injection is part of a broader monetary easing trend observed in China’s recent policy stance. Notably, on May 7, the PBOC implemented a 0.5 percentage point reduction in the reserve requirement ratio (RRR), a move that freed up approximately RMB 1 trillion ($138 billion) in long-term liquidity, effectively coinciding with a Bitcoin price surge above $97,000 on that day and new all-time high a few weeks after.

However, unlike the RRR cut which had more enduring liquidity implications, the latest RMB 161.2 billion injection via reverse repo is designed for short-term liquidity management. Nevertheless, popular crypto analyst and key opinion leader Ted Pillows explains it is a strong indicator that China’s M2 money supply is now trending upward again after peaking in Q1 2025.

Generally, an increase in M2 signals expanding liquidity, often viewed as a long-term bullish indicator for both traditional and digital asset markets. Considering the ongoing crypto market correction, China’s latest monetary intervention is a positive signal reinforcing the potential of bullish resurgence in the coming weeks.

US Fed To Follow Suit?

Following the recent announcement by the PBOC, speculation is mounting over whether the US Federal Reserve might adopt similar liquidity-boosting measures. However, according to a report by Scotsman Guide, analysts at Wells Fargo predict that the Fed is likely to maintain its quantitative tightening stance throughout 2025.

At press time, the total crypto market cap is worth $3.14 trillion following a 1.48% decrease in the past day. Daily trading volume has also dropped to $94.96 billion. Meanwhile, Bitcoin, the market leader, is currently valued at $102,784 reflecting losses of 0.74% and 3.39% on the daily and weekly chart respectively.

Featured image from Adobe Stock, chart from Tradingview

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.