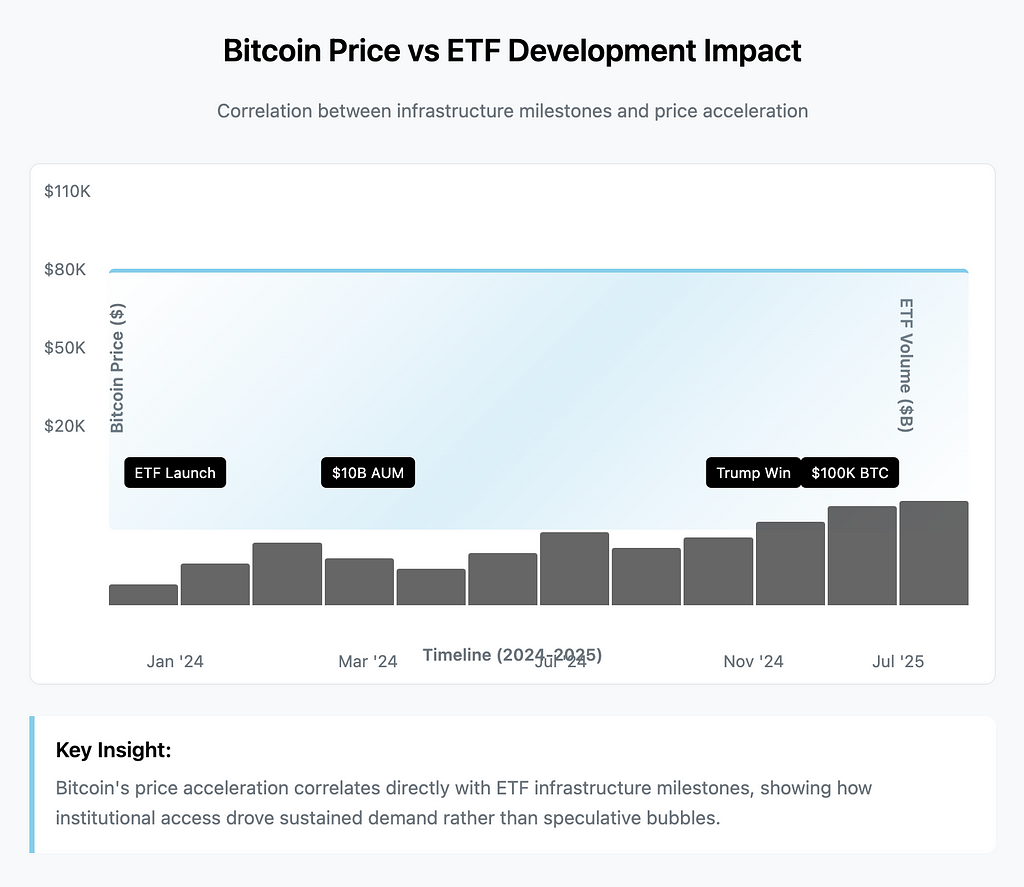

When Bitcoin smashed through $100,000 in December 2024, it wasn’t just another price milestone; it was the culmination of something much bigger. The January 2024 SEC approval of spot Bitcoin ETFs had fundamentally rewired how institutional money flows into crypto, and we were watching the payoff in real time.

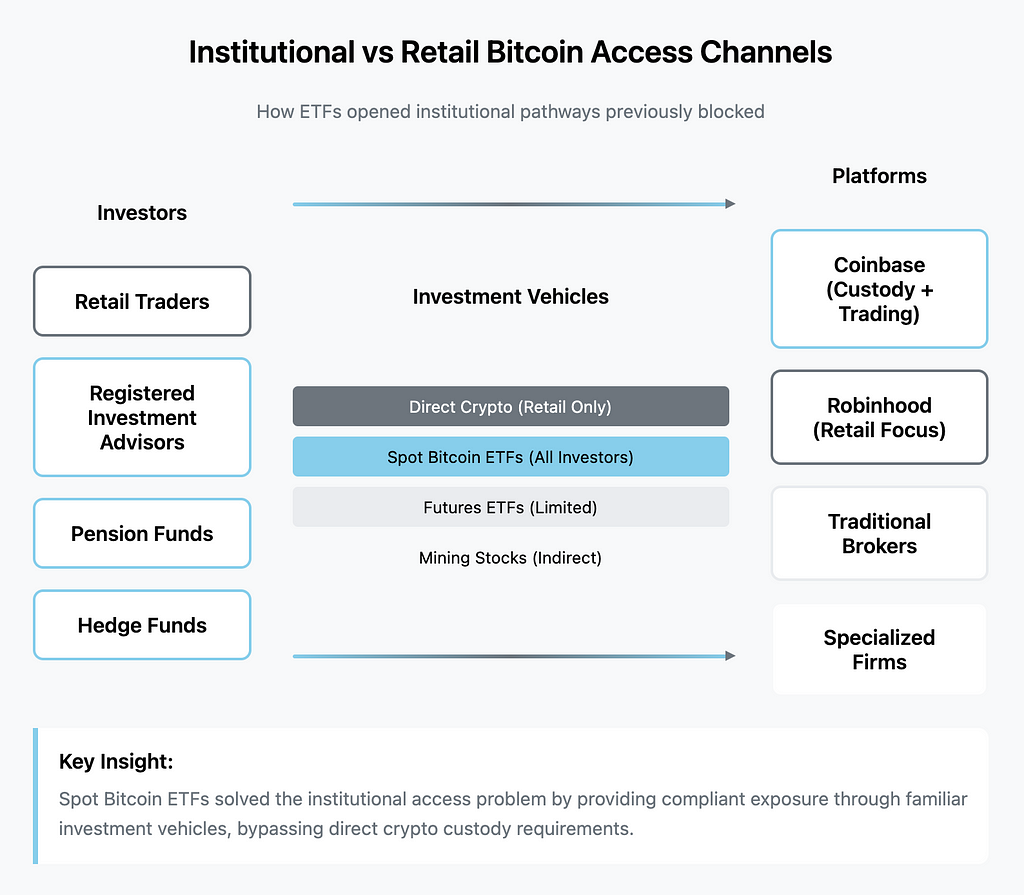

Here’s what struck me about this moment: after years of regulatory resistance, the approval didn’t just legitimize Bitcoin; it created an entirely new infrastructure layer that traditional finance could finally plug into. The result? Bitcoin went from digital curiosity to portfolio necessity faster than anyone anticipated.

The infrastructure shift is where things get interesting. These aren’t your typical investment products. Spot Bitcoin ETFs hold actual Bitcoin, not contracts or derivatives. Think of it like a gold ETF that stores physical bullion, except the “vault” is digital and the custodians are crypto-native companies that suddenly found themselves managing institutional billions.

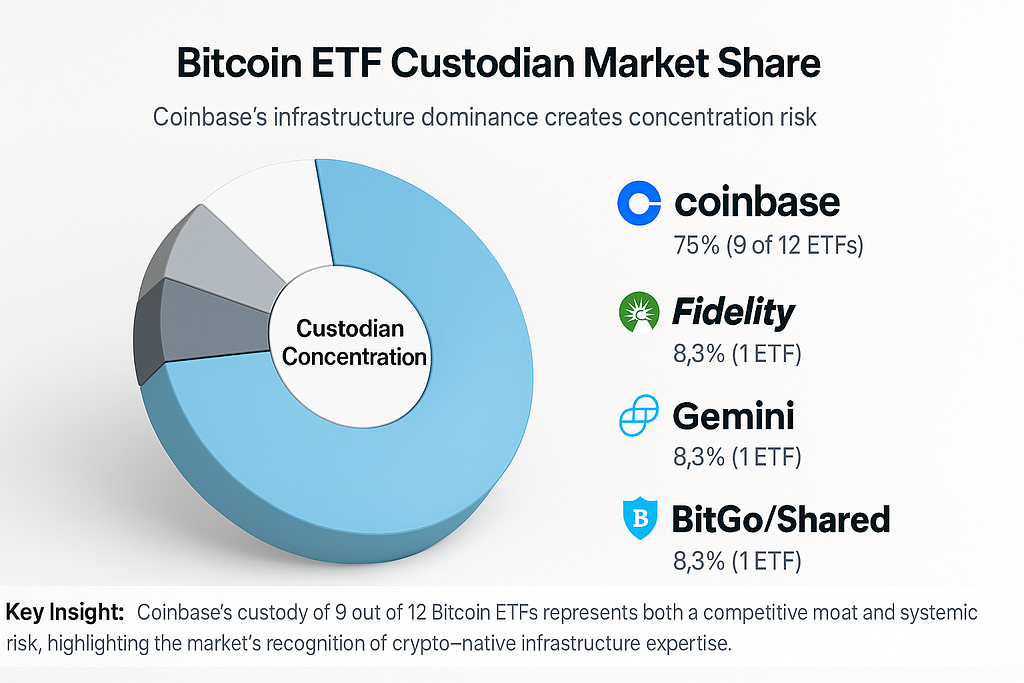

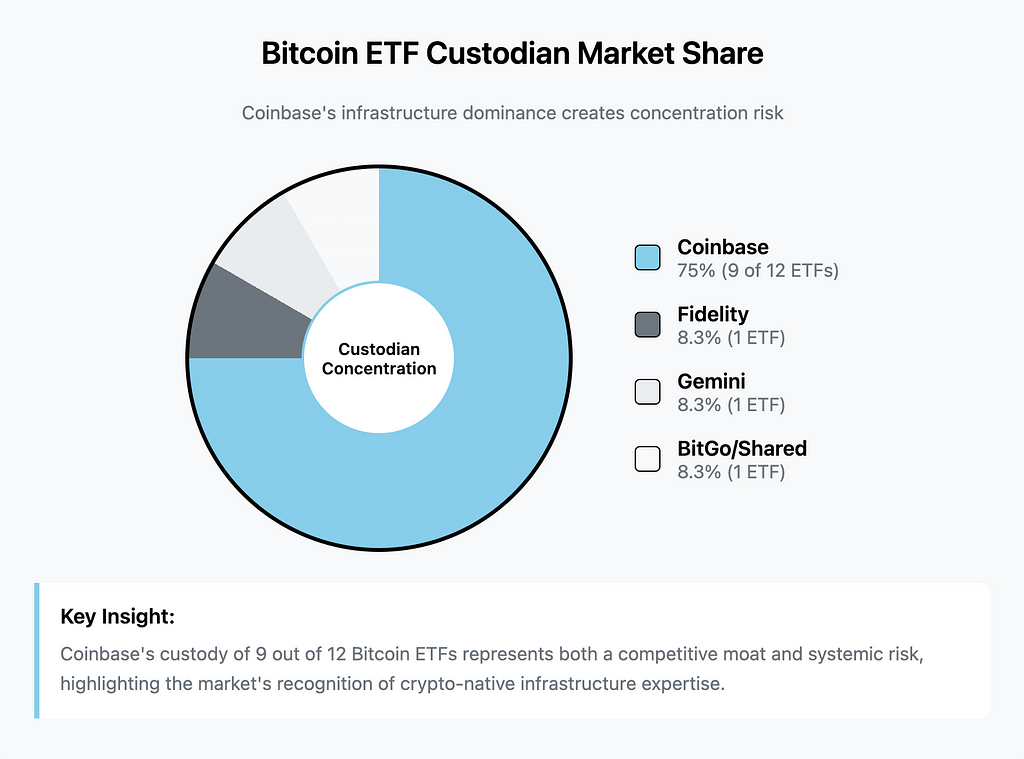

Nine of the twelve currently trading spot Bitcoin ETFs rely on Coinbase for custody.

That’s not an accident; it’s the market recognizing that crypto infrastructure requires crypto expertise. Traditional banks talking about “blockchain solutions” for years suddenly needed companies that actually knew how to secure digital assets at institutional scale.

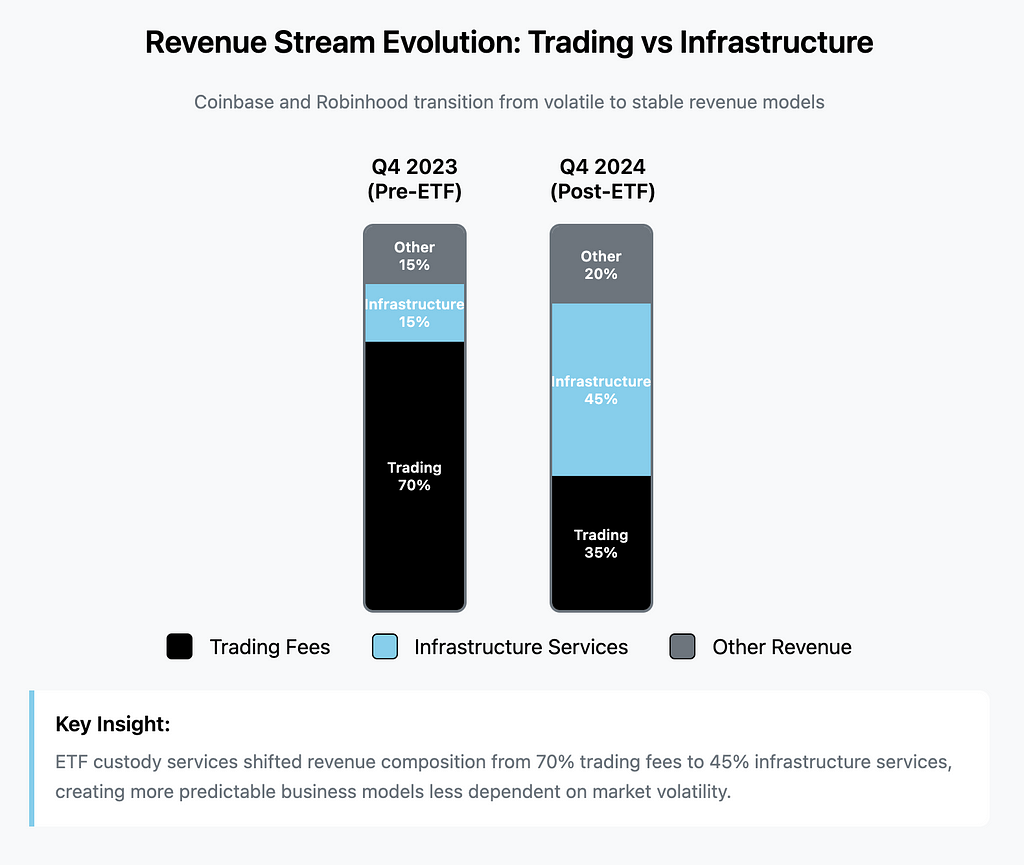

This concentration creates fascinating dynamics. Coinbase transformed from a platform dependent on trading fees (feast during bull markets, famine during crypto winters) into critical financial infrastructure. ETF custody generates predictable revenue regardless of market sentiment. It’s the difference between being a casino and being the bank that handles the casino’s money.

The numbers tell the story. Coinbase posted record results through 2024, positioning itself for what analysts expect will be a massive 2025. The company evolved from riding crypto waves to becoming the infrastructure that institutional waves crash against.

But infrastructure plays attract competition, and Robinhood has been gaining ground with a different approach. While Coinbase focuses on institutional custody and compliance, Robinhood targets the retail investor frustrated with crypto complexity.

Recent moves show this strategy in action: tokenized U.S. stocks across Europe, crypto staking for major cryptocurrencies, perpetual futures trading, and a custom blockchain for real-world asset settlement. Robinhood is building the on-ramp for mainstream adoption while Coinbase manages the vault.

The platform’s commission-free crypto trading and streamlined experience have captured market share, particularly as regulatory clarity reduces friction. Record trading volumes and analyst optimism for 2025 suggest this retail-focused approach complements rather than competes with institutional infrastructure.

Then there’s BTCS Inc., which offers a different lesson entirely. As the first cryptocurrency company on NASDAQ back in 2014, BTCS represents the pure-play approach to crypto business models. The company pioneered “Bividends” (paying shareholders in Bitcoin rather than cash) and operates blockchain analytics while maintaining direct crypto holdings.

BTCS currently holds 90 Bitcoin and has expanded to 12,500 Ethereum through strategic financing. The company demonstrates how crypto-native businesses adapt to institutional validation without abandoning their foundational principles. While giants battle for infrastructure dominance, specialized players carve sustainable niches.

What makes this entire ecosystem shift fascinating is how quickly traditional finance absorbed what was supposed to be disruptive technology.

ETFs provided the compliant wrapper institutional investors needed, turning crypto from alternative asset to portfolio component.

The regulatory environment signals this acceptance is permanent. Political leadership openly supporting crypto as strategic national infrastructure, combined with continued SEC evolution, suggests the framework will expand rather than contract. Ethereum ETFs, multi-crypto funds, and integration with traditional wealth management represent logical progressions.

Institutional behavior confirms this maturation. Recent filings show mixed activity: some asset managers trimming Bitcoin ETF positions during Q1 2025 volatility while others made first-time allocations. This isn’t speculation; it’s portfolio management. Institutions treat crypto like any other asset class requiring risk assessment and allocation decisions.

The infrastructure supporting this transformation continues solidifying. Custody solutions evolved from exchange wallets to institutional-grade security. Trading infrastructure handles billions in daily volume without the technical failures that plagued early crypto markets. Regulatory frameworks provide clarity for compliance officers nervous about digital assets.

Market structure reflects this evolution. Price discovery happens across regulated exchanges with institutional participation rather than fragmented crypto-only platforms. Liquidity comes from diverse sources including algorithmic trading, institutional arbitrage, and retail participation through familiar brokerages.

But here’s what I find most compelling: we’re witnessing the creation of parallel financial infrastructure rather than replacement of existing systems. Crypto didn’t disrupt traditional finance; it forced traditional finance to build crypto-compatible systems.

Coinbase became the bridge between Bitcoin networks and institutional custody requirements. Robinhood built crypto trading that feels like stock trading. ETF providers wrapped crypto exposure in familiar investment vehicles. Each player solved specific friction points rather than demanding wholesale adoption of new paradigms.

This infrastructure approach explains why Bitcoin ETF approval catalyzed such dramatic price movements.

Institutional money wasn’t waiting for crypto to mature; it was waiting for compliant access methods. Once those existed, allocation decisions followed standard portfolio logic rather than speculation.

The winners in this transformation aren’t necessarily the platforms with the most users or the highest trading volumes. They’re the companies providing reliable infrastructure for an asset class that institutional investors can no longer ignore.

Success metrics have shifted accordingly. Revenue stability matters more than growth rates. Regulatory compliance generates competitive advantages. Technical reliability determines institutional trust. These factors favor established players with resources to build proper infrastructure over startups promising disruption.

Looking forward, the infrastructure is set. Regulatory frameworks continue evolving supportively. Institutional adoption follows predictable patterns based on risk tolerance and allocation models. The speculation phase is ending; the infrastructure utilization phase is beginning.

The revolution isn’t in Bitcoin’s price reaching six figures. It’s in the infrastructure making crypto a standard component of diversified portfolios. The companies that built this infrastructure (and continue maintaining it) control the future of institutional crypto adoption.

That’s where the real value gets created and captured.

Coinbase, Robinhood, and the Race to Put Stocks on the Blockchain was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.