Hong Kong regulators intend to broaden the scope of crypto trading activities subject to stringent licensing requirements and rigorous testing procedures.

The proposed legislation aims to restrict the range of assets available to customers on over-the-counter (OTC) trading platforms, thereby increasing regulatory oversight within the crypto industry.

Hong Kong Regulators Plan To Capture OTC Crypto Trading Platforms

In a recent public consultation initiated by the Hong Kong Financial Services and the Treasury Bureau, the public is being asked whether they agree that crypto regulations should be expanded to encompass OTC trading of crypto assets.

OTC trading offers a wider range of assets but also entails greater risks. However, if the proposed legislation is enforced, it will be subject to the same regulatory requirements as traditional crypto exchanges.

Read more: Crypto OTC: How OTC Cryptocurrency Trading Works

Consequently, this will result in fewer products being permitted for sale to customers.

“Under the proposed regime, any person who conducts a business in providing services of spot trade of any VA5 in Hong Kong is required to be licensed by the Commissioner of Customs and Excise (“CCE”), subject to a fit-and-proper test and other factors deemed relevant by CCE.”

The primary motivation behind initiating this public debate is the apprehension regarding anti-money laundering measures. OTC trading, is not currently subject to the rigorous requirements imposed on regular crypto exchanges.

Hong Kong Securities Regulator Recent Crackdown

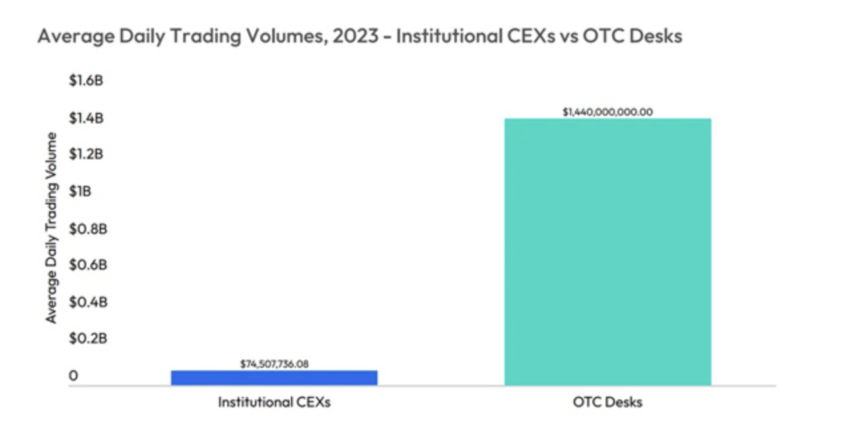

Data from Mondo Visione reveals that OTC desks boast a notably higher average daily trading volume compared to institutional centralized crypto exchanges.

In 2023, OTC desks recorded an average of $1.44 billion in daily trading volume. However, institutional CEXs averaged around $74.5 million.

However, it presents a heightened risk of facilitating illicit activities such as money laundering.

Meanwhile, this comes after the Hong Kong Securities and Futures Commission (SFC) cracked down on crypto exchanges operating within the region without a license.

The deadline has been set for the end of this month, 29th February. This is the latest that crypto exchanges can continue operating without an adequate license.

Read more: 11 Best Altcoin Wallets To Consider In January 2024

Furthermore, the regulator emphasized the importance of investors conducting their own due diligence. It highlighted that investors should verify that the crypto trading platforms they utilize have the appropriate licensing in place.

“Investors should check whether a VATP is on the ‘List of licensed virtual asset trading platforms’ or the ‘List of virtual asset trading platform applicants.’”

![]()

FXGT.com

FXGT.com” target=”_blank”>Explore →

![]()

Bitrue

Bitrue” target=”_blank”>Explore →

![]()

Coinrule

Coinrule” target=”_blank”>Explore →

![]()

BYDFi

BYDFi” target=”_blank”>Explore →

![]()

KuCoin

KuCoin” target=”_blank”>Explore →

![]()

Kraken

Kraken” target=”_blank”>Explore →

The post Could This New Proposed Law Decrease Interest in OTC Crypto Trading? appeared first on BeInCrypto.