In today’s Crypto for Advisors newsletter, Alex Tapscott, explains the flywheel effect, and it’s impact on the crypto markets.

Then, Natalie Hirsch from Polymath answers questions about questions about investing in public crypto companies in Ask an Expert.

Thank you to our sponsor of this week’s newsletter, Grayscale. For financial advisors: register for the upcoming Minneapolis event on September 18th.

The Crypto Flywheel Keeps Spinning!

These days it’s become fashionable to describe how crypto is driving a “flywheel effect” in the market, and that is a reason to be bullish. But what is the flywheel effect, exactly?

The term was popularized by Jim Collins in his 2001 book “From Good to Great.” Collins asked us to imagine someone pushing a giant wheel. With the first push, the wheel budges only slightly, but after hundreds of pushes, it begins to gain momentum — every new push becomes easier and accelerates the wheel further.

Nobody can say for sure which push helped it to achieve that momentum, because it is the product of all the small pushes together. The lesson for business leaders is this: Do the small stuff right consistently and you’ll be rewarded in the long run.

Today, the term has evolved into something else. Rather than describing only the impact of sound operational decision-making, flywheel effects now describe how positive feedback loops impact systems, like marketplaces and whole industries.

Here are some of the ways that dynamic is at play in crypto and public markets:

Because of the demand from investors for access to crypto assets, digital asset treasury companies (aka DATs) like MicroStrategy can issue shares at a premium to their underlying net asset value, buy bitcoin and other assets, and grow NAV per share. This can drive the underlying asset higher and induce more people to buy shares of their company.

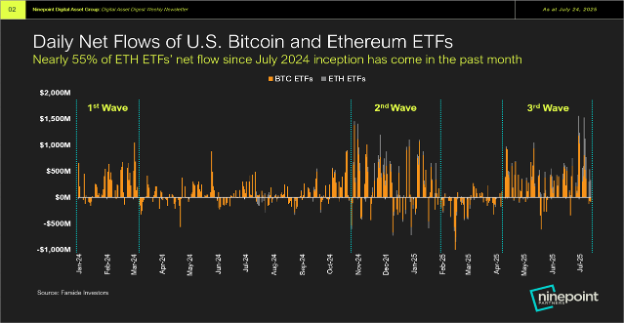

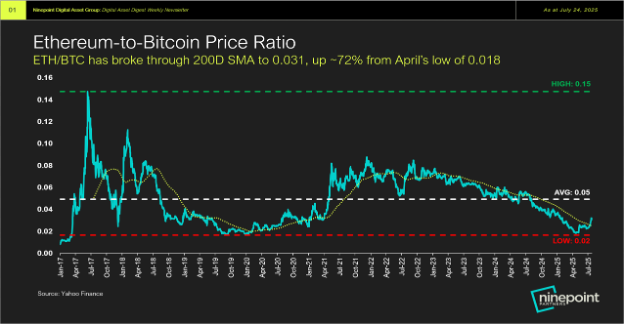

Flywheel effects are also seen in ETF markets. The launch of ether-focused digital asset treasury companies helped accelerate flows into ETFs too. Ether ETFs have seen inflows of more than $6 billion since launching. ETH gained as much as 50 percent in July and closed the month at around $3,800, and the Ether-to-bitcoin price ratio broke above its 200-day moving average.

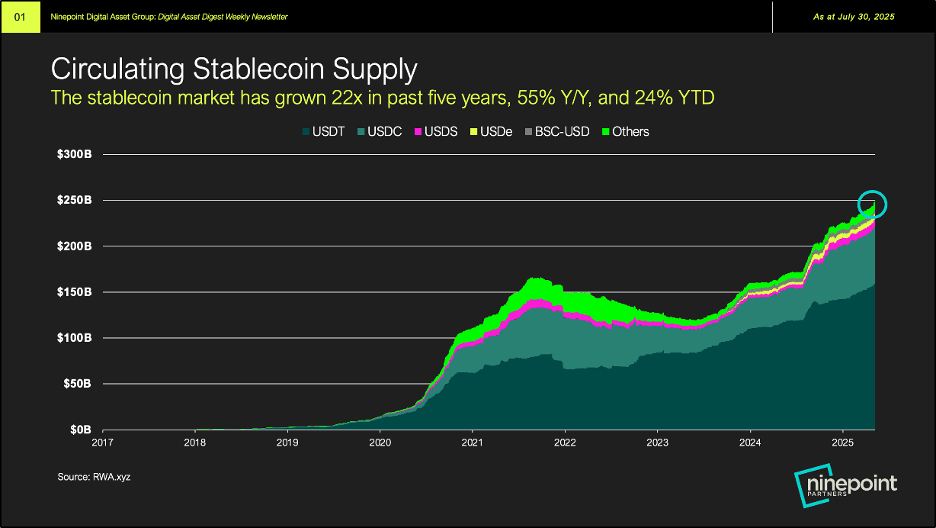

Stablecoin issuers produce flywheel effects too. For example, Tether, issuer of the USDT coin, reinvests its enormous profits ($4.9 billion last quarter) in bitcoin, pushing the price higher, increasing aggregate interest in bitcoin and creating demand for stablecoins like USDT to buy them.

Another flywheel effect can be seen in the IPO market. Circle’s (CRCL) successful IPO was followed with several companies filing to go public, such as Grayscale, BitGo, Bullish and Gemini. A wave of successful IPOs grows the total investable universe of companies, broadening its appeal and accelerating its inclusion in traditional portfolios and indexes.

A flywheel is, by its nature, something that creates a positive feedback loop. What happens when things reverse?

Let’s start with those digital asset treasury companies. Some have taken on leverage. If their shares fall or the underlying asset declines, they will need to sell assets to meet these liabilities. That will put downward pressure on their stock and the underlying asset, like bitcoin.

Right now, IPOs are acting as a tailwind, but if the cycle lasts long enough, all sorts of businesses will try to tap the markets. If they fail to meet expectations, investors may write off the whole sector for a time, as they did during the dot-com crash. That will have a chilling effect on everything.

Currently, ETH treasury companies are buying ETH, driving the price higher. However, as the price rises, ETH holders are queuing up to sell their staked ETH. The higher the price goes, the more that may come free-trading. That’s putting the brake on the flywheel.

In the end, the good times can’t last forever. Markets are cyclical, and this one will come to an end. But right now, the (fly)wheels are in motion, and everyone from regulators to public companies to crypto founders and institutional investors are nudging that wheel. It will take a lot to stop their momentum.

– Alex Tapscott, managing director, Ninepoint Capital Digital Asset Group

Ask an Expert

Q. Is it a good time to invest in crypto IPOs?

A. The short answer is yes. While the success of Circle, which exceeded expectations with precedent-setting gains, stood out, overall market sentiment remains highly favourable.

The launch of spot BTC and ETH ETFs in the US has brought a significant capital influx. Regulatory clarity in major markets like the U.S. and Europe has boosted investor confidence in asset issuers who now follow established listing procedures and operate with legitimised governance frameworks.

Add to this the ongoing bull run, and investors are seeing a robust opportunity for long-term value creation.

Q. What type of crypto IPOs should investors focus on?

A. More than token prices, investors should focus on the project’s fundamentals and core propositions. Projects with robust, foolproof, clearly drafted business models, realistic plans, and defined revenue streams will perform better. These may include stablecoins, custody services, and staking platforms at the primary level.

On a secondary level, fintech, infrastructure, and analytics-related projects are also expected to yield well. The founder and leadership team play a crucial role, which implies better fund management and ongoing innovation.

With adoption surging, advisory services can help investors identify the best-positioned projects in a growing field.

Q. What are the prospects of crypto IPOs?

A. The crypto market has matured, and institutional adoption is rising. In the near future, crypto-asset issuers are expected to become more structured and efficient in accessing traditional capital markets. If the positive trend continues, investor confidence in high-risk-high-return opportunities will also grow.

Issuers are now more confident in going public. However, investors should approach with prudence. Crypto IPOs are best treated as high-risk components within a well-diversified portfolio.

Retail investors must stay alert to macro events that may affect market sentiment. Asset and fund managers should compare the performance of crypto stocks with traditional tech stocks while monitoring liquidity and volatility.

– Natalie Hirsch, CFO, Polymath

Keep Reading

- A July recap of the crypto markets by CoinDesk, in partnership with NYSE and TrackInsight.

- CoinDesk breaks down July crypto ETF and ETP flows.

- The SEC permits in-kind creation and redemptions for crypto ETFs.

- President Trump prepares to sign an order that blocks banks from denying banking services to companies involved in bitcoin and crypto.

- JP Morgan has partnered with Coinbase to let users fund wallets and purchase crypto directly this fall.