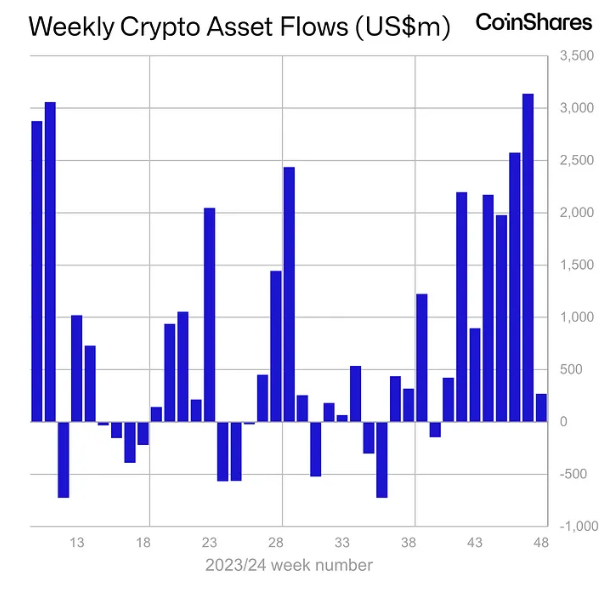

Crypto investment inflows experienced a sharp contrast last week, dropping to $270 million, signaling a slowdown after consecutive weeks of strong activity.

Year-to-date inflows have reached a record $37.3 billion, reflecting the continued growth of institutional interest in cryptocurrencies despite market volatility.

Crypto Inflows Drop Amid Profit Booking

Bitcoin faced significant outflows of $457 million last week, marking the first notable retreat since early September. It comes after a series of positive flows into digital asset investment products as BTC reached new highs. Specifically, crypto inflows reached $3.12 billion the prior week.

The impact of macroeconomic trends also played a role. Two weeks ago, inflows hit $2.2 billion as optimism surrounding a Republican sweep in US elections and a softer stance from the Federal Reserve buoyed investor sentiment.

However, momentum appears to be fading. Following the initial post-election rally, inflows have moderated. Last week’s figures also reflect a significant pullback compared to the $1.98 billion seen immediately after the elections. CoinShares’ James Butterfill attributes the selloff to profit-taking after Bitcoin approached the $100,000 psychological level.

“We believe is profit taking following bitcoin testing the very psychological level of $100,000,” Butterfill wrote.

Meanwhile, experts have divided Bitcoin’s outlook. Pessimistic analysts, including prominent figures like former Wall Street quant Tone Vays, forecast further downside.

Vays disclosed his decision to exit all long positions at $97,800, reflecting caution among seasoned traders. The analyst expressed skepticism about Bitcoin sustaining its $100,000 breakthrough this year.

“Still think sustaining a $100,000 break this year is unlikely. Will be more than happy to be wrong OR Buy the Dip sub for $90,000! Might even consider a short,” he expressed.

Conversely, more optimistic views persist. Fundstrat’s Tom Lee remains bullish, projecting Bitcoin to reach $250,000 by the end of 2025. However, Lee’s team acknowledges potential short-term setbacks, with some expecting a dip to $60,000 before resuming its upward trajectory.

Robert Kiyosaki, the author of Rich Dad Poor Dad, echoed this sentiment but highlighted that any dip is a buying opportunity for long-term accumulation.

“Bitcoin is stalled short of $100,000. That means BTC may crash to $60,000. If and when that happens, I will not sell,” Kiyosaki stated.

While Bitcoin faced outflows, Ethereum recorded a massive $634 million in inflows, signaling renewed investor confidence in the asset. Ethereum’s YTD inflows have reached $2.2 billion, supported by a growing shift in sentiment as traders pivot to altcoins amid Bitcoin’s short-term uncertainty.

The crypto exchange-traded products (ETPs) market saw a drop in trading volumes, declining to $22 billion last week from $34 billion the week before.

Even with the introduction of options on US ETFs (exchange-traded funds), their effect on overall market volumes has been limited. This development raises concerns about the level of sustained institutional interest in these financial instruments.

The post Crypto Investment Inflows Decline to $270 Million Amid Bitcoin Profit-Taking appeared first on BeInCrypto.