In brief

- Monero hit a fresh all-time high above $667, surging 54% in the past week as traders rotate into the privacy sector.

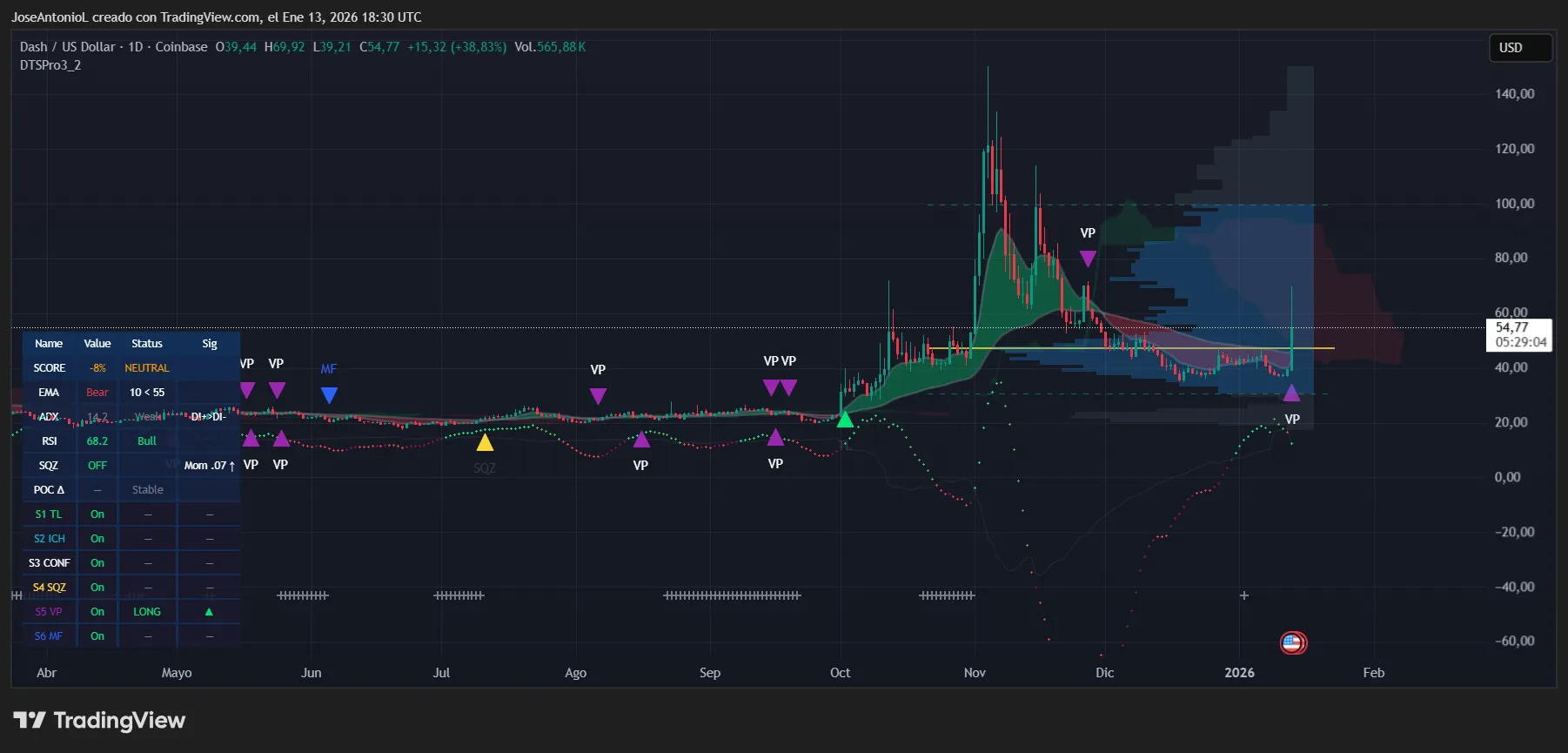

- Dash exploded nearly 39% in a single day—its largest four-hour candle since October 12, 2025—driven by short squeezes and thin liquidity.

- The EU’s DAC8 crypto tax reporting rules, which kicked in January 1, have revived the “privacy as a feature” narrative just as Zcash’s governance crisis sent capital fleeing toward competitors.

Privacy coins haven’t moved like this in years. Monero is up 54% on the week, Dash just posted a 39% single-day gain, and the entire privacy sector is suddenly outperforming every other niche in crypto.

The question now is: Can it last?

The catalyst appears simple on the surface: In late September of last year, traders’ attentions suddenly turned to the privacy coin Zcash, with trades as ZEC. Privacy coins, unlike standard cryptocurrencies like Bitcoin and Ethereum, make it difficult if not impossible to trace individual transactions and the source of funds for accounts.

In October, the entrepreneur and AngelList founder Naval Ravikant tweeted: “Bitcoin is insurance against fiat [currency]. Zcash is insurance against Bitcoin,” suggesting investors should rethink the transparency that digital assets like Bitcoin afford. And the newfound attention on privacy coins only swelled from there, with ZEC nearly breaking an eight-year all-time high price in early November.

More recently, Monero, another privacy alternative, broke into new all-time-high territory just yesterday, eclipsing $667 per coin. Traders who missed the first leg started chasing “the next privacy meta.”

But dig deeper and you’ll find a confluence of factors that go well beyond technicals. The EU’s DAC8 directive, which began requiring crypto service providers to collect user tax data on January 1, 2026, has reignited the narrative that privacy is a feature not a bug.

Dubai added fuel to the fire. The Dubai Financial Services Authority brought into force its updated regulatory framework for crypto tokens in the Dubai International Financial Centre, explicitly banning privacy tokens across trading, promotion, fund activity, and derivatives. The framework also prohibits regulated firms from using mixers, tumblers, and other obfuscation services.

This regulatory crackdown arrives precisely as privacy coins catch a bid. In markets, that kind of tension often amplifies volatility rather than suppressing it. Sometimes it amplifies pessimism, but this time it seems to have helped amplify bullishness—traders read the ban as confirmation that privacy matters enough to regulate.

There’s also the Zcash Factor. After a historic run to end the year, the coin entered 2026 in crisis after the entire development team behind the token, the Electric Coin Company, resigned on January 7, citing “constructive discharge” by the board. CEO Josh Swihart accused board members Zaki Manian, Christina Garman, Alan Fairless, and Michelle Lai of moving into “clear misalignment with the mission of Zcash.”

The team is forming a new company and launching a wallet called cashZ, but the damage is done: ZEC is now heavily bearish on the charts and remains down approximately 50% from its recent high two months ago.

Why does this matter for Dash and Monero? Because capital rotates. Privacy-focused traders who held ZEC as their sector bet are likely moving funds to alternatives. Monero, with its decentralized structure and no central development organization that can implode, is the obvious beneficiary. Dash, trading at much lower absolute prices with similar privacy features, becomes the high-beta play for those who missed XMR’s first leg.

Prediction market sentiment on Zcash, though, remains bullish. On Myriad, a prediction market developed by Decrypt’s parent company Dastan, traders expect a ZEC bounce after the token cratered, placing odds at nearly 53% that Zcash reclaims $550 before dipping to $250.

If sentiment analysis is your thing, this could translate into an interesting buying zone. If technical analysis is your thing, this means you should wait a bit more before placing a bullish position that doesn’t feel like a bet.

Bitcoin is also cooperating. BTC is holding firm above $92,000, and the broader market has shifted into risk-on mode. Privacy coins rarely pump in isolation for long, but when Bitcoin is stable and altcoins are heating up, the conditions favor rotational plays into higher-beta sectors.

Dash: The short squeeze special

Dash is up nearly 39% today, trading at $54.77 after opening near $39.44. The intraday high touched $69.92 before sellers stepped in. This is the largest four-hour move the coin has seen since October 2025, and the mechanics tell the story: shorts got trapped on the breakout, forced buy orders hit thin order books, and the price of Dash gapped higher, triggering more stops in a cascading squeeze.

The Relative Strength Index, or RSI, for Dash sits at 68.2, placing the token in bullish territory but not yet overbought even after the massive jump. RSI measures momentum in markets on a scale from 0 to 100, with scores below 30 suggesting oversold conditions and above 70 signalling overbought.

Traders typically view RSI above 70 as a signal that profit-taking may begin. This is probably one key component of the price correction after the daily high: too close to the overbought zone, heavy volume involved and prices touching a natural resistance.

The Average Directional Index, or ADX, measures trend strength regardless of direction. And for Dash, it reads just 14.2. ADX below 25 typically signals a market lacking conviction; this heavy spike took a lot of the bearish force out, so it makes sense for the ADX to correct before a new trend sets its course.

The exponential moving averages, or EMAs, paint a cautious picture. EMAs help traders identify trends by taking the average price of an asset over the short, medium, and long term. For Dash, the short-term 50-day EMA remains below the longer-term 200-day, which for traders is a bearish configuration that suggests the longer-term structure hasn’t flipped yet despite today’s explosion.

The price of Dash has surged into the visible range resistance zone between $55 and $60, which coincides with prior consolidation from November 2025. This creates a pretty strong barrier that bulls must decisively conquer to confirm the breakout.

What’s driving the fundamentals? Beyond the sector rotation from Zcash, Dash recently partnered with Alchemy Pay, opening fiat access in 173 countries through 300 payment channels. The Evolution platform rollout planned for Q1 2026 is also drawing speculative interest. Likely not a huge deal in the grand scheme, but still important enough to influence a coin with a smaller market capitalization like Dash.

We’re thrilled to be supported by Alchemy Pay!

Thanks for the partnership, this will help us get Dash in the hands of even more people around the world🤝 https://t.co/Ke9MkOady7

— Dash (@Dashpay) January 13, 2026

But make no mistake: Today’s move is primarily a derivatives-driven squeeze on top of a narrative catalyst. If spot demand doesn’t materialize to absorb the move, reversals can be equally violent.

Privacy coins have spent years accumulating structural friction: fewer venues, more compliance pressure, and uneven liquidity. When a real bid arrives, prices can travel faster because the market is less deep than it looks on a chart. Uneven liquidity and reduced exchange access are part of why these moves can be violent.

Key Zones:

- Resistance:

- $60 (immediate/psychological),

- $80 (November 2025 highs)

- Support:

- $40 (breakout level),

- $37 (200-day EMA zone)

Monero (XMR): Price discovery mode

Monero is the engine driving this entire rally at the moment. XMR opened at $631.41, touched an intraday high of $695.98, and currently trades at $667.78—up 5.65% on the day and 54% on the week. The coin has broken into genuine price discovery territory, eclipsing its previous all-time high from May 2021 and erasing years of resistance in a matter of days.

The technicals here are unambiguous: The charts scream bullish. And, at least right now, Monero, which trades as XRM, has not registered a trend correction like Zcash or Dash. The 50-day EMA trades firmly above the 200-day in a bullish configuration, confirming the trend structure.

Also, unlike Dash, Monero’s ADX sits at 28.5, comfortably above the 25 threshold that confirms a trending market. This is a confirmed breakout with momentum behind it.

The RSI tells a different story, though. At 85.4, Monero is deep in overbought territory—the kind of reading that typically precedes at least a short-term pullback or consolidation. RSI above 80 doesn’t mean price must reverse immediately, but it does mean the easy gains have likely been made. Traders who chase here are buying into an extended condition.

The Squeeze Momentum Indicator is off with momentum at 1.76 and rising, a reading that dwarfs Dash’s 0.07. This reflects genuine directional conviction in the XMR move versus the squeeze-driven mechanics dominating Dash. Monero’s rally has more structural support underneath it.

Veteran trader Peter Brandt compared Monero’s chart structure to silver’s decades-long consolidation before its historic breakout, suggesting XMR could be entering a similar phase of delayed but explosive upside.

The $600 psychological level has now flipped from resistance to support. As long as XMR holds above this zone on pullbacks, the bullish structure remains intact. The next targets in price discovery are $700 (psychological) and potentially $800-$880 if momentum sustains.

Key Zones

- Resistance:

- $700 (psychological),

- $800-$880 (extended target)

- Support:

- $600 (psychological/flipped resistance),

- $554 (liquidation cluster)

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.