Dave Weisberger, former chairman and co-founder of CoinRoutes and now president of BetterTrade.digital, delivered a pointed critique of popular XRP price targets while laying out a structurally bullish—yet methodical—thesis for Bitcoin’s long-term value. In a November 10 video, Weisberger argued that Bitcoin’s investment case rests on verifiable scarcity and a distributed network with unmatched uptime, whereas XRP’s path to durable upside must be underwritten by tangible network revenues that accrue to the token.

Weisberger framed investor behavior in first principles: people buy assets because they expect them to rise and because they have a thesis for why they should. For Bitcoin, he said, that thesis is the re-emergence of “sound money” in a digital age. He positioned Bitcoin as a successor to gold, which he argues lost its monetary anchor after 1913 and definitively in 1971.

“The idea of gold, where you have to trust the people who have what they say they have […] there’s a lot of trust baked in the system,” he said. By contrast, “the idea of Bitcoin, which is maintained by a network of node operators that is incredibly large, global and distributed […] it is provably scarce. It is programmatically scarce at the same time.”

Weisberger also emphasized Bitcoin’s open participation model, drawing a line between permissionless validation and the industrial realities of block production. “There’s no barriers to entry […] If you want to run a node, you can,” he said, while noting economies of scale for miners. That, he claimed, differentiates Bitcoin from other crypto assets.

Why $1,000 XRP Price Targets Are ‘Delusional’

Turning to XRP, he asserted that non-Bitcoin tokens must answer an equity-like question: how does the network generate revenue, and how does value flow back to token holders? “Your path to value has to be the same as with an equity,” he said. The mechanism could be direct profit sharing, fee-driven burns, or required token usage, but “there has to be a reason.”

He warned that in systems offering commoditized, switchable utility, large financial institutions can migrate if costs rise, naturally capping fee levels and, by extension, token value. That switching dynamic, he suggested, limits the ceiling for XRP even under generous adoption scenarios.

Weisberger was explicit that he is not anti-XRP. He disclosed he holds a position, calling the asset “potentially a good investment” with scope to “appreciate a couple of times from here.” But he rejected extreme price claims as mathematically incoherent.

“What gets me completely crazy are these idiots who talk about this in terms of $10,000 prices or $1,000 prices,” he said, contrasting XRP’s supply with Bitcoin’s. “There are quite literally 5,000 times more XRP tokens than Bitcoin […] if you think it flips Bitcoin, you’re saying $21.” On four-figure targets: “$1,000 are […] on its face absurd and clearly innumerate or can’t do math.”

He also reiterated a separation he says Ripple itself drew in the early years: “Ripple and XRP are not the same thing. One is a token. One represents an operational business.” While praising Ripple’s push into prime brokerage—“a brilliant move,” in his words—he framed the strategic aim as balance-sheet strength and financing income, not necessarily perpetual token price appreciation.

“They need the XRP on their balance sheet to be robust because that’s what gives them their advantage,” he said, describing prime brokerage as a leverage-provision business augmented by software. He claimed Ripple has assembled components—“They bought Hidden Road. They bought Custodians. They bought other components.”—to build “what could be a very interesting business,” drawing an analogy to profit centers at Goldman Sachs and Morgan Stanley.

For XRP’s market price, however, he argued operational priorities are pragmatic: “XRP, the ledger, they need it to not go down. They don’t need it to go up, although they would like it to go up.”

My take on XRP vis a vis Bitcoin… Rather than focus on one clip, this goes through the logic. pic.twitter.com/xK27a3djs9

— Dave W (@daveweisberger1) November 10, 2025

Price spikes, he added, can even be counterproductive for network economics. “If the price of XRP goes up too much, they’re, just like everybody else, going to be forced a little bit to switch […] they’re not going to subsidize it for very long.” In his view, the sustainable equilibrium is one where the ledger operates cost-effectively and any token appreciation is justified by usage-driven cash flows, not hype.

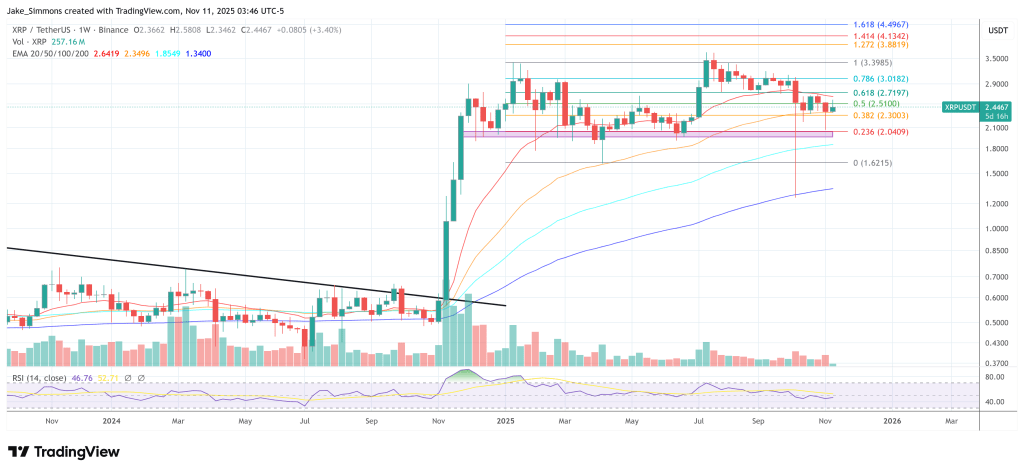

At press time, XRP traded at $2.44.