Join Our Telegram channel to stay up to date on breaking news coverage

White House AI and crypto czar David Sacks slammed a New York Times report about his alleged conflicts of interest, calling it a ”nothing burger.”

Sacks said on X that even though he debunked claims made by the paper in correspondence over the past five months, it just threw up its hands ”and published this nothing burger.”

“Anyone who reads the story carefully can see that they strung together a bunch of anecdotes that don’t support the headline,” Sacks said. “At no point in their constant goalpost-shifting was NYT willing to update the premise of their story to accept that I have no conflicts of interest to uncover.”

Sacks said he hired the law firm Clare Locke, which specializes in defamation law, and shared a screenshot of a letter that the firm sent to the paper that says it “willfully mischaracterized or ignored the facts to support their bogus narrative.”

The NYT lines up the usual passel of tech journos, runs the 2018 hit piece playbook, and only manages to make @DavidSacks look like the perfect man for the job.

Finally, someone running AI and crypto…who actually knows about the business of AI and crypto. pic.twitter.com/8egbBfb3dG

— Antonio García Martínez (agm.eth) (@antoniogm) December 1, 2025

The New York Times alleged in its story that crypto-related investments retained by Sacks, including stakes held through his venture firm Craft Ventures, could benefit from his White House role and thus represent a conflict of interest.

NYT Says Sacks Retains Crypto Investments

Before becoming crypto czar, Sacks and Craft Ventures divested more than $200 million in crypto and stocks tied to crypto, with at least $85 million of that owned by Sacks himself, the paper said.

Based on financial disclosures, Sacks has retained 708 tech investments, 449 of these related to AI companies and 20 tied to crypto, the NYT report added. All of these investments could benefit from Sacks’ ability to influence policy at the White House, the paper said.

One of the investments was made by Craft Ventures into the crypto infrastructure company BitGo, which offers a stablecoin-as-a-service. The story said that Craft owned 7.8% of the company, which went public in September.

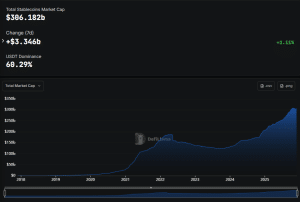

The story noted that Sacks threw his support behind the GENIUS Act, the first regulatory framework on the federal level for stablecoins, which led to a boom in the stablecoin market that resulted in the sector’s total market capitalization soaring toward $400 billion for the first time.

Stablecoin market cap (Source: DefiLlama)

AI Investments Also Present A Conflict Of Interest For Sacks, NYT Says

The paper noted that Sacks and Craft have ties to companies in the AI space as well, and that their valuations skyrocketed as the White House and Wall Street bet on the technology’s potential.

The NYT said Sacks’ ethics waivers made in March stated that he would close his investments in AI and crypto. It added that these waivers did not disclose when Sacks sold assets or the value of investments he still held.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage