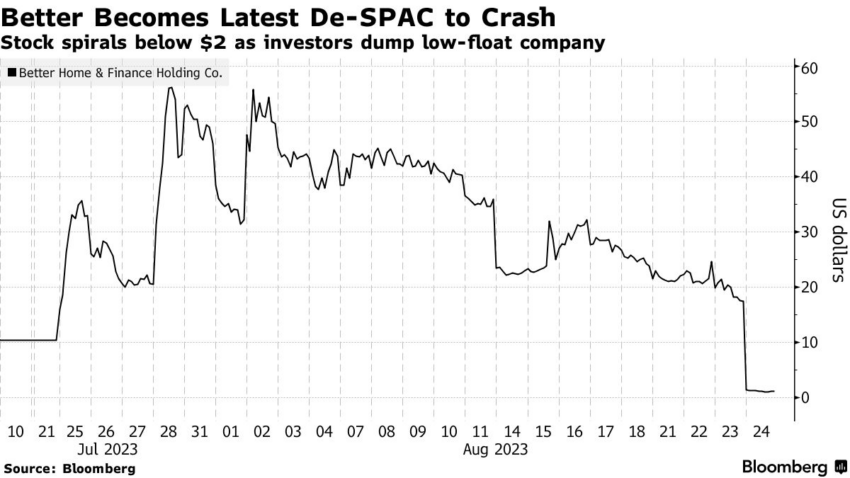

Trading the market has always been a roller-coaster ride, with stocks and crypto making or breaking investors’ fortunes daily. However, the recent Nasdaq debut of Better Home & Finance Holding (BETR.O), the online mortgage lender, sent shockwaves throughout the industry, overshadowing even the most volatile altcoin.

On its opening day, the company’s shares took a harrowing nosedive of more than 93%, making even altcoins seem like a safer bet.

Better Home and Financing Gets a Bitter Nasdaq Stock Launch

Backed by the giant SoftBank, Better’s journey to the public domain was facilitated through a merger with the special purpose acquisition company (SPAC) Aurora Acquisition Corp. The intricacies of the SPAC mechanism allow shell companies to go public with the goal of acquiring and taking a private company public.

Yet, a staggering 95% of Aurora’s shareholders opted to redeem their shares before the merger, exacerbating the stock’s vulnerability to volatility.

“What is the largest drop on the day a company goes public? I don’t remember anything bigger than this one from Better.com,” said Sheel Mohnot, VC at Better Tomorrow Ventures.

The dramatic plunge isn’t the first controversy that Better has faced. December 2021 saw the company in the limelight for the wrong reasons, as CEO Vishal Garg laid off 900 employees over a Zoom call.

This incident heavily tarnished the company’s image and underscored the unpredictable nature of the fintech world, especially amid the mounting pressure of high mortgage rates dampening the demand for home loans.

A Fall From Grace

Once a darling in the fintech sector during the early days of the COVID-19 pandemic, Better reaped benefits from the plummeting mortgage rates, recording revenues exceeding $850 million in 2020. However, as the US mortgage rates soared to their highest since December 2000, the company reported a net loss of $89.9 million in the first quarter.

The SPAC ecosystem is also evolving. In 2021, as interest rates hovered at all-time lows, the SPAC market flourished. However, it soon found itself under the scrutiny of the US Securities and Exchange Commission. Concerns grew over investors potentially getting the short end of the stick. With the US Federal Reserve’s interest rate hikes and an SEC clampdown, the SPAC market has cooled. This has, in turn, led to increased redemption rates.

But there’s a silver lining for Better, post this tumultuous debut. The merger with Aurora means an influx of $550 million from SoftBank.

As per CEO Vishal Garg, these funds will be channeled towards expanding the company’s mortgage product offerings. Despite the current setbacks, Better’s visionaries see a brighter future. It’s anticipating a surge in refinancing demands when interest rates are projected to drop.

Rex Salisbury, Founder & GP of Cambrian Ventures, said,

“Better.com is down 93% today, but I’m still bullish on pre-seed / seed stage for mortgage tech. The market is huge, there’s more talent in the industry than ever, the tooling (yes AI/LLMs, but also other infra) is better than ever…and no one has yet cracked the nut.”

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.

The post Did You Think Altcoins Were Risky? This Nasdaq Stock Dropped 93% on Day 1 appeared first on BeInCrypto.