Digital Asset stocks split this week as spot prices stayed flat, with sharper signals emerging from public companies holding digital assets.

Research firm 10x Research said the sector is dividing between constrained incumbents and new winners. Premiums that once fueled growth have compressed, raising stress risks as liquidity shifts.

Treasuries Down, Businesses Rebound

Bitcoin’s flat performance contrasts with widening splits, which 10x Research warned could precede a more dramatic rotation.

“What appears as consolidation may, in fact, be the calm before a sharp rotation.”

MicroStrategy, once the most aggressive buyer of bitcoin, now faces limits. Its net asset value (NAV) multiple fell from 1.75x in June to 1.24x in September, curbing new purchases. The stock slid to $326 from $400, showing how the treasury model weakens without premium support.

The skepticism is echoed outside research desks.

“My best financial advice continues to be that you should just buy bitcoin if you want exposure to it and that you should stay as far away from $MSTR as possible — because it’s complicated, layered and you lose control.”

The comment, from investor and podcaster Jason, underscored concerns that treasury stocks can add complexity rather than direct exposure.

Metaplanet, often called “Japan’s MicroStrategy,” plunged 66% amid tax policy worries this summer. Despite trading near 1.5x NAV, volatility remains high, with retail flows keeping it unstable.

Circle, by contrast, rebounded 19.6% since September 9 after USDC adoption expanded through a Finastra partnership. 10x Research reaffirmed a bullish stance, calling Circle more attractive than Coinbase as a liquidity beneficiary.

Options Reset, Pressuring Treasury Firms

Alongside these equity shifts, the derivatives market signaled calm. 10x reported that BTC implied volatility fell 6% and ETH 12% on September 12 expiries after softer producer prices and in-line CPI. Traders sold volatility aggressively, treating conditions as stable. Yet 10x warned that compressed premiums and low option pricing could set the stage for a sharper squeeze if flows reverse.

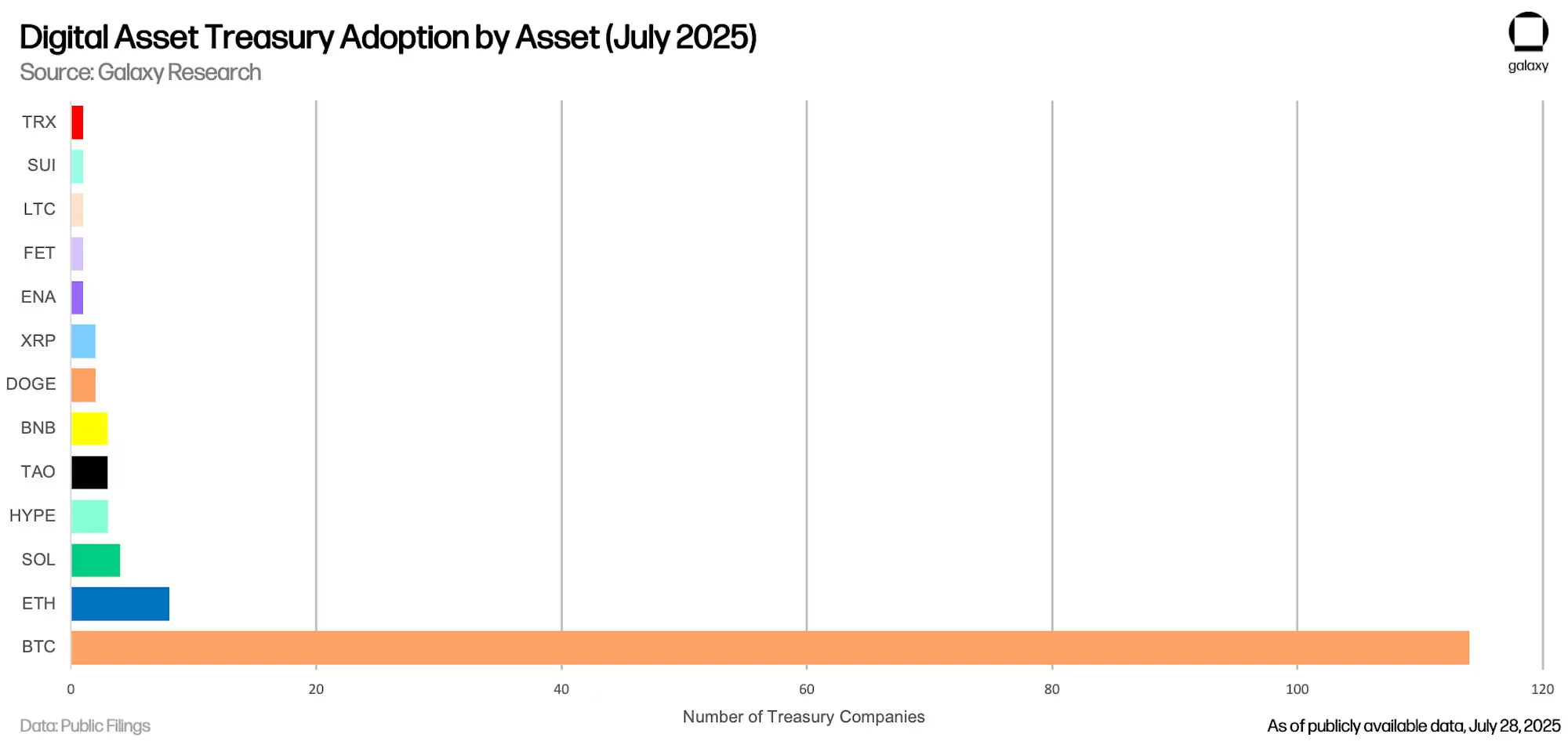

Galaxy Research estimated that digital asset treasury companies (DATCOs) now hold over $100 billion in crypto, led by Strategy (formerly MicroStrategy), Metaplanet, and others. The model thrives on equity premiums, but collapsing valuations threaten capital access. Galaxy cautioned that At-the-Market offerings and PIPEs fuel growth in bull cycles but can backfire in downturns.

The Monthly Outlook from Coinbase Institutional described the sector as entering a “PvP stage” where success depends on execution, not imitation. It argued that the easy-premium era is over, though DAT flows still support Bitcoin into late 2025.

BeInCrypto reported that treasury firms’ buying has slowed, and several ETH-focused companies now trade below mNAV, limiting fundraising and raising risks of forced sales. It also noted that smaller players relying on debt face heightened vulnerability, with liquidation cascades a looming threat.

The outcome for bitcoin may hinge on whether Circle’s rebound builds confidence or whether NAV compression across incumbents sparks stress. For now, options suggest calm, but the divergence among treasury stocks shows a cycle under strain.

The post Digital Asset Stocks Diverge: Circle Rises and MicroStrategy Stalls appeared first on BeInCrypto.