Dogecoin has spent the past several weeks struggling to reclaim momentum after falling below $0.16. The pullback is due to a larger selling pressure built across the broader crypto market, leaving Dogecoin in a continued downtrend.

Despite this weakness on lower timeframes, a much larger pattern is forming on the yearly chart, one that suggests Dogecoin is approaching the end of a powerful consolidation phase. A recent technical analysis points out that the meme coin has printed four inside-year candles in a row, and this is pointing to compression ahead of a major breakout.

Four Inside-Year Candles: Evidence Of Tight Compression

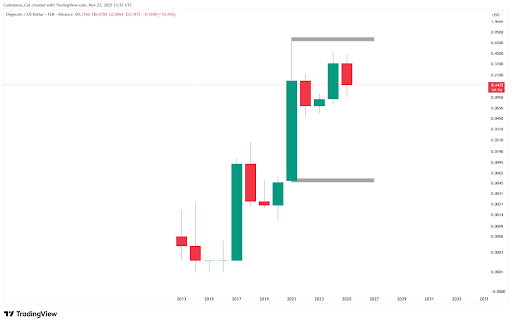

The yearly chart shared in the analysis shows DOGE trading within a tight band ever since the explosive breakout rally in 2021. Each of the last four yearly candles has played out inside the range of the massive green candle formed during the last cycle, creating a pattern known as inside-year consolidation.

This structure generally reflects a market that is neither breaking to new highs nor collapsing into new lows, instead coiling with decreasing volatility. The chart below visually captures this contraction, with price repeatedly finding resistance in the upper region around $0.30 to $0.35 and support holding around $0.05 to $0.15.

This extended period of compression is rarely sustainable, and when it breaks out, it should break out to the primary trend.

Dogecoin Price Chart. Source: @cantonmeow On X

Breakout Expected Toward The Primary Trend

The most recent Dogecoin yearly candlestick is red, meaning that the meme cryptocurrency has spent the majority of the year correcting from its yearly open. According to the technical outlook, once the consolidation is done, Dogecoin is expected to move in the direction of the dominant trend.

The primary trend on the yearly time frame is still upward, as shown by the series of higher highs stretching back to 2013 and highlighted by the vertical surge in 2021. The chart above this upward bias shows how the post-2021 candles have not violated the broader bullish structure.

If the current inside-year pattern breaks to the upside, the analysis means that DOGE could re-establish its long-term trajectory and undergo a continuation over the next few years.

Such a move would imply that Dogecoin has absorbed years of selling pressure and distribution, transitioning back into a trending phase. From a technical standpoint, reclaiming the upper region of the consolidation box, around $0.35 to $0.45, would confirm strength and open the path toward breaking above its 2021 peak price.

The projection of this happening will take Dogecoin to a price target of at least $0.95 over the coming years. Considering the meme cryptocurrency is currently trading at $0.15, this will translate to a gain of about 530% from its current level.

Featured image created with Dall.E, chart from Tradingview.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.