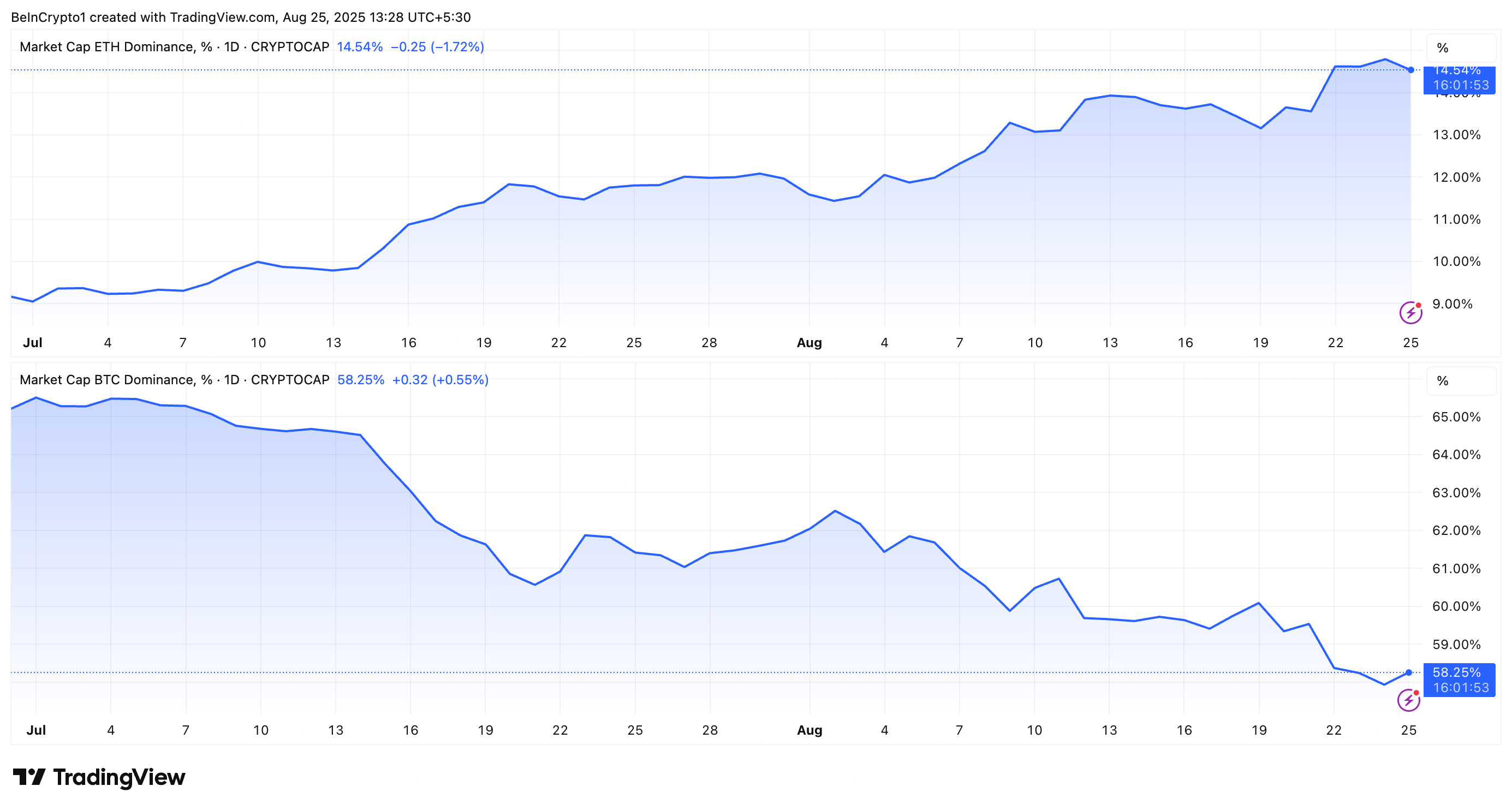

Ethereum dominance (ETH.D) has reached 14.98% in August, marking its highest level since September 2024. This milestone coincided with the altcoin’s new record high of $4,946 yesterday.

Meanwhile, Bitcoin dominance (BTC.D) has continued to decline. This divergence in momentum has sparked notable predictions from analysts, who foresee significant market changes ahead.

Bitcoin vs. Ethereum: Capital Rotation Sparks Market Predictions

Data from BeInCrypto Markets showed that the second-largest cryptocurrency has outperformed the first over the past month. Bitcoin’s value has dipped 5% in the past 30 days.

At the same time, Ethereum has appreciated 23.4%. Furthermore, Ethereum’s dominance has also been rising since July, while BTC.D has taken the opposite path. In fact, yesterday, ETH.D reached a yearly high of 14.98%.

At the time of writing, it had adjusted to 14.54%. Meanwhile, BTC.D was recorded at 58.2%, its lowest point since January 2025.

This momentum underlines a growing capital rotation trend. Whale buying trends further evidence this.

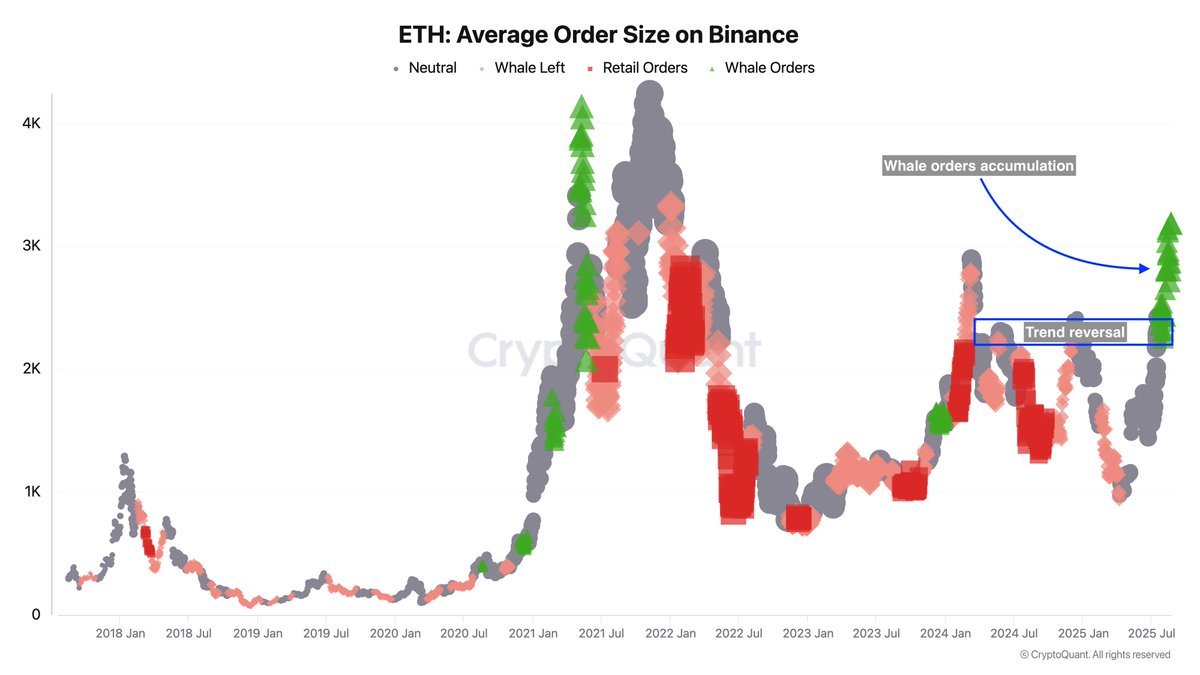

In a recent post on X (formerly Twitter), a crypto analyst highlighted that since July, Binance whales have consistently bought ETH through spot and futures orders.

“Whales act differently and often prefer to enter positions after a positive trend has been well validated, which is clearly observable here as these orders only started after the trend reversal. This strong accumulation thus supports the upward movement and will likely provide enough momentum to push ETH toward the $5 000 level,” Darkfost said.

Meanwhile, BeInCrypto also reported that several old Bitcoin wallets are shifting positions and selling their long-held BTC holdings in favor of Ethereum. And it’s not just retail. Institutional preference for ETH has been quite notable.

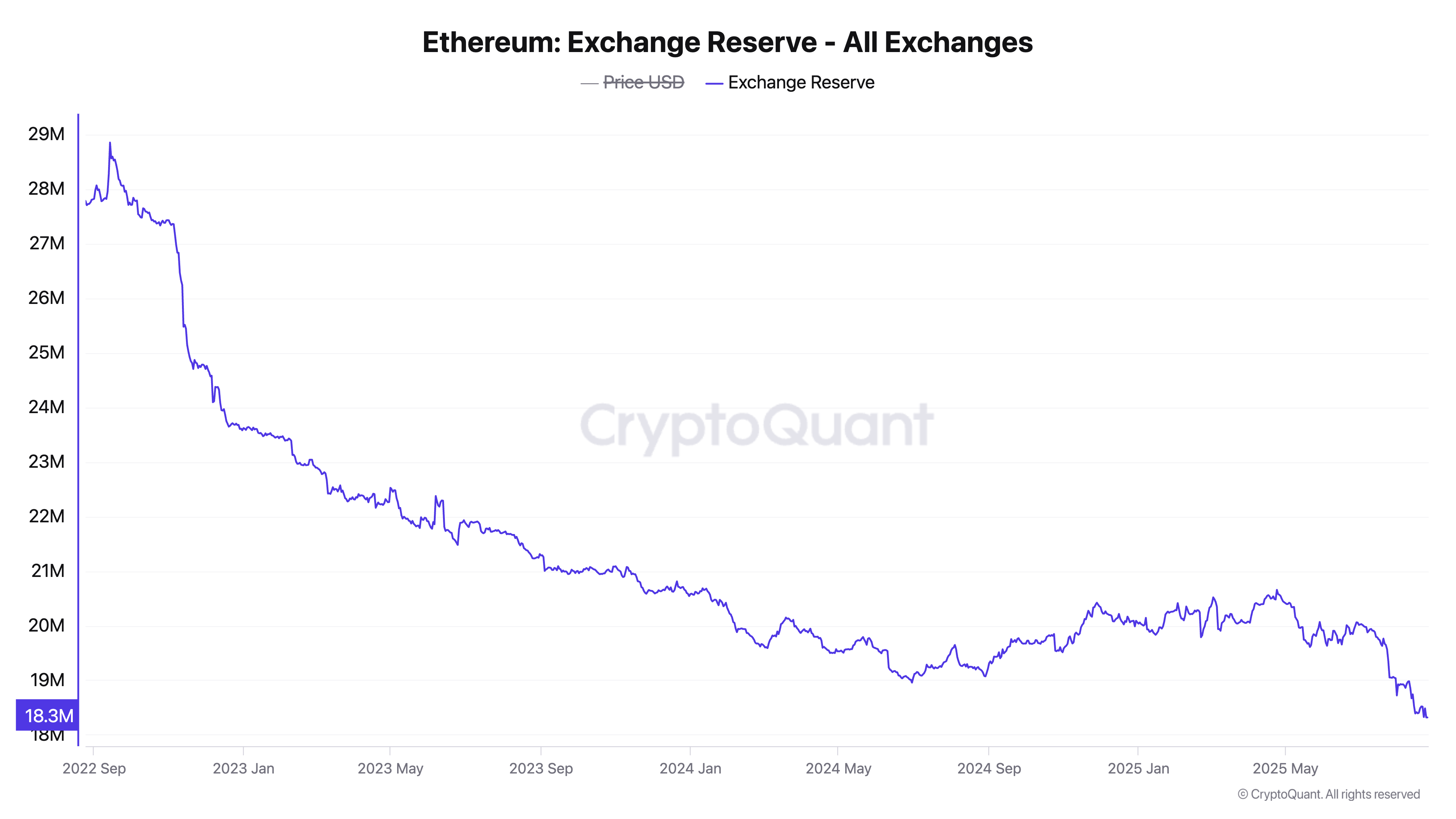

Public firms have been increasing their Ethereum exposure, spending billions of dollars to acquire ETH. Moreover, the ETH balance on exchanges has dropped to a new low of 18.3 million.

This reduction suggests that investors are holding rather than selling, a behavior often associated with confidence in future price appreciation.

“Ethereum supply shock loading,” analyst Ted Pillows stated.

Amid these conditions, some analysts suggest that the capital rotation from Bitcoin to Ethereum may extend to altcoins, broadening the market rally.

“Each Alt cycle begins the same way: Bitcoin shows fatigue. Ethereum awakens. The great rotation unfolds,” an analyst posted.

Meanwhile, Benjamin Cowen, CEO and founder of Into The Cryptoverse, previously forecasted that after Ethereum’s record high, Bitcoin could stage a comeback.

“However, the rotation back to BTC will likely be initiated by a BTC correction in September and will continue on a BTC rally in October,” Cowen mentioned

While predictions may vary, the outlook remains largely bullish. However, it remains to be seen whether other altcoins or Bitcoin will be the primary beneficiaries in the future.

The post Ethereum Dominance Hits Yearly High: What’s Next for the Market? appeared first on BeInCrypto.