One of the largest publicly-traded Ethereum (ETH) treasury firms, SharpLink Gaming, today announced that it had raised $76.5 million in a direct stock offering at a price above market rate. A portion of the proceeds is likely to be used to buy more ETH.

SharpLink Raises $76.5 Million To Buy More Ethereum

According to an announcement made earlier today, SharpLink Gaming has entered into a securities purchase agreement with an unknown institutional investor for the purchase and sale of 4.5 million shares of its common stock.

Notably, the Minneapolis-based firm stated that it had sold shares for $17 per share, a 12% premium above its market rate of $15.5 recorded in the closing hours of trading on October 15. It is also at a premium to the Net Asset Value (NAV) of the firm’s current holdings of 840,124 ETH.

The offering is expected to close on October 17, subject to satisfaction of customary closing conditions. Commenting on the development, Joseph Chalom, co-CEO of SharpLink said:

This is a novel equity sale transaction that is both accretive to stockholders and strategically structured, reflecting strong institutional confidence in SharpLink and our long-term vision. By raising equity at a meaningful premium to both market price and NAV, we’re able to continue accumulating ETH and increasing ETH-per-share for our investors.

He added that Ethereum adoption continues to grow among both retail and institutional investors, across different verticals such as stablecoins, decentralized finance (DeFi), and tokenized assets.

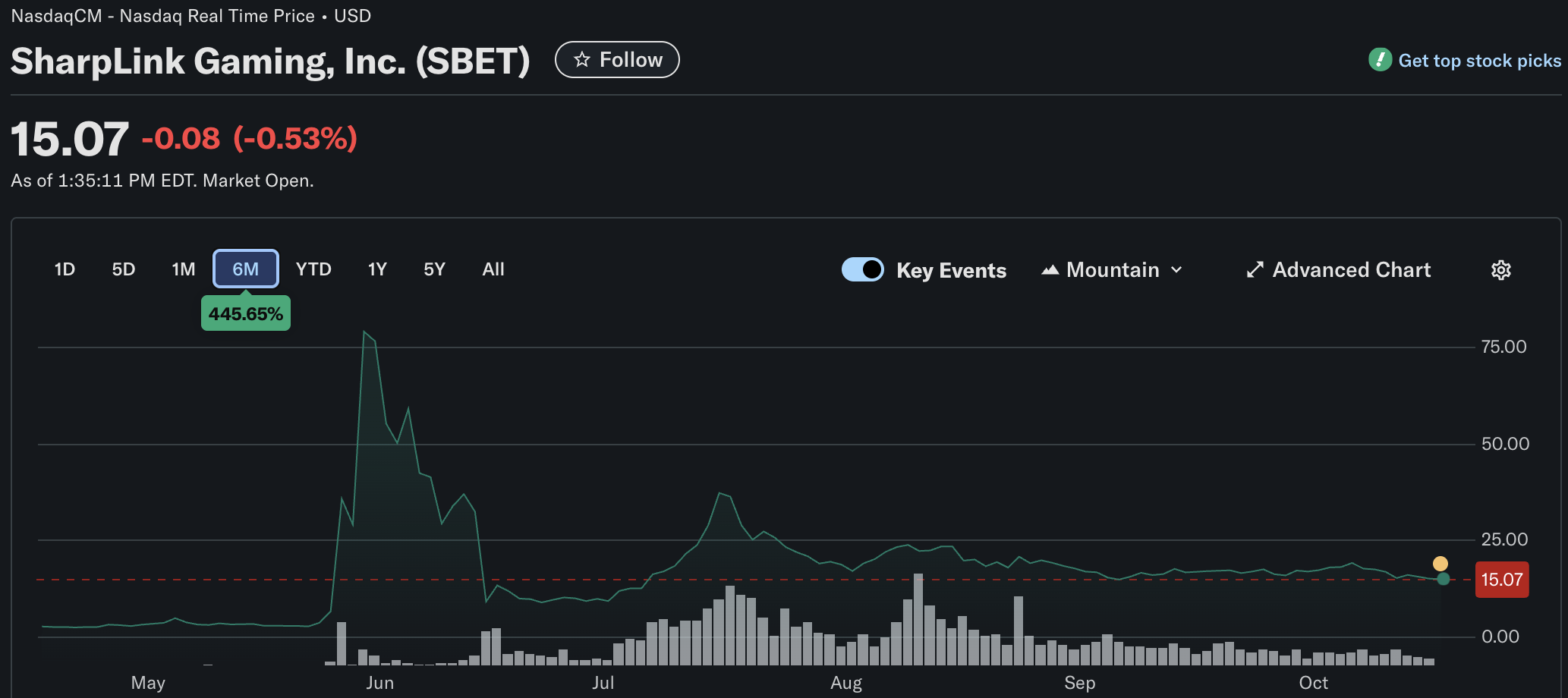

Following today’s announcement, SharpLink shares are slightly down, trading at $15.07 at the time of writing. However, the shares are up an impressive 445% over the past six months, largely driven by an increase in the price of ETH.

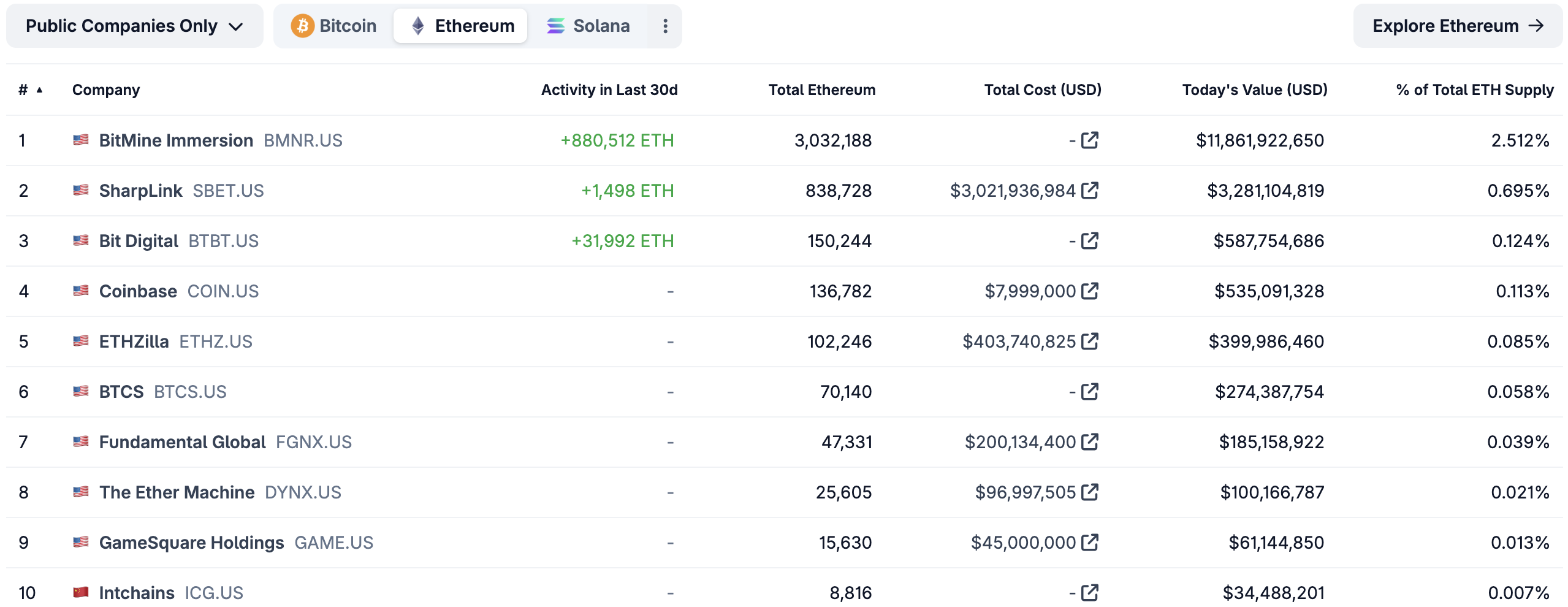

As mentioned earlier, SharpLink is currently ranked second among publicly-traded firms in terms of the amount of ETH held in their treasuries. BitMine Technologies continues to lead the pack, with more than three million ETH on its balance sheet, according to data from Coingecko.

Is Crypto Treasury Still The Play?

The practice of companies developing crypto treasury strategies has become increasingly popular over the past few years. It picked up pace following the victory of pro-crypto Donald Trump in the November 2024 US presidential election.

This trend is not just limited to leading digital assets like Bitcoin (BTC), or Ethereum, but companies are also exploring crypto treasury strategies focused on other altcoins such as Solana (SOL), Avalanche (AVAX), and Dogecoin (DOGE).

That said, some warning signs have the investors doubting the benefits of a crypto-focused treasury strategy on a company’s finances. For instance, recently, Metaplanet’s valuation fell below the value of the total BTC it holds on its balance sheet.

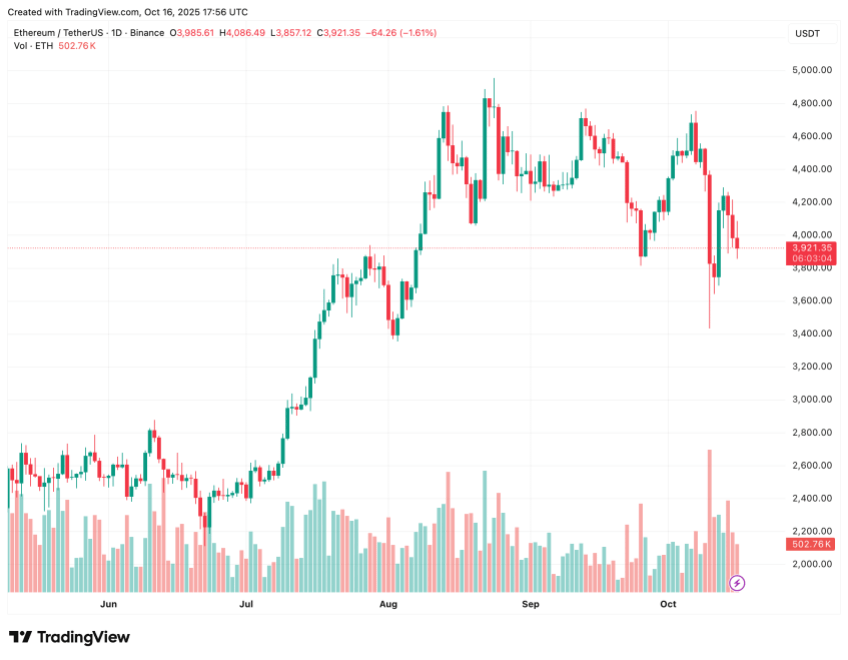

Similarly, Michael Saylor’s Strategy’s shares – the largest publicly-listed firm in the world by amount of BTC held – have also shown poor performance over the past few months. At press time, ETH trades at $3,921, down 1.7% in the past 24 hours.