Key takeaways

Ethereum’s Open Interest has hit a record $8.7B on Binance, a sign of growing leveraged bets without overheating. ETH now may be on track for a breakout toward $5K.

Ethereum [ETH] may be on the verge of a breakout. Open interest on Binance has soared to an all-time high of $8.7 billion — nearly 3.5 times its peak during the 2021 bull run — showing heightened trader anticipation.

With Funding Rates still hovering near neutral and historical August patterns favoring strong post-halving rallies, market analysts believe ETH could be setting the stage for a speculative run toward the $5K mark.

Leverage builds alongside caution

Source: CryptoQuant

Ethereum’s Open interest on Binance has exploded to an all-time high of $8.7 billion, shattering its previous bull market peak of around $2.5 billion in 2021.

This massive 3.5x increase shows an intense buildup of leveraged positions, yet without the extremes often seen in overheated markets.

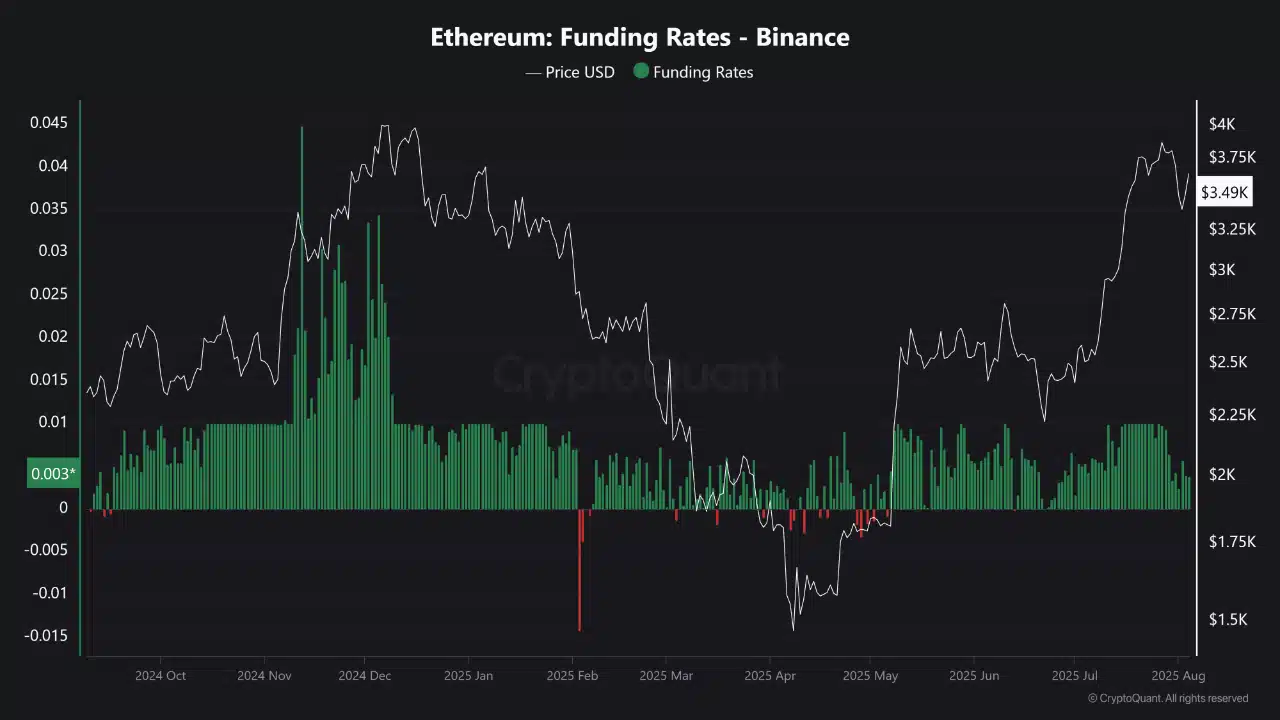

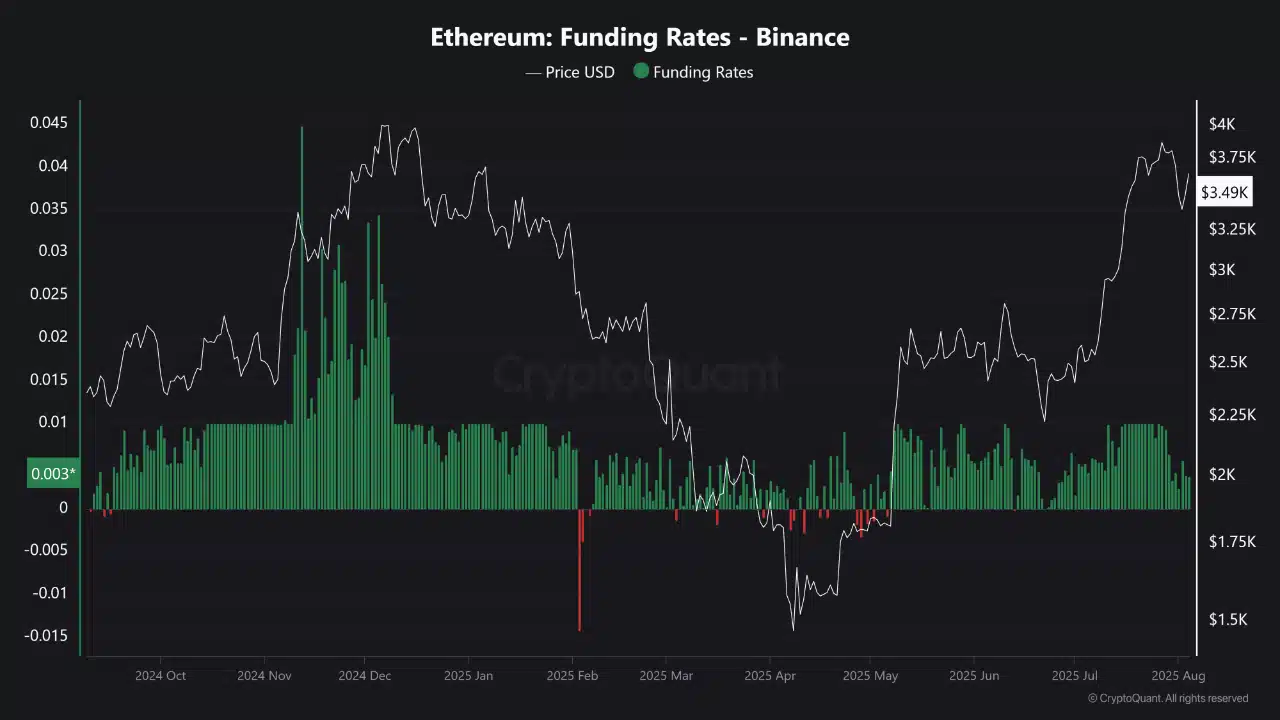

Source: CryptoQuant

What’s striking is the disconnect between rising OI and flat Funding Rates. Current data shows that funding remains neutral, indicating that traders aren’t aggressively positioned long or short.

This equilibrium implies there’s still significant headroom for price action without forced liquidations or overcrowded bias.

Post-halving patterns point to great potential

August has always been a powerful month for crypto, especially in post-halving years.

While Bitcoin usually takes the spotlight, Ethereum tends to outperform during these cycles, thanks to its beta-like responsiveness to Bitcoin’s strength.

Source: X

According to analyst Alek Carter, ETH has averaged a staggering 64.2% gain in August during past post-halving years.

If this pattern repeats, it could catapult ETH toward the highly anticipated $5,000 mark in the coming weeks.

Minor dip, with momentum intact

Ethereum’s latest daily chart showed a slight pullback to $3,632, making a 2.38% drop. However, technical indicators have shown this isn’t a breakdown.

The RSI was still above neutral at 57.61 at press time, a sign of continued strength without being overbought.

Meanwhile, the MACD showed convergence but not a bearish crossover yet, indicating the recent dip could be a healthy pause in a broader uptrend.

As volatility resets and momentum consolidates, ETH may be preparing for a greater move, especially if macro and on-chain trends remain supportive.