Ethereum has slipped below the $3,300 mark, indicating persistent selling pressure in this zone. While bears aren’t showing strong momentum just yet, the fact that the price declined following a major liquidation event, one that already cleared out many over-leveraged longs, raises the risk of further downside. This hints that spot sellers could now be in control, opening the door for a deeper short-term correction.

Technical Analysis

By Shayan

The Daily Chart

On the daily chart, ETH dropped below the channel and has fallen slightly beneath the 200-day moving average. It is currently breaking below the $3,300 demand zone too. This is a key level Ethereum is now losing, as the 200-day moving average is known as one of the most critical indicators for determining whether the overall market phase is bullish or bearish.

The RSI also remains weak at 32, showing the market is not bound for recovery yet. For buyers to regain control, ETH needs to break back above $3,500 and flip that region and the 200-day moving average into support. Until then, the price is sitting in a vulnerable zone, which could push the price lower toward the $3,000 support level in the coming days.

The 4-Hour Chart

The 4-hour chart shows a quick rejection from the lower boundary of the broken channel and the previous support zone, around $3,400. The price is currently hovering around the level and has yet to form a convincing rebound or create a higher low.

The RSI is also stabilizing below the 50% level, as the momentum is clearly bearish. With ETH breaking the $3,300 to the downside once more, the next sweep toward the $3,000 zone and lower could come fast.

Sentiment Analysis

Long Liquidations

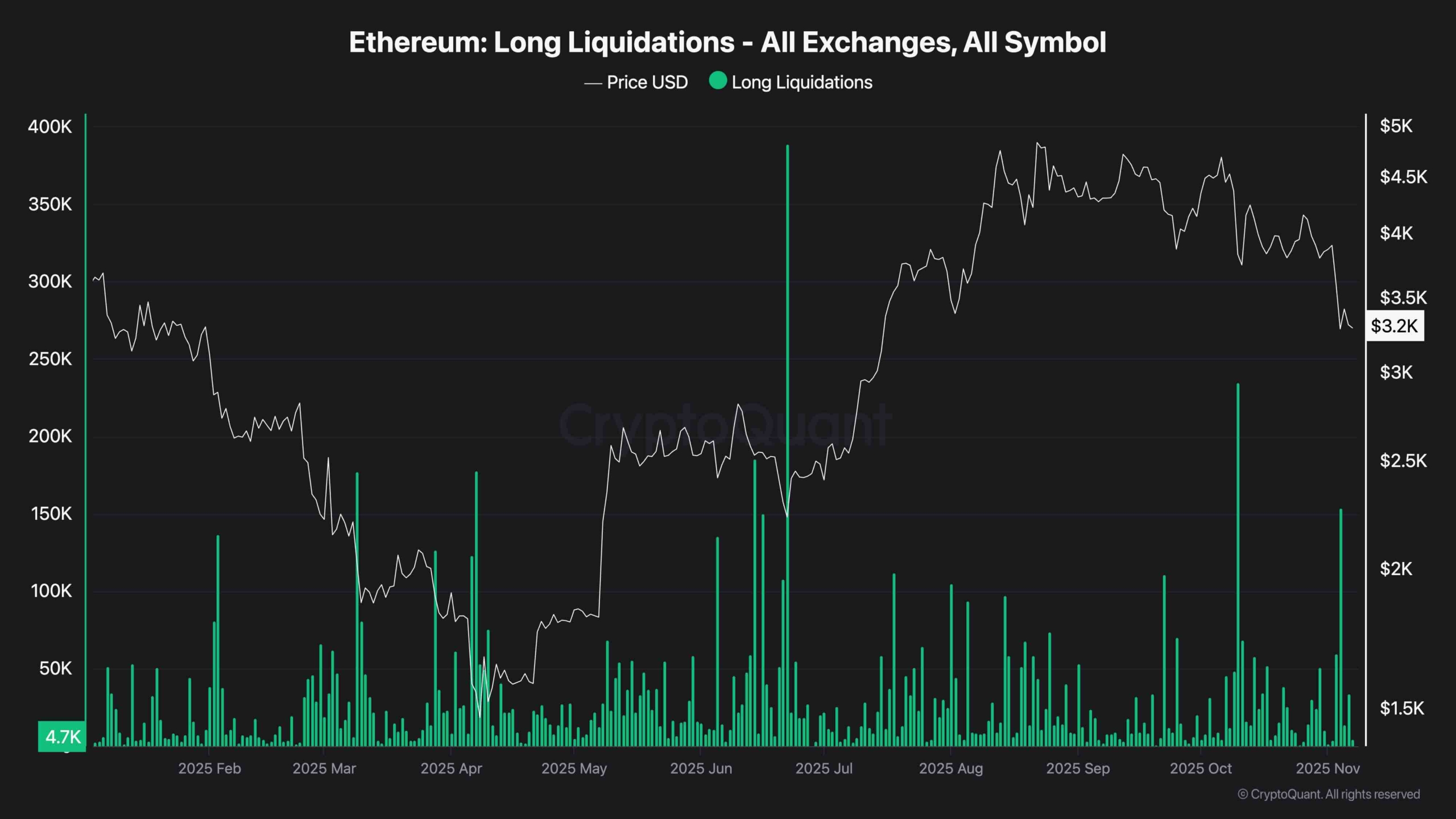

Sentiment-wise, liquidations wiped out a large portion of late long entries, creating a cleaner slate for the price to stabilize. The chart shows a major liquidation spike right before the small bounce, confirming the shakeout.

With many positions flushed and the RSI nearing oversold regions across multiple timeframes, the market might soon be due for a reset. Yet, traders are likely to stay cautious, waiting for clearer strength and a break back above $3,500 before reloading on longs.

On the other hand, a drop toward the $3,000 level could ignite another liquidation cascade and lead to an even more significant liquidation event, which could result in another flash crash in the upcoming weeks.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Cryptocurrency charts by TradingView.