The European Securities and Markets Authorities (ESMA) has requested public input to aid in the assessment of criteria for categorizing cryptocurrency assets as financial instruments or otherwise.

Meanwhile, this follows the regulations development in August of last year when the European Parliament passed the Europe Markets in Crypto Assets (MiCA).

Europe Crypto Regulations: An Ongoing Discussion

In the statement, it explains that the MiFIDD does not include a “one-size-fits all” definition for all types of financial securities. It says not having a common definition does make it more difficult to actually define and apply a standardized test to what actually is considered a financial instrument.

“National competent authorities and market participants should take into account whether the crypto-asset is a digital representation of value or rights, capable of being transferred and stored using DLT, including whether these value or rights represent a right vis-à-vis the issuer, aligning with the definition of ‘crypto-asset’ within the meaning of MiCA.”

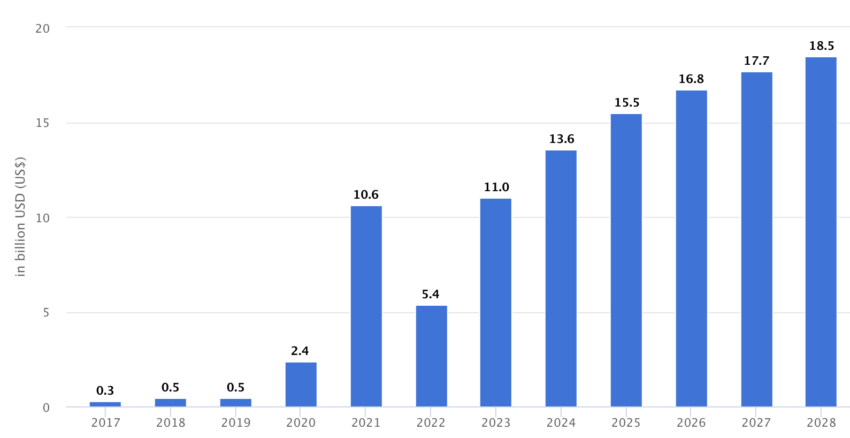

The regulatory consultation comes amid the growing crypto industry in Europe. According to Statista, the European crypto market could hit $18.5 billion in annual revenue by 2028.

Meanwhile, recent survey data from crypto exchange Binance suggests that approximately 73% of European citizens are optimistic about the future of crypto.

Furthermore, almost 55% of those survey participants use crypto for everyday purchases.

Read more: Top 12 Crypto Companies to Watch in 2024

Europe Actively Seeking Crypto Regulatory Clarity

However, it highlights the exclusion of non-transferrable digital assets, like email and social media accounts, from the regulations of MiCA.

“National competent authorities and market participants should ensure that digital assets that are non-transferable to other holders and that are only accepted either by the issuer or by the offeror do not fall within the definition of crypto-assets and should be excluded from the scope of MiCA.”

For some time now, Europe has been actively working to achieve regulatory clarity.

On Jan. 18, BeInCrypto reported that European Union has amended its anti-money laundering laws. It has expanded the obliged entities required to report on crypto transactions exceeding €1000.

Read more: 4 Best Crypto Learn and Earn Platforms in 2024

Meanwhile, the UK had already taken steps to regulate crypto even before leaving the EU.

In 2019, the Financial Conduct Authority (FCA) published key guidance. It clarified that crypto could be classified as “security tokens,” “e-money tokens,” or “unregulated tokens,” depending on their characteristics.

However, the ongoing crypto debate has not stopped major players from offering crypto services within the region.

In December 2023, Robinhood launched crypto trading services in the European Union. The trading platforms offers European citizens 26 cryptocurrencies, including Solana, Polygon, and Cardano.

![]()

AlgosOne

AlgosOne” target=”_blank”>Explore →

![]()

DeGate

DeGate” target=”_blank”>Explore →

![]()

PrimeXTB

PrimeXTB” target=”_blank”>Explore →

![]()

KuCoin

KuCoin” target=”_blank”>Explore →

![]()

BYDFi

BYDFi” target=”_blank”>Explore →

![]()

Сoinex

Сoinex” target=”_blank”>Explore →

The post EU Securities Regulator Seeks Feedback on Classifying Crypto as Financial Instruments appeared first on BeInCrypto.