Today, March 5, Germany’s premier financial marketplace, Deutsche Börse Group, has officially launched the Deutsche Börse Digital Exchange (DBDX), aiming to set a new precedent in the world of institutional crypto trading in Europe. This platform represents the Group’s strategic move into the digital asset sphere, offering a regulated, secure ecosystem for trading, settlement, and custody of cryptocurrencies like Bitcoin and Ethereum to institutional clients.

Exchange For Institutional Investors

Carlo Kölzer, Head of FX & Digital Assets at Deutsche Börse, underlined the platform’s significance in the official press release, restating, “Our new offering is a game changer for digital ecosystems. We aim to provide institutional clients in Europe with trustworthy markets for crypto assets, characterized by transparency, security, and regulatory compliance.” This initiative reflects Deutsche Börse’s goal to enhance market integrity and security, particularly catering to the needs of banks, asset managers, and affluent families.

DBDX introduces a fully regulated trading environment, a critical development that addresses a longstanding gap in the market, according to the firm. The platform’s launch leverages the existing market connectivity of participants, providing a comprehensive suite of services that encompasses the entire value chain of crypto asset transactions.

In a collaboration, settlement and custody of trades on DBDX will be managed by Crypto Finance (Deutschland) GmbH. Stijn van der Straeten, CEO of Crypto Finance, remarked on the partnership: “This is a pivotal moment in our endeavor to create a stable and trusted digital asset ecosystem together with Deutsche Börse, while strengthening Crypto Finance’s established and regulated custody and settlement offering in Germany.”

Crypto U-Turn

The establishment of DBDX is a cornerstone of Deutsche Börse’s “Horizon 2026” strategy, which aims to lead in the digitalization of asset classes. This move is bolstered by the recent licensure from BaFin, which granted Crypto Finance (Deutschland) GmbH four crucial licenses for the regulated trading, settlement, and custody of digital assets, enabling the operational launch of the platform.

Notably, Deutsche Börse has long been more cautious than its competitors. The US exchanges Chicago Board Options Exchange (CBOE) and Chicago Mercantile Exchange (CME) launched Bitcoin futures back in 2017. “We have deliberately kept our hands off trading in cryptocurrencies so far, because a large part of these transactions take place entirely in the unregulated area,” said CEO Theodor Weimer at the end of 2018.

The introduction of DBDX by Germany’s stock exchange not only signifies Deutsche Börse’s adaptive response but also sets a benchmark for the institutional adoption of cryptocurrencies in Germany and Europe.

By providing a regulated, transparent, and secure platform for the trading, settlement, and custody of digital assets, Deutsche Börse aims to pave the way for a new era of financial market operations, reinforcing Germany’s position as a leading financial hub in Europe.

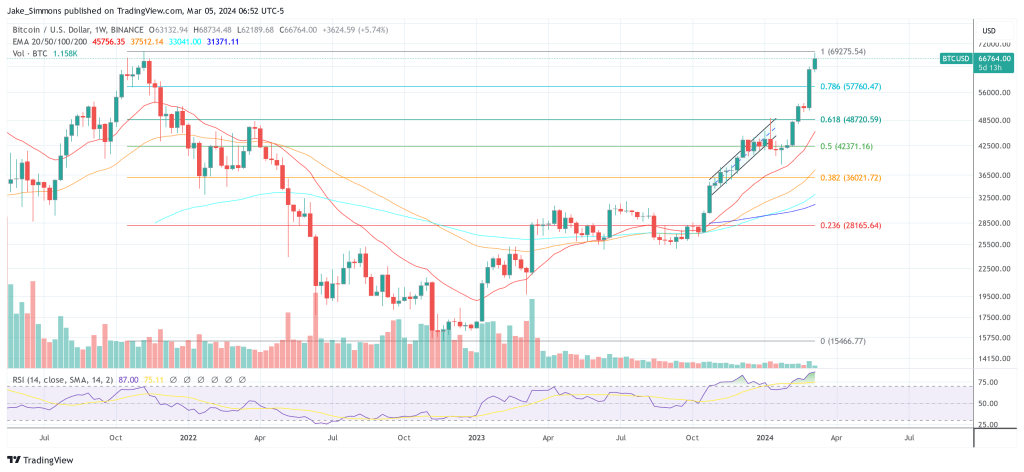

At press time, Bitcoin traded at $66,674.