Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

China has added five tonnes of gold to its reserves in under a month as part of an increasing aggressive purchase of the precious metal. Bitcoin continues to stand firm above the $87,000 level despite recent market fluctuations.

Related Reading

PBOC Gold Accumulation Up As Bitcoin Price Soars

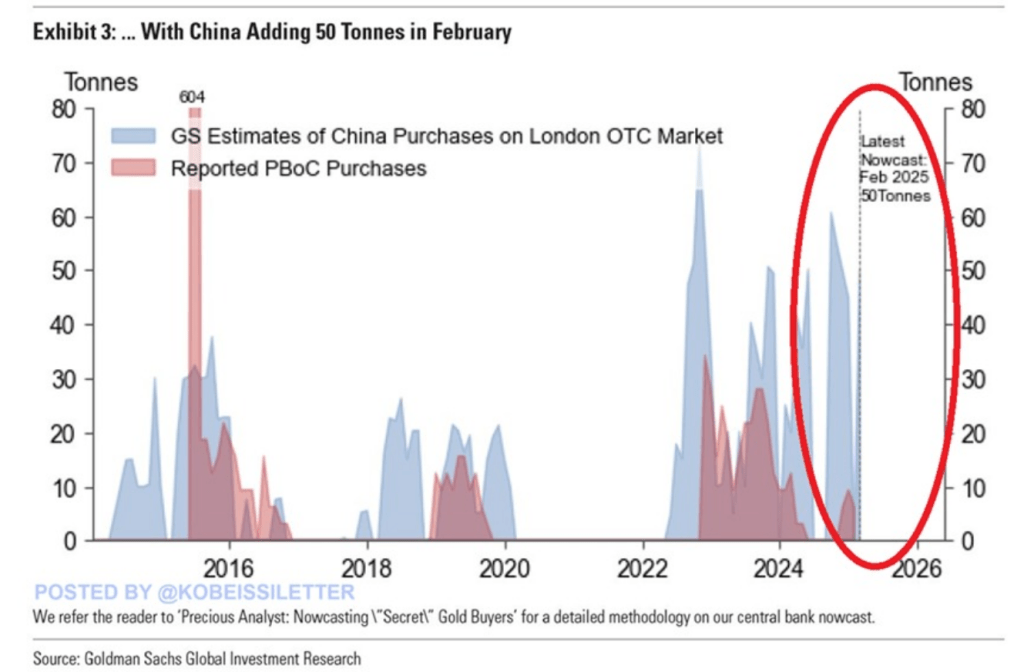

According to the Kobeissi Letter in posting messages on X, the People’s Bank of China has been abruptly accumulating gold. It has acquired five tonnes over the last month. This has taken place amid uncertainty in global markets from the rift caused by persistent tensions in trade along US-China fronts.

Bitcoin traders seem to witness this, as the price of the crypto holds strong at $87,280, with scanty negative macronews in the background. Merely four days ago, cryptocurrencies fell back after US President Donald Trump proclaimed a 245% import tax on Chinese items. The quick recovery has surprised many market observers.

BREAKING: China’s central bank increased its gold holdings by 5 tonnes in March, posting their 5th consecutive monthly purchase.

This brings total China’s gold reserves to a record 2,292 tonnes.

Chinese gold holdings now reflect 6.5% of its total official reserve assets.… pic.twitter.com/LuwiBvnirn

— The Kobeissi Letter (@KobeissiLetter) April 20, 2025

Whale Wallets Indicate Growing Appetite For Bitcoin

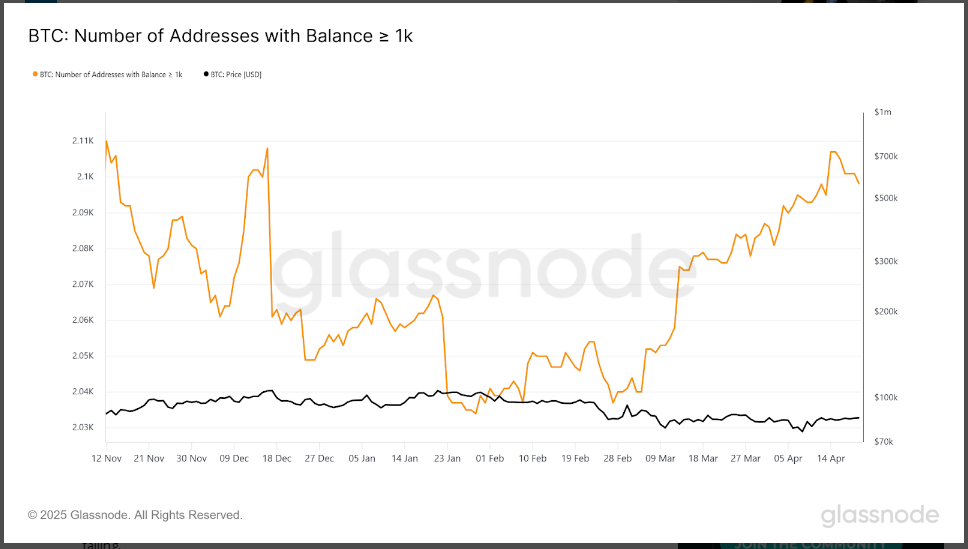

Statistics by Glassnode indicate a steep increase in addresses containing over 1,000 Bitcoin. More than 60 new “whale” wallets have entered the market since early March.

The number of such large Bitcoin addresses has increased from 2,030 in late February to 2,100 as of April 15, which is the highest in four months. The boost indicates large investors are purchasing more Bitcoin despite changing market conditions.

Others say the strength of Bitcoin lies in its increased popularity as an inflation hedge, akin to gold. This theory has become more widely accepted as China seems to be steering away from US dollar-denominated assets.

Gold Prices Hit New Records As Trade Tensions Mount

Prices of gold have surged to $3,401, up by close to $100 over only a week. The rise comes as institutions, dominated by China, raise their gold stockpiles.

The ongoing tariff war between the US and China has driven investors towards traditional safe-haven assets. Bitcoin is also seen to be gaining from this same trend, with some investors seeing it as a contemporary option for gold in times of uncertainty.

Mixed Signals From ETF Flows And Market Analysts

Not everything is rosy for Bitcoin. Reports disclose that nearly $5 billion has exited Bitcoin ETFs since their aggregate flow hit all-time highs. In spite of this outflow, Bitcoin’s price has remained extremely stable.

Related Reading

There are also contradictory reports regarding China’s position on Bitcoin. While there are rumors that China may be accumulating a Strategic Bitcoin Reserve, other reports say the nation sold 15,000 BTC on offshore exchanges.

The cryptocurrency’s ability to maintain its price despite these mixed signals has caught the attention of traders worldwide. As US-China economic tensions continue, investors are watching both gold and Bitcoin as potential safe havens in an increasingly unstable global market.

Featured image from GEPL Capital, chart from TradingView