Grayscale Investments announced Monday that it has launched the first US-listed spot crypto exchange-traded products (ETPs) with staking, marking a major milestone for the regulated digital asset market.

The firm said its Ethereum Trust ETFs (ETHE, ETH) and Solana Trust (GSOL) now allow investors to access staking yield directly through traditional brokerage accounts.

Grayscale Unveils US Staking Spot ETPs

The products enable spot exposure to Ether and Solana while also generating staking rewards through institutional custodians and validator providers.

Grayscale CEO Peter Mintzberg called the initiative a “first mover innovation” that underscores the firm’s role as the world’s largest digital-asset ETF issuer with $35 billion in assets under management.

The firm said it will stake passively to support Ethereum’s and Solana’s network security while helping investors earn long-term yield. The company emphasized that staking rewards will accrue within the funds’ net asset value, not as separate distributions, to maintain tax efficiency.

In practice, staking within an exchange-traded product differs from direct on-chain participation. Custodians, such as Coinbase Custody or BitGo, delegate assets to professional validators like Kiln and Figment, adding rewards to the fund’s net asset value instead of paying them out.

Because of Ethereum’s withdrawal delay, issuers typically stake only part of their holdings, keeping liquidity for redemptions — a setup that leaves investors with an effective yield near 2%.

If GSOL receives regulatory approval for uplisting as an exchange-traded product, it will become one of the first Solana spot ETPs with staking in the US market.

Industry observers said the move could redefine how investors access yield-bearing digital assets. In a recent analysis, analysts noted that while Bitcoin ETFs only provide price exposure, staking-enabled Ether and Solana products offer a structural advantage as yield-bearing alternatives.

Why Ethereum and Solana Matter for Yield Investors

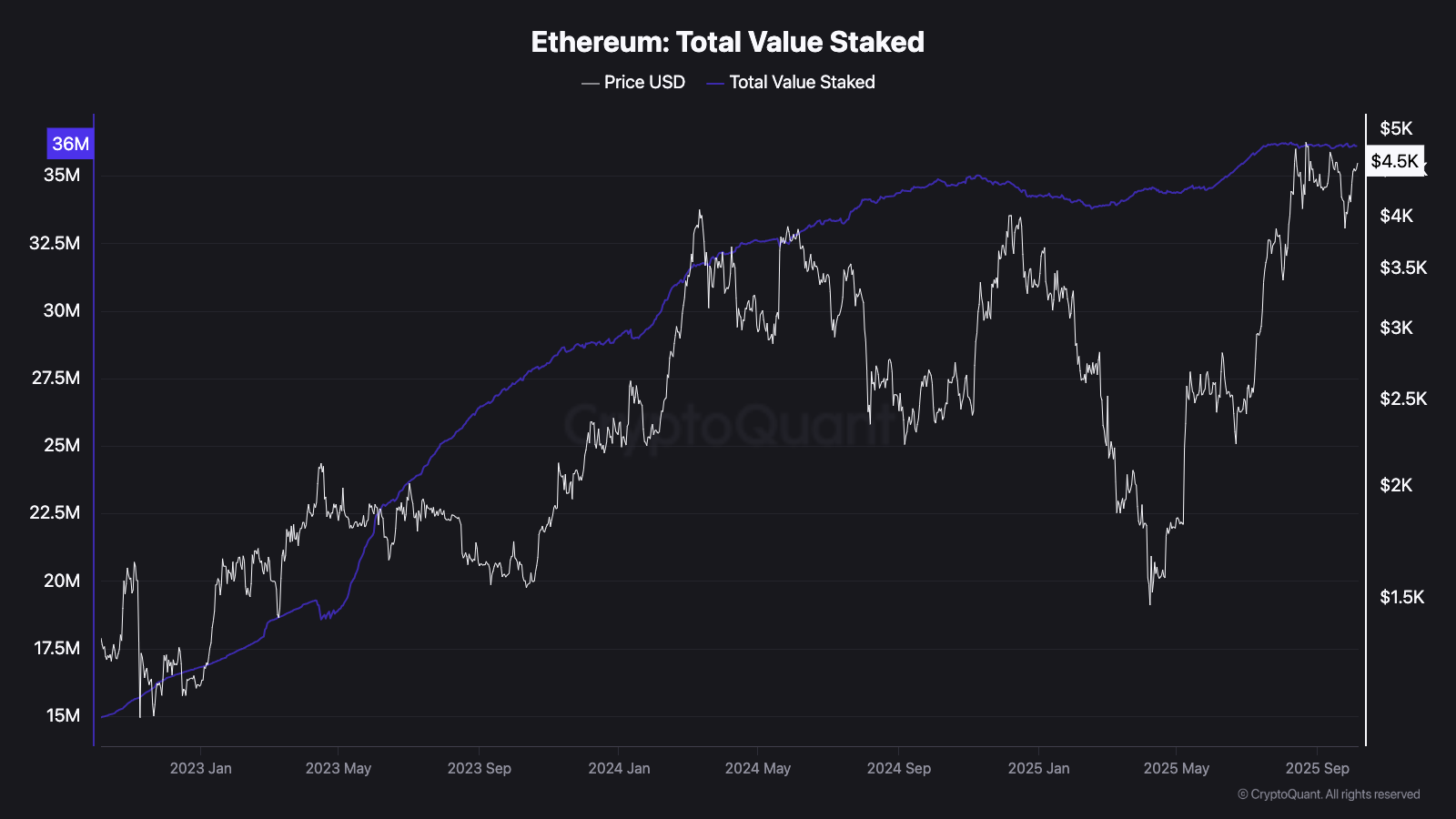

On-chain data indicate a tightening of the Ethereum supply base as staking participation increases. According to network statistics, Ethereum’s staking queue surpassed unstaking in September, signaling strong confidence from institutions and long-term holders.

Nearly 36 million ETH—about 30% of the total supply—is now locked in staking contracts, reducing liquid circulation and supporting price stability.

A separate report said smart contract activity and on-chain transactions have surged, reinforcing Ethereum’s role as a “reserve network” for decentralized finance and tokenized assets.

Meanwhile, data shows that Solana ETF interest continues to grow as institutional investors explore diversification beyond Bitcoin.

Academically, the inclusion of staking within ETFs was already being studied before regulatory approval. A 2024 paper by Associate Professor David Krause at Marquette University analyzed how staking could improve returns and network security, emphasizing the need for investor protection and clarity.

His findings now appear prescient, as many mechanisms he described—such as passive validator participation and yield accrual within fund NAVs—have become foundational features of the newly approved staking ETPs.

Market analysts estimate that Ethereum’s staking yield—currently around 3%—combined with price appreciation, could attract traditional investors seeking diversified income streams.

As the ETPs enter the US market, their impact on fund flows will be closely watched. The outcome could signal whether yield-bearing crypto products can transform Ethereum and Solana from speculative assets into regulated, income-generating instruments for mainstream portfolios.

The post Grayscale Launches First Staking Spot ETPs in US appeared first on BeInCrypto.