Litecoin (LTC) holders have yet to see profits in 2026, as the price remains weighed down by the sharp sell-off in October last year. However, when zooming out to the broader trading picture, Litecoin exhibits several signs that indicate a potential reversal.

Positive signals supporting a reversal thesis include sustained whale trading activity and a renewed interest in Litecoin.

Sponsored

Sponsored

How Have Whales Dominated Litecoin (LTC) Trading For More Than a Year?

Data from Coinglass shows that the LTC Whale vs. Retail Delta has remained mostly positive from Q4 2024 to the present.

Whale vs. Retail Delta measures the difference between trading activity by whales and retail investors. When this indicator remains above zero and is elevated relative to historical levels, it indicates strong participation from whales.

This behavior can signal the accumulation of positions at low prices. It can also warn of heavy selling pressure if prices move higher.

For Litecoin, the chart highlights two distinct phases, marked in red and green.

Before Q4 2024, the delta stayed negative. Retail traders dominated activity during this period, while LTC traded mostly below $100. After Q4 2024, whales took control of trading activity. The delta turned positive, even though LTC remained stuck in a multi-year sideways range.

This pattern suggests that retail investors may have capitulated, while whales actively prepared positions.

Sponsored

Sponsored

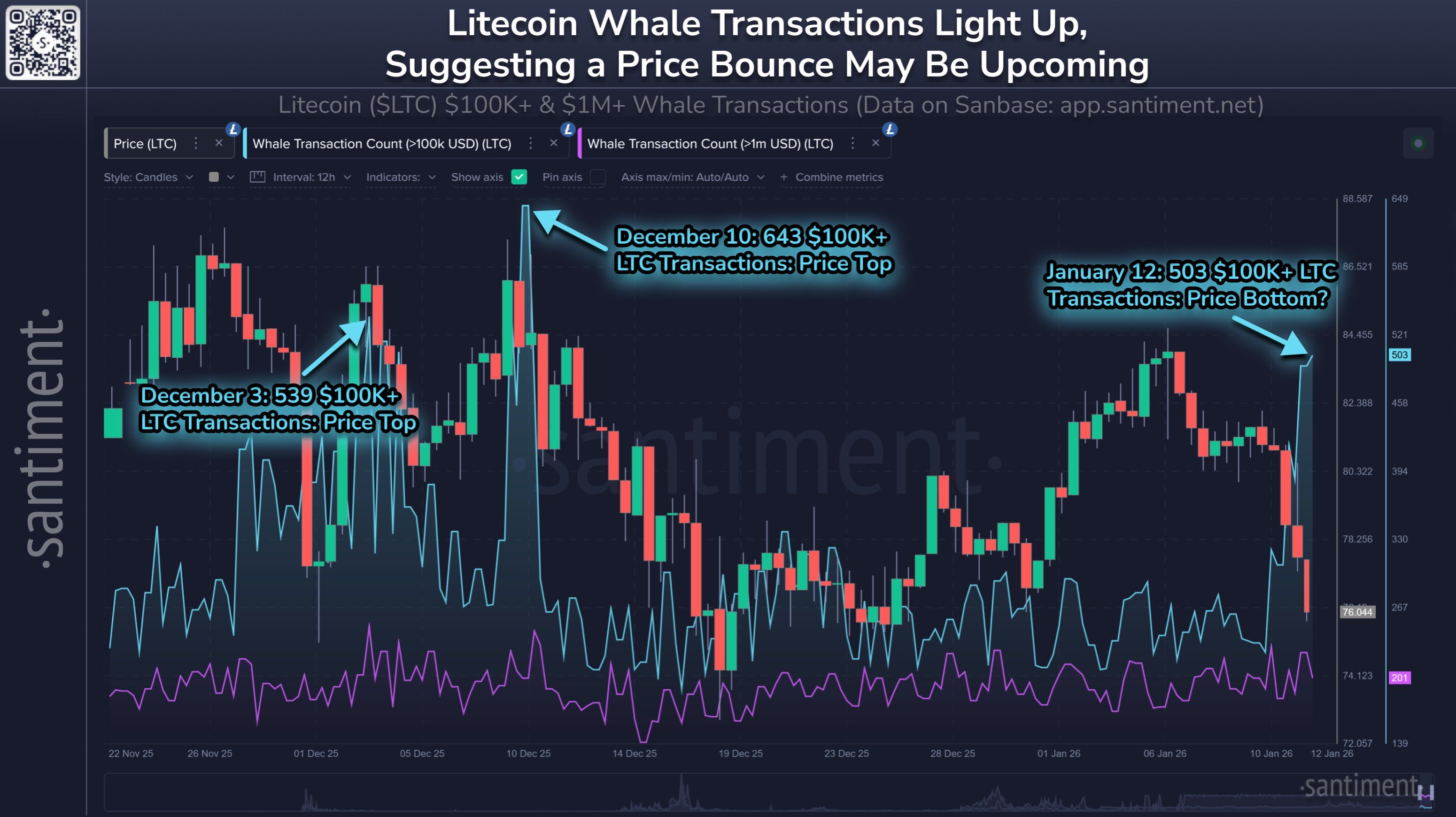

Additionally, short-term data from Santiment, an on-chain analytics platform, indicates a surge in Litecoin network activity. Whale transactions have reached a five-week high.

“Historically, an asset has a significantly higher likelihood of reversal on whale spikes,” Santiment reported.

This data strengthens the case that LTC could recover or reverse at any time, even if the price experiences a deeper decline.

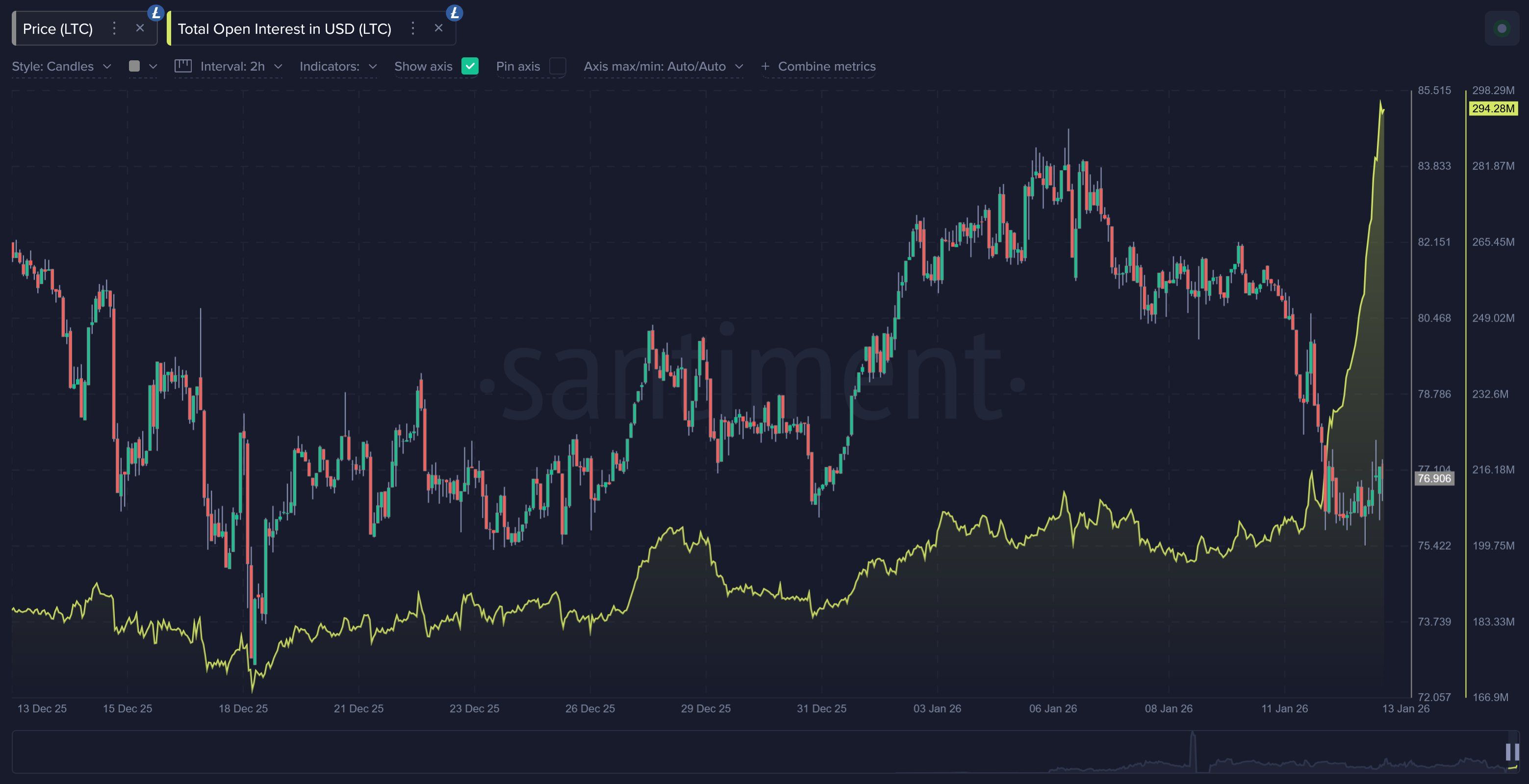

Derivative market data adds another layer. Open interest in LTC has recently spiked. On the negative side, elevated open interest increases the risk of liquidation when traders use high leverage.

On the positive side, it signals that more traders are increasing exposure to Litecoin than before. This shift may indicate that retail interest in LTC is returning.

In summary, the combination of long-term and short-term whale activity, along with renewed momentum in derivatives markets, may indicate a potential recovery for LTC.

However, any rebound is unlikely to be easy or rapid, as the price still trades roughly 46% below last year’s peak.