As Bitcoin’s value surges, cryptocurrency investors are increasingly turning to commercial real estate (CRE) as a stable outlet for their digital wealth. However, this shift highlights a unique set of challenges and opportunities for developers, brokers, and investors alike.

A Booming Market, but Complex Exits

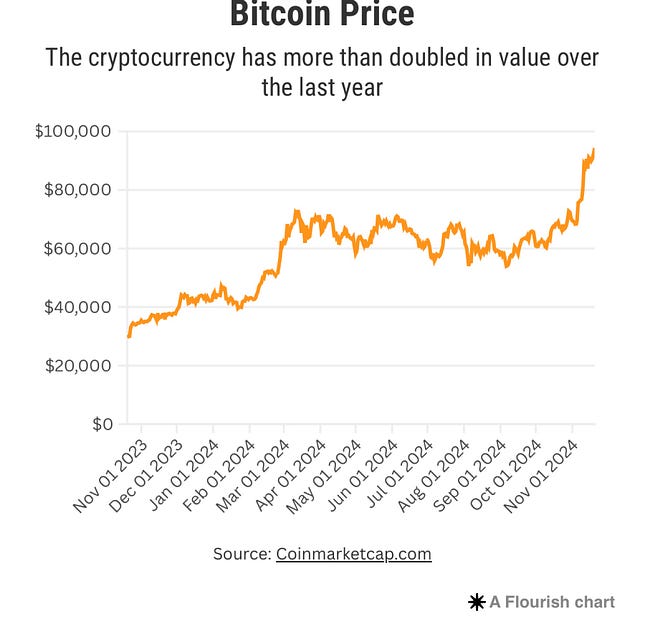

The cryptocurrency bull run has doubled Bitcoin’s value in the past year, enticing investors to cash out and reinvest in tangible assets. Yet, transitioning large crypto holdings into physical property remains fraught with obstacles. High fees, bank delays, and regulatory ambiguity make the process complex. Without clear federal guidelines, both developers and investors navigate a patchwork of state regulations, risking inconsistent enforcement and legal uncertainty.

Hope for Federal Guidance Under Trump

Crypto proponents are optimistic that a Trump administration will usher in a regulatory framework that legitimizes digital assets. The resignation of SEC Chair Gary Gensler, a crypto skeptic, has fueled expectations for a more blockchain-friendly leader. A cohesive federal policy could bring clarity to issues like taxation and transaction records, pushing cryptocurrencies into the financial mainstream.

Opportunities for Developers and Investors

This surge in crypto wealth offers lucrative opportunities for CRE developers:

• New Buyer Pools: Crypto holders seek to diversify into physical assets, presenting a growing market for commercial and residential properties.

• Liquidity through Rentals: Multifamily units and office spaces remain popular due to affordability and adaptability.

• Seamless Transactions: Specialized brokers and platforms now facilitate smoother crypto-to-cash exchanges, making it easier for developers to attract crypto buyers.

The Road Ahead: Challenges and Benefits

Despite these opportunities, a lack of federal rules has deterred some institutional investors and fueled concerns about fraud. Yet, with regulation, CRE could become a safer, more attractive option for cryptocurrency wealth. Standardized guidelines would help developers tap into this market confidently, ensuring long-term growth and innovation.

As the worlds of crypto and real estate intersect, now is the time for developers and investors to adapt. How will your strategy evolve in this digital era? Share your thoughts below!

How Crypto Investors Are Changing the Real Estate Landscape was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.