Russia’s introduction of its Central Bank Digital Currency (CBDC), the digital ruble, marks a strategic shift. It challenges the US dollar’s stronghold on international transactions.

Amid geopolitical tensions, the digital ruble emerges as a symbol of financial independence, signaling a broader shift in global trade dynamics.

Russia’s CBDC Challenges the Dominance of the US Dollar

Russian officials, including State Duma’s Financial Markets Committee Chairman Anatoly Aksakov, have highlighted the international interest in the digital ruble for cross-border settlements. Consequently, Russia’s Finance Minister Anton Siluanov has emphasized the goal of fostering a trading environment independent of Western influence.

This development aligns with Russia’s ambition to sidestep Western sanctions, showcasing a commitment to financial autonomy. Indeed, the Duma’s legislative efforts to allow digital financial assets in international commerce highlight Russia’s determination. Similarly, allies like Belarus, Kazakhstan, and Kyrgyzstan are advancing their CBDC initiatives.

These steps indicate a collective move towards digital currencies as instruments of economic sovereignty. However, challenges such as technological barriers persist. Despite these obstacles, Russia’s formal commitment, evidenced by President Vladimir Putin’s endorsement of the digital ruble, underscores a significant step forward.

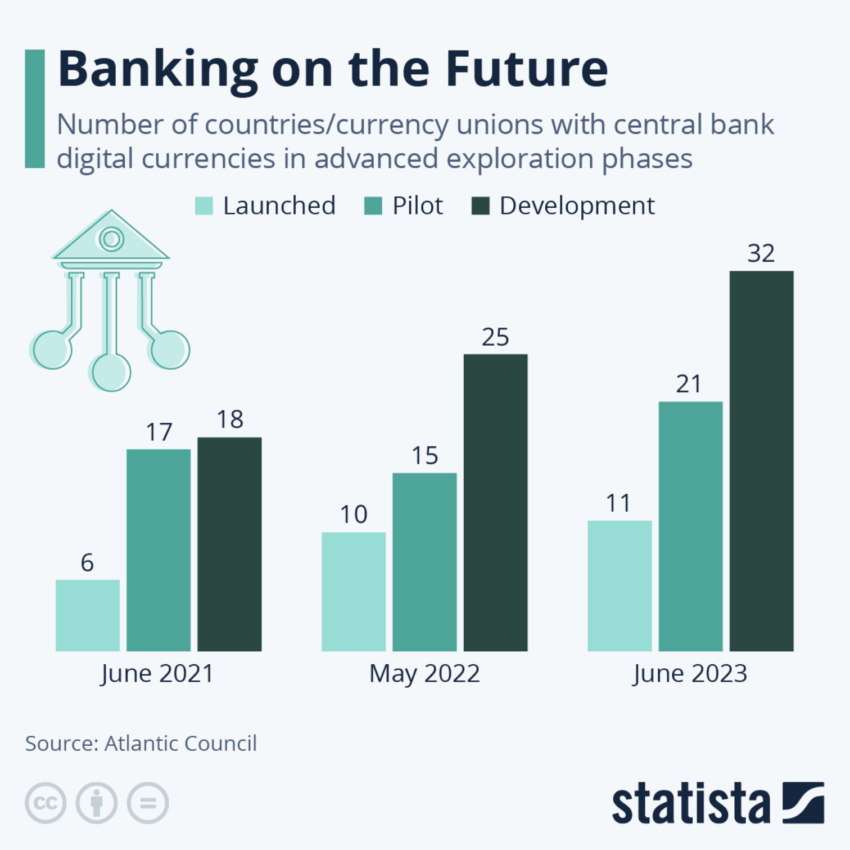

Globally, the race to develop CBDCs is heating up. Major economies like China and India are progressing with their digital currency projects. This trend challenges the traditional dominance of fiat currencies, such as the US dollar.

Federal Reserve analysts have voiced concerns over the US dollar’s global standing if the US does not introduce a competitive CBDC. They underscore the strategic importance of digital currencies in the future of global finance.

“Depending on other CBDCs’ (or foreign currency-denominated stablecoins’) design features, there is some potential for the erosion of the dollar’s role as a medium of exchange if a US CBDC is not issued or has unattractive design features,” wrote Fed analysts Jean Flemming and Ruth Judson.

Read more: Digital Rupee (e-Rupee): A Comprehensive Guide to India’s CBDC

In the US, the notion of a digital dollar faces opposition. Figures like former President Donald Trump and several Republican senators have resisted the idea of a US CBDC. They cite privacy concerns and the potential for governmental overreach. This opposition reflects a broader skepticism towards CBDCs within the US, contrasting with the proactive stances of other nations.

The post How Russia’s Digital Ruble Is a Threat to US Dollar’s Dominance appeared first on BeInCrypto.