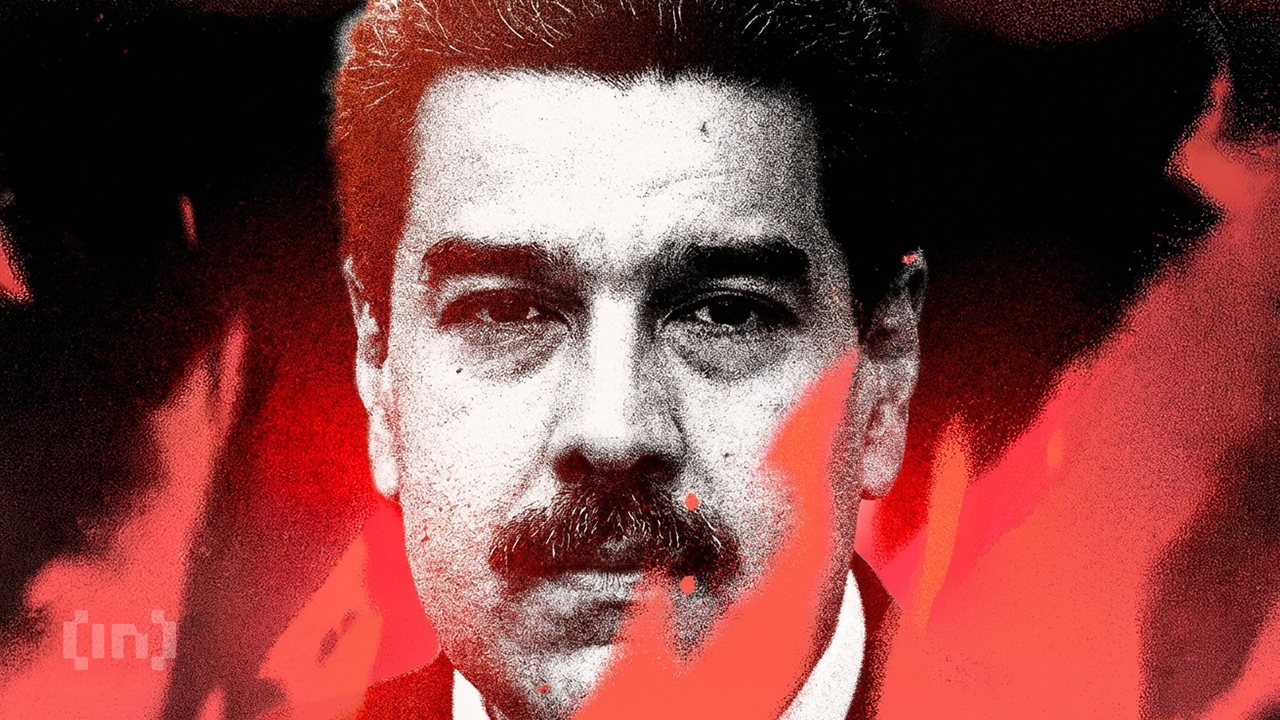

Blockchain analytics platform Bubblemaps has rejected growing speculation tying a Polymarket account involved in the Nicolás Maduro market to a World Liberty Financial (WLFI) co-founder.

The debate intensified after on-chain analyst Andrew 10 GWEI pushed back against Bubblemaps’ assessment, stressing that his comments were intended to be cautious and analytical rather than accusatory.

Sponsored

Polymarket’s Profitable Bets Raise Insider Trading Questions

The situation originates from events that unfolded over the past weekend. On January 3, US President Donald Trump announced the capture of the Venezuelan President.

Notably, blockchain analytics firm Lookonchain identified activity on Polymarket involving three wallets that placed bets on Maduro leaving office before the arrest. The wallets had been created and funded several days earlier, and executed the bets hours ahead of the announcement.

“Notably, all three wallets only bet on events related to Venezuela and Maduro, with no history of other bets — a clear case of insider trading,” Lookonchain reported.

One wallet, identified as 0x31a5, recorded a significant return, converting an initial position of approximately $32,000 into $400,000. Researcher Andrew 10 GWEI pointed to unusual funding patterns in this account.

Both wallets that funded the Polymarket account received deposits from Coinbase and transferred funds directly to the platform, with no other activity.

“I noticed that the second wallet (2i7HJJ) was funded from Coinbase with 252.39 SOL on January 1st at 11:53 PM UTC. I decided to check all deposits to Coinbase within a day before the insider’s wallet withdrawal and found one match with 99% accuracy. BCcTrxcowNeUqhr4yPtAMy5PhhQ5eD8hsjHYmMS8FaV8 (STVLU.SOL) – from this wallet there was a deposit to Coinbase through a deposit address of 252.91 SOL on January 1st at 00:48 AM UTC, meaning approximately 23 hours before the withdrawal to the insider’s wallet,” Andrew explained.

Sponsored

The analyst further pointed out that one wallet held domain names resembling “Steven Charles.” This sparked comparisons to Steven Witkoff, the co-founder of World Liberty Financial.

“I noticed that this wallet had several registered ENS domains: STVLU.SOL and StCharles.SOL. And the first funder – ES6SiK66UZcsPevTgfVtKtay4o1vWUepeVvb5kfWnJXF with ENS Solhundred.sol. Moving to the latter, we see transactions of $11 million with someone with ENS Stevencharles.sol (22Tqm7fBbrGb5XmT9UkcZhSPjT1Q1DMBatacpmsJGkUz) Steven Charles – or Steven Charles Witkoff(?), one of the co–founders of World Liberty Finance (WLFI), meaning a person who potentially had access to insider information,” the post added.

Finally, Andrew highlighted what happened after the Polymarket bet settled. The winnings were withdrawn to Coinbase. A few hours later, about $170,000 worth of Fartcoin was withdrawn from Coinbase to “STVLU.sol (stcharles.sol) wallet.”

Sponsored

Bubblemaps Disputes Connection Logic

Blockchain analytics platform Bubblemaps challenged the analysis, stating that the logic does not hold up.

“This needs to stop. Polymarket insider analysis is out of hand. Some posts are linking the Maduro’s Polymarket insider to a WLFI cofounder. It sounds explosive, but the logic is weak,” the platform said.

Bubblemaps asserted that the one-day time gap between transfers is insignificant. Furthermore, it contended that focusing solely on SOL inflows ignores potential deposits in other assets, such as USDC or ETH.

They further noted that funds might originate from bank transfers or multiple smaller deposits, rendering the linkage speculative. According to the post,

“Claiming “one address match with 99% accuracy” is pure clickbait. In reality, thousands of wallets could fit this pattern.”

Sponsored

Andrew 10 GWEI responded in a detailed post. The analyst clarified that his analysis offered a cautious hypothesis rather than a direct accusation.

“I specifically used the phrasing ‘Could turn out to be someone connected to Steven Charles Witkoff’- which makes it clear this is closer to speculation and conjecture than a direct accusation. It’s a sufficiently cautious formulation that leaves room for doubt and emphasizes the hypothetical nature of the statement. Yet you disregarded that,” the analyst commented.

According to Andrew, the “99% match” referenced in his post applied strictly to the similarity in transaction amounts. He also defended focusing on SOL versus stablecoins. The analyst explained that moving through USDC, SOL, and back to USDC on Polymarket would have been inefficient.

While acknowledging that the 23-hour gap between deposit and withdrawal could be coincidental, he pointed to additional factors, including SNS names resembling “Steven Charles” and subsequent transfers of Polymarket winnings, as compounding coincidences.

Andrew stressed that his observations do not constitute proof and that only Coinbase could confirm or deny any connection through KYC data.