Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee as the crypto market goes eerily quiet. ETF inflows have dried up, digital asset treasuries are unwinding, and traders seem to have lost their spark. As sentiment flatlines and altcoins lag, analysts say this lull may be masking deeper structural and psychological fatigue.

Crypto News of the Day: DAT Unwinds and ETF Outflows Leave Market Lagging Stocks

The crypto market’s momentum has hit a wall, with analysts attributing the latest stretch of weakness to structural and psychological factors.

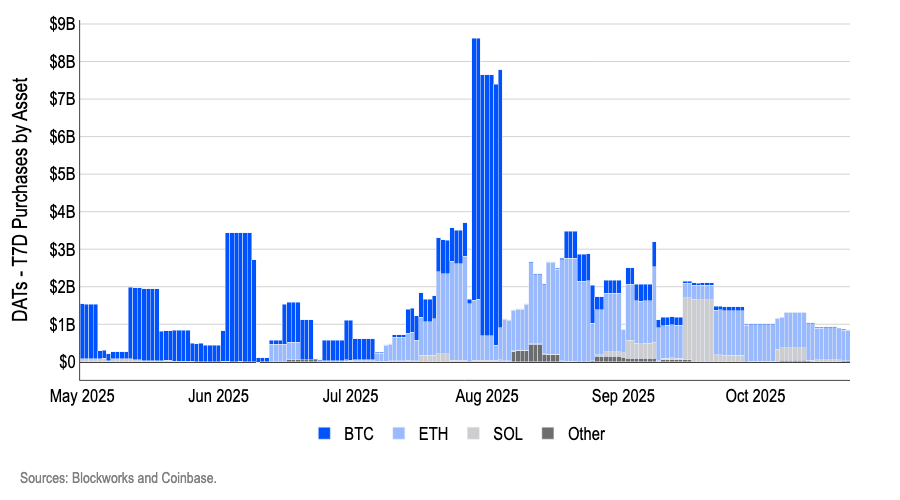

ETF demand has dried up, digital asset trusts (DATs) are unwinding exposure, and traders are struggling to find conviction as crypto continues to underperform equities. Market analyst Miles Deutscher said several forces are converging to pressure Bitcoin and Ethereum.

According to Deutscher, while most large trusts remain stable, smaller ones are moving to protect their net asset values.

“ETF demand has dried up (been net outflows for the past few weeks) …There is a bit of a DAT unwind going on for $BTC and $ETH,” he explained.

Deutscher also cited the October 10 market shock, a day of broad crypto liquidations, as a lingering overhang.

“October 10 did a lot of damage on a few fronts…Psychologically, it’s a bad look for crypto and was the nail in the coffin after already underperforming equities for weeks. Materially, market makers are still unwinding. I don’t think we fully understand the extent of the damage,” he said.

The result has been widespread retail exhaustion, with prolonged price stagnation wearing down even seasoned traders.

With unwinds continuing and spot ETF flows turning negative, Deutscher says it is no surprise that prices are going down. Still, Deutscher believes sentiment could flip quickly if Bitcoin breaks higher.

“There’s one thing that can change this entire dynamic: a proper $BTC pump. Even in August, we saw BTC/ETH pumping completely flip sentiment on its head… It doesn’t really need a reason. It’s Bitcoin,” he wrote.

Altcoin Lethargy Deepens as Analysts Urge Patience and Research

Meanwhile, altcoins continue to stagnate, reflecting broader risk aversion. Analyst Daan Crypto Trades highlighted that only 29% out of the top 50 altcoins have outperformed BTC this year.

The metric has not exceeded 39% for six months, a stark contrast to the 2020–2021 cycle, when altcoins outperformed for extended periods.

“Anything after that point has been short periods of outperformance, never lasting more than two to three months,” Daan noted.

Therefore, investors’ best move is to focus on research rather than short-term trades, identifying emerging themes such as AI agents, RWAs, and prediction markets.

With Bitcoin consolidating below major resistance and traditional equities printing new highs, crypto’s next move may depend less on fundamentals and more on whether the market can rediscover its confidence.

Chart of the Day

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- Bitcoin’s Halloween dip looks like a setup—Not an accident.

- Circle exec says EU risks “regulatory own goal” amid MiCA–PSD2 clash.

- Bitcoin ETFs bleed $490 million as BlackRock faces fraud scandal.

- Sam Bankman-Fried claims FTX was solvent, blames lawyers for collapse.

- Crypto sell-off shocks market — Hidden signal suggests it’s not over.

- Kraken tests AI-proof identity system — Can crypto beat deepfake fraud?

- Strategy reports $2.8 billion Q3 profit, Bitcoin treasury model gains momentum.

- A $16 billion options expiry is set to shake the Bitcoin and Ethereum markets today.

Crypto Equities Pre-Market Overview

| Company | At the Close of October 30 | Pre-Market Overview |

| Strategy (MSTR) | $254.57 | $270.00 (+6.06%) |

| Coinbase (COIN) | $328.51 | $343.14 (+4.45%) |

| Galaxy Digital Holdings (GLXY) | $34.13 | $35.42 (+3.78%) |

| MARA Holdings (MARA) | $17.76 | $18.26 (+2.82%) |

| Riot Platforms (RIOT) | $21.09 | $21.94 (+4.03%) |

| Core Scientific (CORZ) | $20.74 | $21.94 (+5.79%) |

The post Investor Sentiment Flatlines Amid Dry ETF Flows and DAT Unwinds | US Crypto News appeared first on BeInCrypto.