Pi Network’s performance has been underwhelming, even in a broader bull market. While many cryptocurrencies are reaching record highs, Pi Coin (PI) fell to an all-time low earlier this month, reflecting a significant loss of investor confidence.

Though it boasts an ambitious community-driven model and a user base exceeding 60 million, several indicators point to a growing disinterest in the network, raising concerns about its long-term viability.

Pi Network in Trouble: 3 Signs You Need to Watch

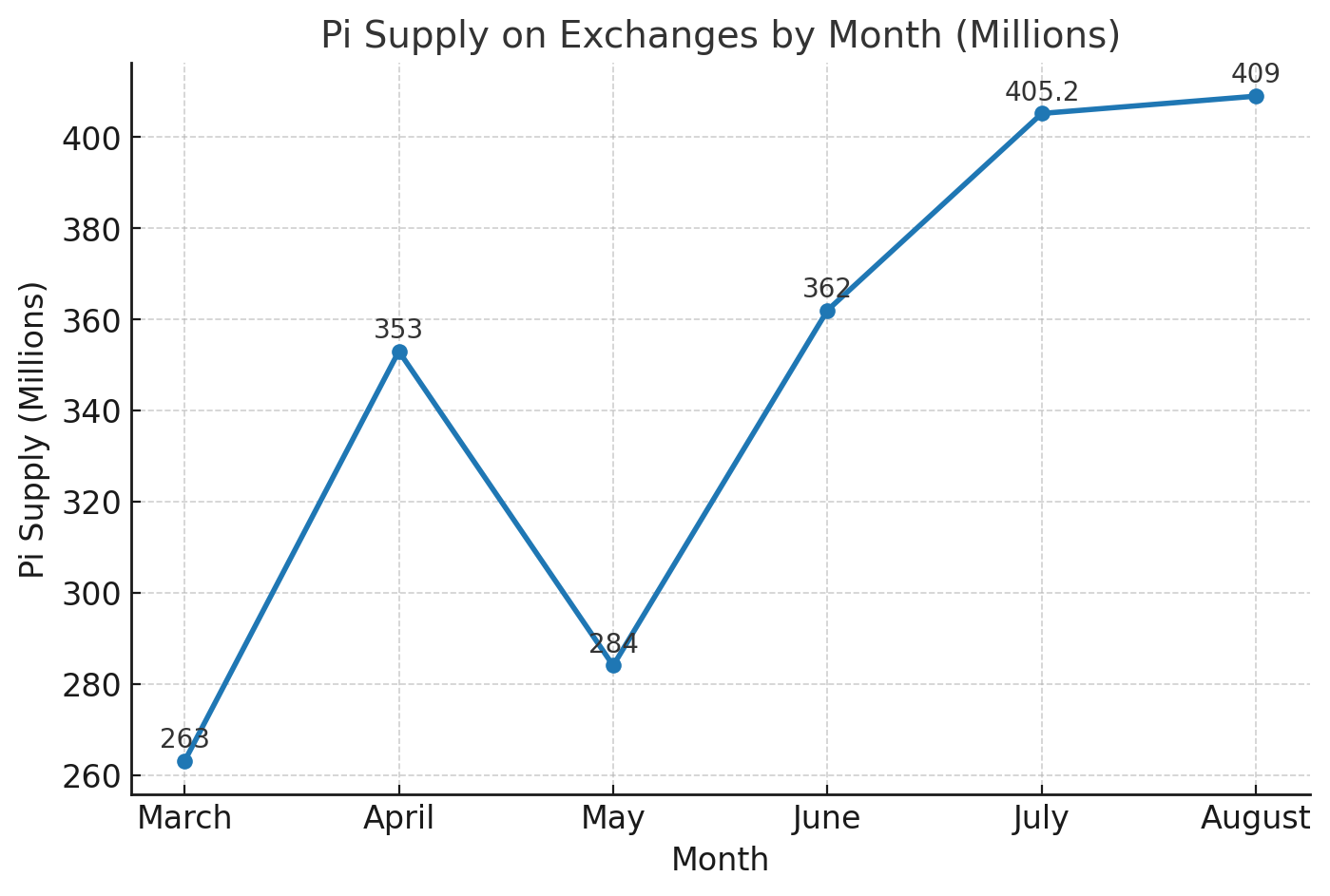

First, the supply of Pi coins on centralized exchanges has surged dramatically. Data from PiScan revealed that over 409 million Pi coins were held on exchanges in the second week of August, marking the highest level to date.

This influx suggests that holders are offloading their tokens to capitalize on liquidity or cut losses. Such a spike in exchange-held tokens often precedes increased selling pressure.

Furthermore, Pi Coin’s daily unlocks exacerbate this. Over the next 30 days, Pi Network will release 166.5 million tokens, flooding the market with additional supply.

Thus, these factors could put downward pressure on the already dropping price. CoinGecko data showed that Pi Coin’s price has dipped 36.4% over the past 60 days. This decline has made it the top loser in the crypto market.

Second, retail interest in Pi Network is waning. According to Google Trends, when comparing search interest for ‘Pi Network’ with ‘Altcoins,’ the former significantly lags behind. This starkly contrasts with previous trends when Pi Network dominated online attention.

The shift suggested that the initial hype surrounding PI’s mobile-mining model and the open network launch has faded, as competing altcoins capture more public interest amid the altcoin season build-up.

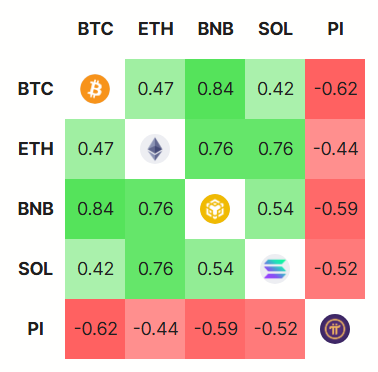

Third, Pi Network’s market behavior is diverging from the broader crypto rally. Data from DeFiLlama highlighted that while Bitcoin, Ethereum, and Solana maintain a high positive correlation—moving in tandem as investor sentiment fuels gains—Pi Network exhibits a negative correlation. This divergence suggests that PI is moving against the prevailing optimism of the altcoin season.

Compounding these issues is the ongoing controversy surrounding Pi Coin’s Global Consensus Value (GCV). A prominent Pioneer, known by the pseudonym Mr. Spock, stressed previously that the GCV community’s unproven valuation has led them to believe that PI is worth much more. As a result, they’re not contributing as the price crashes.

“We still have GCV pioneers holding only 5 Pi who think they are rich, yet they are not helping us. They are not buying Pi at $0.40 because they believe they are already rich, and they say that’s not real Pi on exchanges, even after KYB, despite us already being in the open network,” he wrote.

Thus, all these factors paint a bearish picture for the PI. For now, it seems that Pi Network faces a challenging road ahead, unless significant changes are made to restore investor confidence.

The post Investors Turn Their Backs on Pi Network: 3 Signs of a Growing Exodus appeared first on BeInCrypto.