Iran’s central bank quietly built up a large stash of Tether’s USDT last year as the rial struggled and trade with the outside world grew harder. The move turned parts of the crypto ledger into a public trail of a policy that would normally be private.

Central Bank’s Crypto Moves

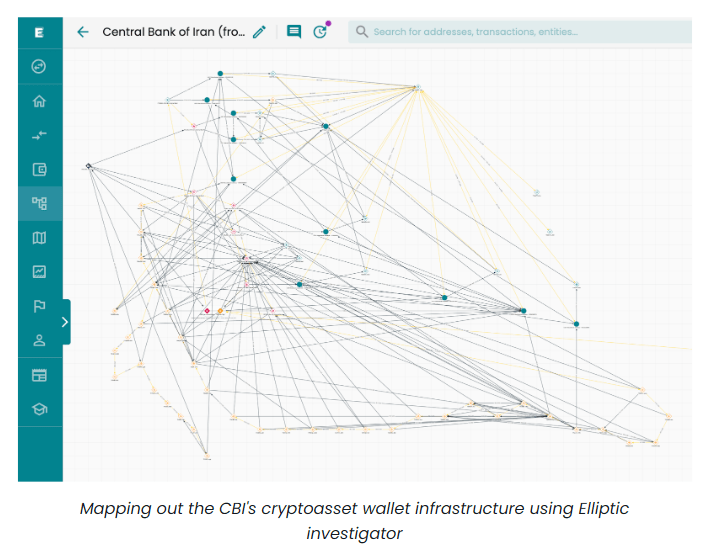

According to a blockchain analysis by Elliptic, the Central Bank of Iran acquired at least $507 million in USDT over 2025, a figure the firm treats as a conservative minimum because it only counts wallets it could tie to the bank with high confidence.

Reports say much of the buying happened in the spring months of 2025 and that payments were routed through channels that included Emirati dirhams and public blockchains. Those stablecoins were then used in local crypto markets to add dollar-linked liquidity and help slow the rial’s slide.

🚨 New Elliptic research: We have identified wallets used by Iran’s Central Bank to acquire at least $507 million worth of cryptoassets.

The findings suggest that the Iranian regime used these cryptoassets to evade sanctions and support the plummeting value of Iran’s currency,… pic.twitter.com/I7NHGO0wtP

— Elliptic (@elliptic) January 21, 2026

How The Money Flowed

Elliptic’s tracing shows an early flow of USDT into Nobitex, Iran’s biggest crypto exchange, where the coins could be swapped into rials and fed into the market. After a breach and growing scrutiny in mid-2025, other paths were used, including cross-chain bridges and decentralized exchanges, to move and convert funds.

Source: Elliptic

A Freeze And A Warning

That open ledger also left the transactions visible to outside observers. On June 15, 2025, Tether blacklisted several wallets linked to the central bank and froze about $37 million in USDT, showing that stablecoins can be cut off when issuers or regulators step in. That intervention narrowed some options for on-chain liquidity.

This episode matters for two reasons. First, it shows how a state institution can use stablecoins to gain access to dollar value when normal banking routes are closed.

Second, it highlights a weakness: if a private issuer can freeze balances, those reserves are not the same as cash held in hard foreign accounts.

Trade, Sanctions, And A New Tool

Reports note the purchases likely served a twin goal — to smooth domestic exchange rates and to help settle trade with partners who avoid direct dollar banking.

The method is blunt. It gives a way to move value, but it also creates new points of control and exposure that can be tracked on public ledgers.

Analysts will be watching how regulators and stablecoin issuers respond. They will also track whether other countries under pressure turn to similar mixes of centralized and decentralized tools.

The public tracing of these flows makes it harder to hide big moves, even when actors try to obscure them across chains and exchanges.

Featured image from Unsplash, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.