While institutional adoption is in full flow and macro-conditions are driving retail investors to Bitcoin, most traders are extremely bullish on Bitcoin. So is the Hyperliquid whale, James Wynn.

But his publicized trades might be why BTC is still dropping despite a new all-time high two weeks ago. Are traders intentionally pressing Bitcoin lower to trigger Wynn’s liquidations?

James Wynn’s Bitcoin Saga Might Not Be Helping the Market

Today, Bitcoin trades near $105,000, down 11% from its all-time high two weeks ago. But bullish headlines suggest BTC should be rallying right now.

This week alone, South Korea’s new president has sparked ETF hope, a Spanish coffee chain planned a $1 billion purchase, and Russia made new Bitcoin developments. Even Trump Media raised $2 billion to invest in BTC.

So, why is the market stalling? Some point fingers at James Wynn, the Hyperliquid whale, whose outsized long bets and public outbursts have drawn scrutiny.

Today, on‐chain data shows Wynn’s leveraged long was liquidated for 240 BTC (about $25.16 million) when Bitcoin dipped toward his $104,720 liquidation price.

Meanwhile, his tweets reveal frustration, as he accused market makers of manipulation. Those tweets suggest he believes coordinated sellers aim to hunt his liquidation.

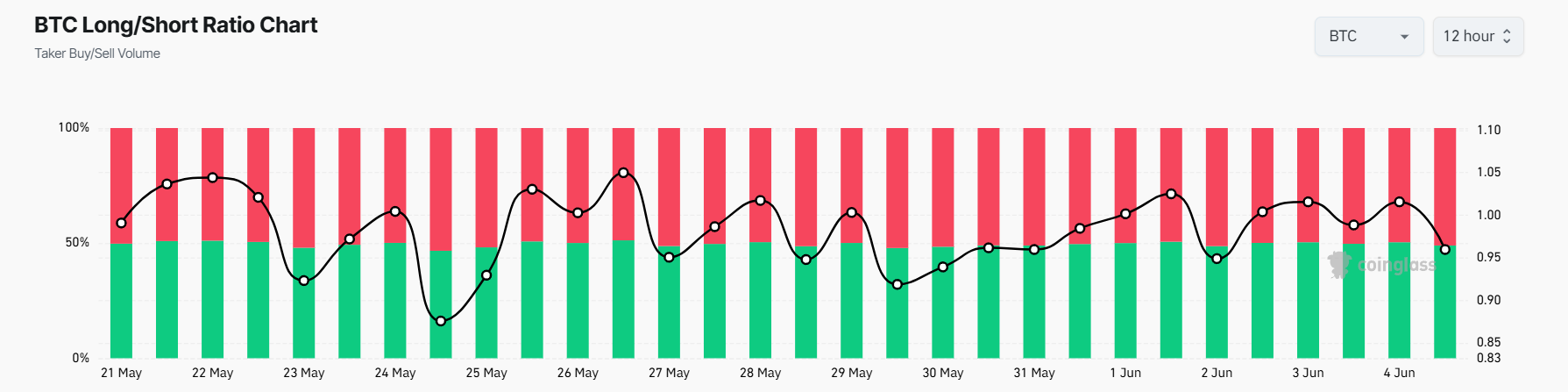

A glance at today’s 12-hour long/short ratio shows shorts at 51.03% and longs at 48.97%. Though short volume marginally exceeds long volume, the divergence is slight.

If bearish sentiment truly stemmed from a vendetta to liquidate Wynn, one might expect a more pronounced short skew and sudden, massive inflows into sell orders.

Instead, on‐chain flow aligns more with overall profit‐taking after the $111,000 peak two weeks ago.

Global macro and crypto‐specific triggers also weigh on price. Reports of profit‐taking by large institutions and traders preemptively reducing risk amid uncertain rate‐cut cues have contributed to selling pressure.

Whale Psychology and Self-Fulfilling Moves

Wynn’s colossal positions can amplify volatility. When a well‐known whale posts liquidation prices publicly, some traders may view it as an invitation to bet against him.

High‐leverage longs often carry cascading risks. One forced sale triggers margin calls and deeper price declines. Yet saying whales single-handedly drive price disregards broader market forces.

Traders might short or sell simply because Bitcoin’s rally felt overextended. Wynn’s tweets might reinforce bearish sentiment, but they do not create it.

For example, if Bitcoin breaches $104,500 and triggers Wynn’s next liquidation, that forced sell could extend declines to $103,500 or lower.

But that move usually reflects existing momentum, not a new catalyst. Market makers and large traders often hedge positions rather than coordinate attacks on individuals.

Wynn’s narrative frames his liquidations as concerted manipulation.

In reality, any spike in sell orders at his thresholds likely comes from algorithmic trading and liquidations. This is common in high‐leverage markets.

Conclusion: More Than a Whale’s Woes

James Wynn’s leveraged longs and colorful tweets add drama to Bitcoin’s pullback. He might exacerbate volatility near his liquidation thresholds.

But attributing the broader 11% drop solely to his positions oversimplifies market dynamics. Profit‐taking, technical resistance, and shifting macro cues play larger roles.

While Wynn’s forced sales could nudge prices lower in tight markets, the primary drivers lie beyond one trader’s drama.

The post Is Bitcoin Price Dropping Because of James Wynn’s Long Bets? appeared first on BeInCrypto.