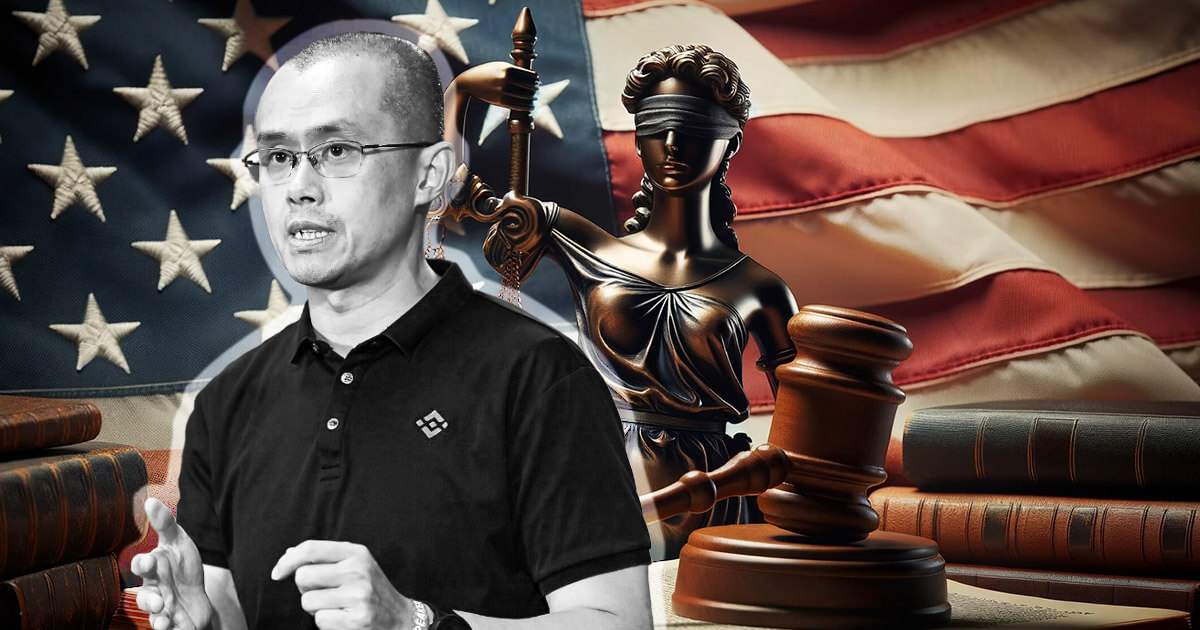

A U.S. District Court has once again denied Binance founder Changpeng ‘CZ’ Zhao’s request to travel internationally in a sealed order, Bloomberg News reported.

CZ, who is currently facing sentencing in the U.S. for criminal charges, had filed a motion seeking permission to visit the UAE, where his family resides. The motion was rejected by Judge Richard Jones of the Western District of Washington on Dec. 29.

It is the second instance where CZ’s travel request has been blocked. The primary concern raised by prosecutors is the potential flight risk posed by CZ, who is worth billions and a citizen of the UAE, which does not have an extradition treaty with the U.S.

The decision comes despite CZ’s efforts to present arguments against the restriction. The details of the arguments against the travel ban remain sealed in the court’s ruling.

Awaiting sentencing

CZ, who has been a pivotal figure in the cryptocurrency and blockchain industry through his leadership of Binance, pleaded guilty last month to a violation of the Bank Secrecy Act. Following his plea, he was released on a substantial personal recognizance bond of $175 million, accompanied by various financial conditions.

Founded in 2017, Binance rapidly emerged as a significant player in the crypto space, known for its extensive range of cryptocurrencies and competitive fees. CZ, a Chinese-Canadian business executive with a robust background in software development and trading systems, has been instrumental in the company’s meteoric rise and influence in the industry.

The exchange’s rapid growth meant it sometimes cut corners and did not have robust compliance measures in place, which allowed some illicit actors to misuse the platform for money laundering and illegal transactions. These lapses eventually attracted regulatory attention, with concerns about money laundering and the lack of stringent know-your-customer (KYC) processes.

Regulatory control

CZ’s legal challenges come amid a broader regulatory effort to establish control over the cryptocurrency market, historically characterized by its lack of regulation. This effort includes enforcing stringent AML and KYC protocols, which have become focal points for governments worldwide, particularly in the U.S.

The case against Zhao and Binance highlights the tension between the decentralized nature of cryptocurrencies and the regulatory frameworks of global financial systems. The outcome of Zhao’s legal proceedings is seen as pivotal, with potential implications for the operational and regulatory future of cryptocurrency exchanges globally.

CZ’s case represents a clash between the traditionally unregulated nature of cryptocurrencies and the established regulatory frameworks of global financial systems. It also raises questions about the future of decentralized finance (DeFi) and the balance between innovation in the crypto space and regulatory compliance.

Moreover, CZ’s situation reflects the cultural and economic challenges faced by international business executives operating in emerging technological sectors, especially in areas like DeFi, where innovation frequently outpaces regulation.