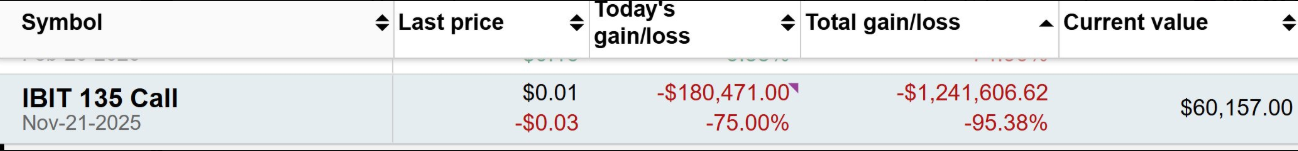

Former Ohio State Treasurer Josh Mandel, once hailed as an early political champion of Bitcoin, has revealed a personal loss of more than $1.2 million on call options tied to BlackRock’s iShares Bitcoin Trust (IBIT).

The former state official’s gamble followed his bold prediction that Bitcoin would reach $444,000 by November 8, a forecast that has clearly not materialized.

Ohio’s Crypto Tax Pioneer Loses $1.2 Million Betting on Bitcoin Options

Mandel shared details of his failed trade in a post on X (Twitter), saying he had gone “all in” on IBIT call options, only to watch them expire worthless.

“Earlier in the cycle, I published a MSTR and MSTR-option-only portfolio. Initially, it was entirely long, then shifted to short with in-the-money covered call sales as I predicted Bitcoin would hit $84,000…These moves worked out well enough, but I grew impatient with my final call for $444,000, and as they say, you’re only as good as your last call,” he wrote.

Mandel added that his post was intended “to be transparent,” rejecting accusations that he misled investors or sought to profit through coin issuance.

Long before retail Bitcoin speculation reached mainstream America, Josh Mandel helped Ohio “plant a flag” for crypto adoption.

In November 2018, as State Treasurer, he launched OhioCrypto.com, the first US government platform allowing businesses to pay state taxes in Bitcoin. The payments, processed through BitPay, were automatically converted into US dollars for the state treasury.

At the time, Mandel described Bitcoin as “a legitimate form of currency” and positioned Ohio as a leader in blockchain innovation.

“We’re looking to plant a flag for Ohio,” he told reporters, arguing that the move would modernize state finances and attract tech-forward businesses.

The program, however, faced regulatory hurdles under his successor, Treasurer Robert Sprague, who suspended it in 2019 after determining that BitPay’s payment structure may have violated state procurement laws. Fewer than ten companies had used the service before it was shut down.

Risks and Lessons From the Bitcoin ETF Options Market

Mandel’s high-stakes loss comes as interest in Bitcoin ETF options has surged since their launch in late 2024. As Kaiko research noted, trading volumes in Bitcoin ETF options soared, with many traders favoring bullish positions.

Recently, however, Bitcoin ETFs have not been performing as well, with outflows reaching levels last seen in May. In fact, they only recently recorded the first inflow after a $2.9 billion outflow streak.

Nonetheless, speculative long-term bets like Mandel’s remain outliers, highlighting the significant risks associated with options and the volatility of Bitcoin prices.

By making his investment loss public, Mandel offers a reminder that experienced public figures and crypto pioneers can also misjudge timing or risk in digital assets.

As regulated crypto derivatives expand and attract more investors, Mandel’s experience demonstrates that market predictions, even when widely shared, come with no guarantee of success.

The post Man Who Once Let Ohio Pay Taxes in Crypto Just Lost $1.2 Million on Bitcoin Options appeared first on BeInCrypto.