Crypto exchanges have recently been making moves to streamline their offerings, and an unprecedented number of digital tokens are being shown the exit. As Bitcoin commands renewed interest and experiences a revival, it’s ironic to witness numerous other tokens getting the chop from major platforms.

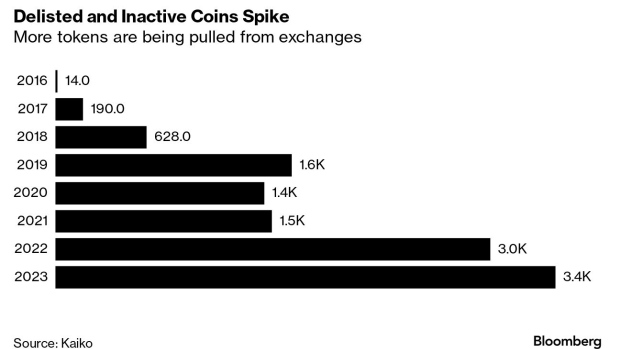

According to data compiled by Kaiko, the numbers are clear: 3,445 tokens or trading pairs are on the chopping block, having been rendered inactive or slated for imminent delisting. In a comparative analysis, this figure overshadows last year’s numbers by 15% and even doubles those of the year prior, as reported by Bloomberg.

Major Exchanges Taking The Lead

Coinbase Global Inc. and Binance, the two behemoths in cryptocurrency exchanges, have been proactive in this culling exercise. Surprisingly, this month alone has seen over 100 tokens being delisted from these platforms.

Data from researcher CCData pinpoints that Coinbase removed 80 pairs just in October – an unparalleled monthly figure for the year. Meanwhile, another significant player, OKX, has already culled 172 tokens this year, with Coinbase not far behind at 176 pairs.

The numbers may seem alarming, but there’s more to the story. Despite the sheer volume of tokens available, trading volumes across most exchanges have taken a significant hit over the last year. Over 1.8 million tokens are up for trade across centralized and decentralized platforms.

According to Bloomberg, liquidity has become rare after events like FTX’s scandals and ensuing bankruptcies. Many exchanges, in response, are opting to funnel it towards more popular and user-favored trading pairs.

Jacob Joseph, an analyst at CCData, sheds light on this crypto exodus. According to him, the strategy to eliminate fragmented liquidity aims to refine the trading experience for users. This tactic can significantly reduce spread and slippage costs, making trades more favorable for users.

However, Bloomberg further disclosed that external pressures are contributing to this trend. Notably, regulatory interventions have played a part.

For instance, the US Securities and Exchange Commission (SEC) has recently classified 19 tokens as unregistered securities, prompting exchanges like Coinbase and Binance to delist them, thereby staying in the regulator’s good graces.

The Bigger Picture

Although these delistings might be abrupt, they align with the general crypto market’s recovery trajectory. Since December, the 100 most significant tokens have surged by approximately 60%, bouncing back from a 66% slump the previous year.

According to Bloomberg, delistings are not a novel phenomenon. 2018, the crypto world experienced a similar trend when numerous tokens bit the dust. This decline was chiefly due to failed startup ventures that had banked heavily on initial coin offerings (ICOs) and a stringent global crackdown on dubious activities and scams.

Riyad Carey, an analyst at Kaiko, adds a final perspective, noting:

This is the result of an explosion in the number of tokens, as well as [the] aggressive listing of these tokens, during the last bull market. Many of these tokens/projects have faded away or folded in the bear market and liquidity and volumes are at multi-year lows, and exchanges will delist pairs that don’t generate enough in fees.

Regardless of the departure, the global crypto market has been in for a bullish trend over the past 24 hours, up by nearly 10%, with a current valuation above $1.2 trillion. This spike comes particularly due to Bitcoin’s recent rally due to a potential approval of spot BTC exchange-traded fund (ETF).

Featured image from Unsplash, Chart from TradingView