From SEC and court decisions that could potentially reshape the ETF landscape to macroeconomic indicators that might dictate next move by Bitcoin, this week promises significant developments. Let’s dive deep into the most anticipated events that every Bitcoin and crypto enthusiast, investor, and trader should have on their radar.

1. Anticipation High For SEC’s Bitcoin Spot ETF Decision

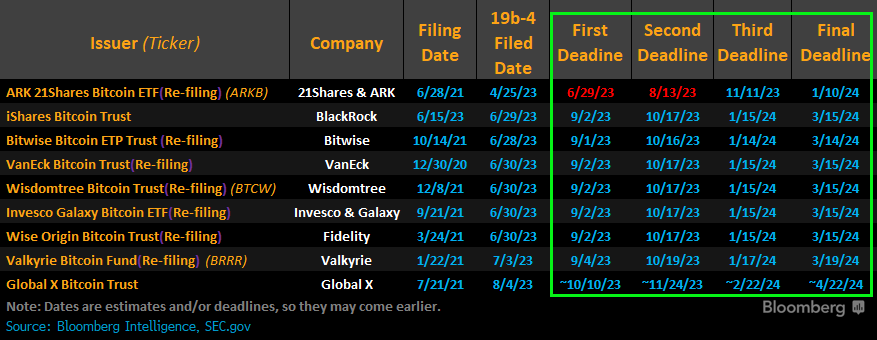

This week could be pivotal for Bitcoin spot ETFs. On Friday, the SEC is set to announce its decision on the Bitcoin spot ETF filings by six heavyweight companies. Bitwise will get its verdict on September 1. Following closely, BlackRock, VanEck, WisdomTree, Invesco & Galaxy Digital, and Fidelity await their decisions on September 2. As the latter falls on a Saturday, it’s likely that announcements for all will be released on September 1, Friday afternoon.

So, why is a Bitcoin spot ETF so significant? The market currently sees a stagnation in new inflows. With decreasing stablecoins on exchanges, there’s no considerable “dry powder” waiting on the sideline. Consequently, retail investors lack compelling reasons to re-enter. However, the narrative might shift with the approval of a Bitcoin spot ETF, which could catalyze market momentum.

The market largely anticipates a delay, but imagine the ripple effect if the SEC were to approve, say, BlackRock’s Bitcoin spot ETF. Given BlackRock’s influence (being the world’s largest asset manager by AUM) and its impressive approval track record (575-1 in terms of approvals vs. rejections), such a decision could potentially catapult BTC prices and alter the broader market sentiment.

2. Grayscale Vs. SEC: The Case That Could Open Doors

The Grayscale case vs the SEC is kind of a back door for a spot ETF approval. The D.C. Circuit Court of Appeals could force the SEC to approve a spot ETF on the reasoning that they already approved several Bitcoin future ETFs.

Current indications suggest a verdict in the Grayscale vs. SEC case within the next few days or weeks. Decisions are typically released on Tuesdays or Fridays at 11 am EST. Given that it’s been 173 days since the oral arguments, anticipation is mounting. Historically, 94% of such cases are resolved within 160 days, with the lengthiest taking 174 days.

If a decision isn’t reached by September 4 or 5 (with the latter being a Tuesday), the case might extend into the court’s next term. As the D.C. Circuit concludes its term, 24 cases from this term (and two from the prior term) remain unresolved. The court has decided 87% (169/193) of this term’s cases, and usually gets over 92% by Sept. Remarkably, on the last Tuesdays and Fridays there were 4, 0 and 1 rulings.

3. DXY And Macro Events: Potential Market Movers

Macro events this week could significantly impact the DXY, and given its inverse correlation, Bitcoin and other cryptocurrencies might react. While the Bitcoin price is sitting at higher time frame support, the DXY is at higher time frame resistance – potentially a crucial moment.

Key events on the week ahead include the US Consumer Confidence & Job Openings on Tuesday (10:00 am EST), US Core PCE and Unemployment Claims on Thursday (8:30 am EST), and the US Unemployment Rate on Friday (8:30 am EST).

Two potential scenarios emerge:

– Lower unemployment, increased PCE, and heightened confidence could propel the DXY, reflecting a “higher for longer” interest rate policy, which would be bearish for Bitcoin.

– Conversely, if unemployment rises alongside drops in PCE and confidence, we could witness a rally in risk-on assets, leading to a DXY/Yields downturn, ultimately benefiting Bitcoin and the broader crypto sector.

4. Other Noteworthy Crypto Events

This week also heralds intriguing developments elsewhere in the crypto domain:

HashKey, the first Hong Kong centralized exchange with regulatory clearance, begins its foray into crypto retail trading today, August 28. Given China’s historical dominance in Bitcoin trading volumes, the market is keenly observing HashKey’s potential impact and the possible resurgence of Chinese players.

Meanwhile, the Sui Network will unlock 4.8% of its SUI supply, translating to 70.89 million SUI (or $41.3 million, which is 10% of its current market cap) into circulation on September 3. Investors are bracing for potential selling pressure as the date approaches.

In essence, the Bitcoin and crypto landscape is on the cusp of a transformative week. At press time, BTC traded at $25,966.